Answered step by step

Verified Expert Solution

Question

1 Approved Answer

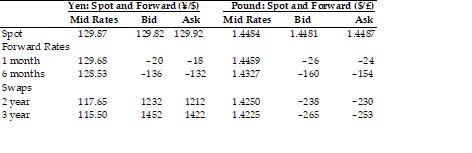

Use the table to answer following question(s). a) According to the information provided in the table, how much the 6-month forward yen is selling? (Use

Use the table to answer following question(s).

a) According to the information provided in the table, how much the 6-month forward yen is selling? (Use the mid rates to make your calculations.)

b) What is the ask price for the two-year swap for a British pound is? [8 marks]

c) The one-month forward bid price for dollars as denominated in Japanese yen is?

d) What the current spot rate of dollars per pound as quoted in a newspaper is?

\begin{tabular}{lccccccr} & \multicolumn{2}{c}{ Yen: Spot and Forward (/5)} & & \multicolumn{2}{c}{ Pound: Spot and Forward ($S)} \\ \cline { 2 - 4 } & Mid Rates & Bid & Ask & & Mid Rates & Bid & Ask \\ \hline Spot & 129.57 & 129.52 & 129.92 & & 1.4454 & 1.4481 & 1.4487 \\ Forward Rates & & & & & & \\ 1 month & 129.65 & -20 & -18 & 1.4459 & -26 & -24 \\ 6 months & 125.53 & -136 & -132 & 1.4327 & -160 & -154 \\ Swaps & & & & & & \\ 2 year & 117.65 & 1232 & 1212 & 1.4250 & -235 & -230 \\ 3 year & 115.50 & 1452 & 1422 & 1.4225 & -265 & -253 \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started