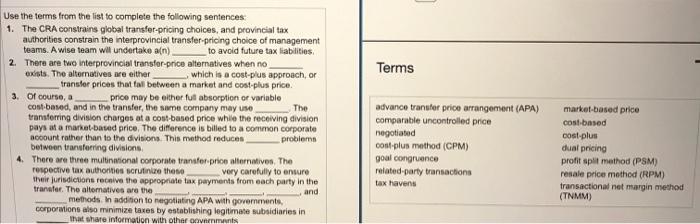

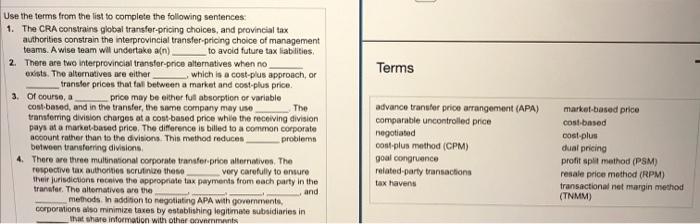

Use the terms from the list to complete the following sentences 1. The CRA constrains global transfer-pricing choices, and provincial tax authoritios constrain the interprovincial transfer-pricing choice of management teams. A wise team will undertake a(n) to avoid future tax liabiliesi. 2. There are two interprovincial transfor-price alternatives when no exists. The alternatives are eithar which is a cost-prus approach, or Iransler prices that fal betweet a market and cost-plus price. 3. Of course, a price moy be either full absorptien or variable costbased, and in the transfer, the same company may use The teansterring division charges at a costbased price while the receiving division pays as a fnarket-based price. The difference is billed to a common corporate acoount rather than to the divisions. This mothod reduces prodinmn betweon tansfaering divisicns. 4. There are three multinnional corporate transfer-price alternatives. The respective tax authorities scrutinire theso very carefully to ansure their jurisdicuans recaive the approphade tax payments from each party in the tranter. The altomatives are the methods in addition to nagotiating APA with goremmente, corporations also minimize taxes by establishing legitimate subsidiaries in that share infoemation with othar oovnerments. Use the terms from the list to complete the following sentences 1. The CRA constrains global transfer-pricing choices, and provincial tax authoritios constrain the interprovincial transfer-pricing choice of management teams. A wise team will undertake a(n) to avoid future tax liabiliesi. 2. There are two interprovincial transfor-price alternatives when no exists. The alternatives are eithar which is a cost-prus approach, or Iransler prices that fal betweet a market and cost-plus price. 3. Of course, a price moy be either full absorptien or variable costbased, and in the transfer, the same company may use The teansterring division charges at a costbased price while the receiving division pays as a fnarket-based price. The difference is billed to a common corporate acoount rather than to the divisions. This mothod reduces prodinmn betweon tansfaering divisicns. 4. There are three multinnional corporate transfer-price alternatives. The respective tax authorities scrutinire theso very carefully to ansure their jurisdicuans recaive the approphade tax payments from each party in the tranter. The altomatives are the methods in addition to nagotiating APA with goremmente, corporations also minimize taxes by establishing legitimate subsidiaries in that share infoemation with othar oovnerments