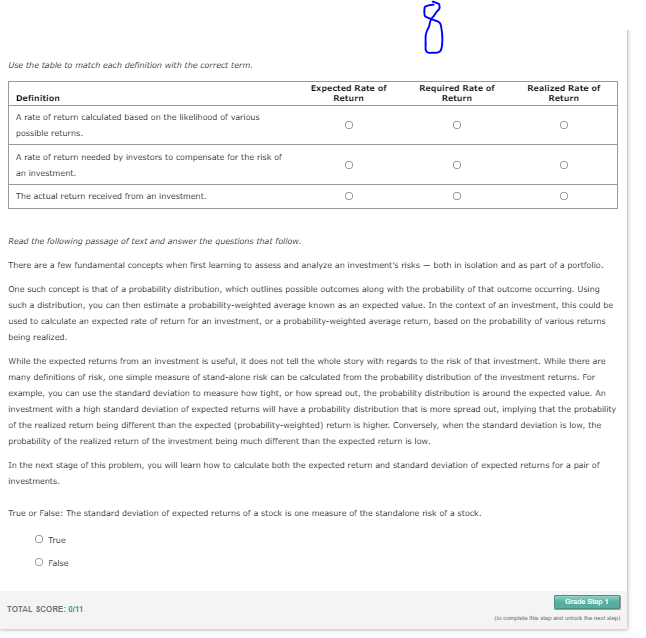

Use the table to match each definition with the correct term. Expected Rate of Return Required Rate of Return Realized Rate of Return Definition A rate of return calculated based on the likelihood of various possible returns. 0 . 0 A rate of return needed by investors to compensate for the risk of an investment. O The actual return received from an investment. o Read the following passage of text and answer the questions that follow. There are a few fundamental concepts when first learning to assess and analyze an investment's risks both in isolation and as part of a portfolio. One such concept is that of a probability distribution, which outlines possible outcomes along with the probability of that outcome occurring. Using such a distribution, you can then estimate a probability-weighted average known as an expected value. In the context of an investment, this could be used to calculate an expected rate of return for an investment, or a probability-weighted average return, based on the probability of various retums being realized. While the expected returns from an investment is useful, it does not tell the whole story with regards to the risk of that investment. While there are many definitions of risk, one simple measure of stand-alone risk can be calculated from the probability distribution of the investment returns. For example, you can use the standard deviation to measure how tight, or how spread out, the probability distribution is around the expected value. An investment with a high standard deviation of expected returns will have a probability distribution that is more spread out, implying that the probability of the realized return being different than the expected (probability-weighted) return is higher. Conversely, when the standard deviation is low, the probability of the realized return of the investment being much different than the expected return is low. In the next stage of this problem, you will learn how to calculate both the expected return and standard deviation of expected returns for a pair of investments. True or False: The standard deviation of expected returns of a stock is one measure of the standalone risk of a stock. True False Grade Step 1 TOTAL SCORE: 0/11 lo complete and unlock thes