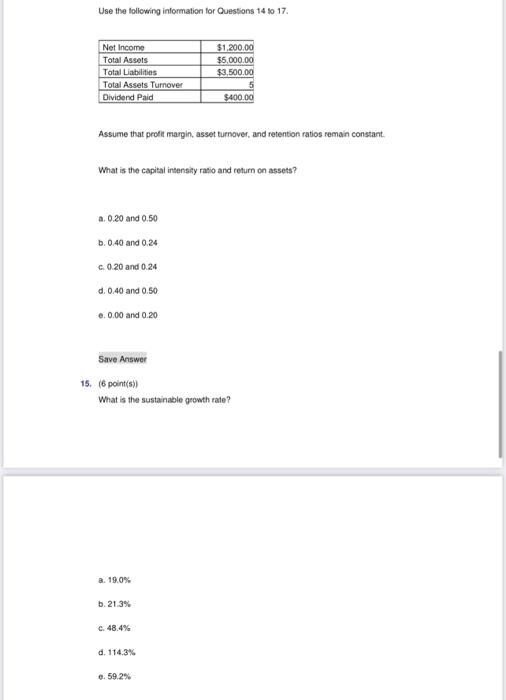

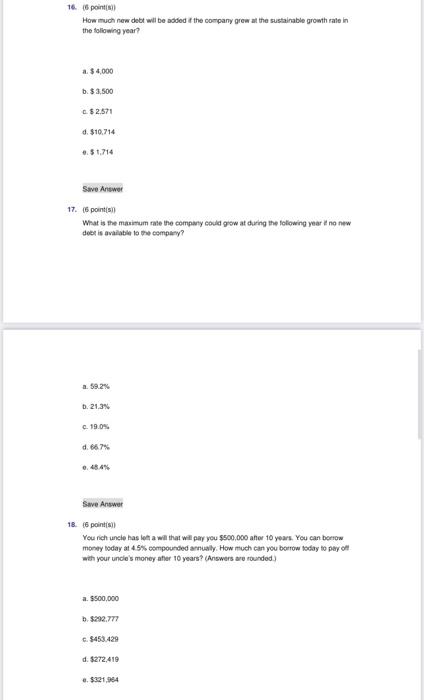

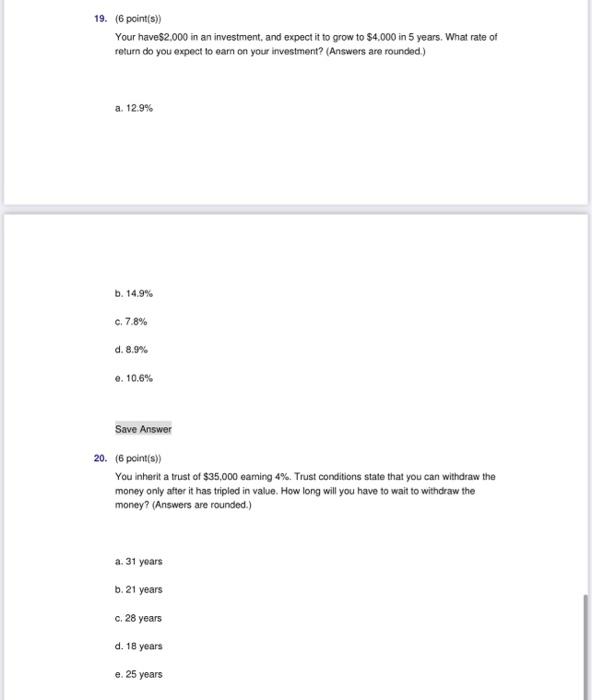

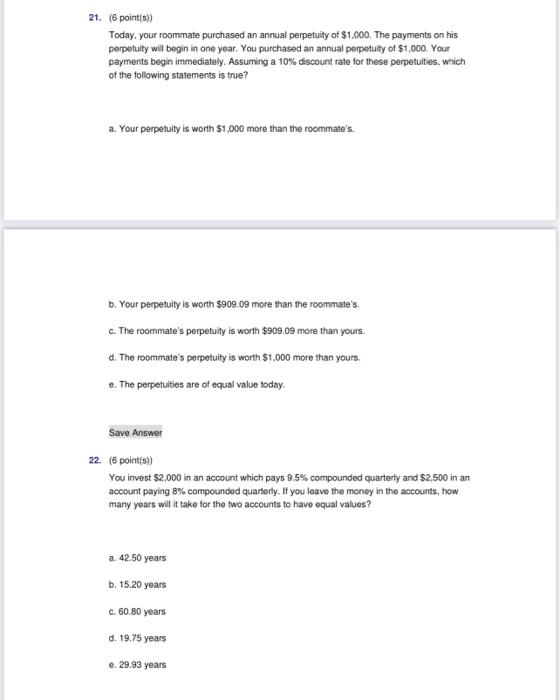

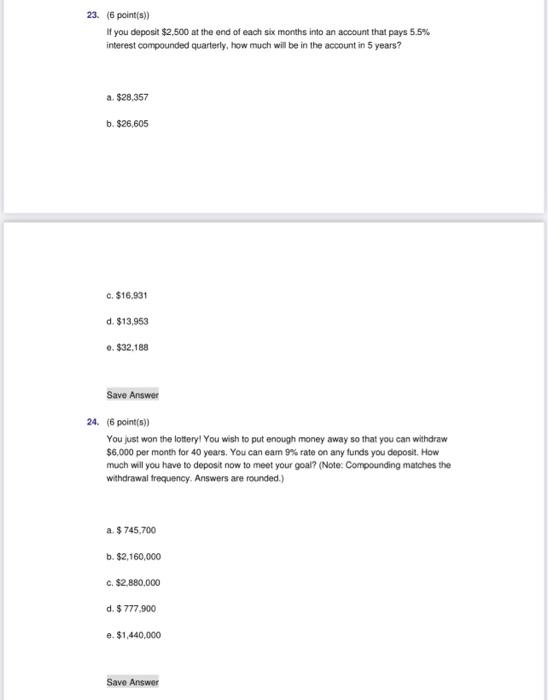

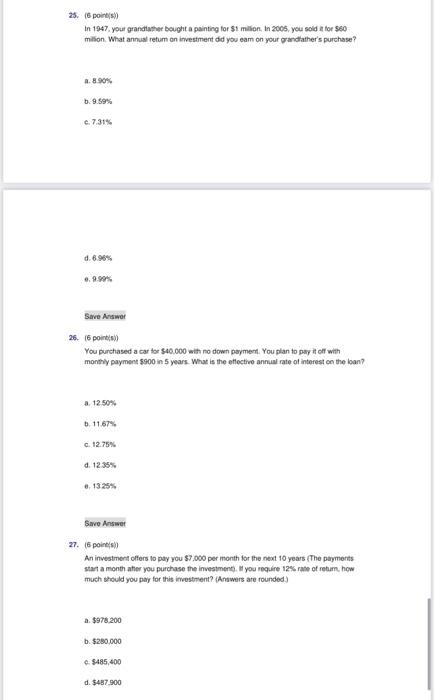

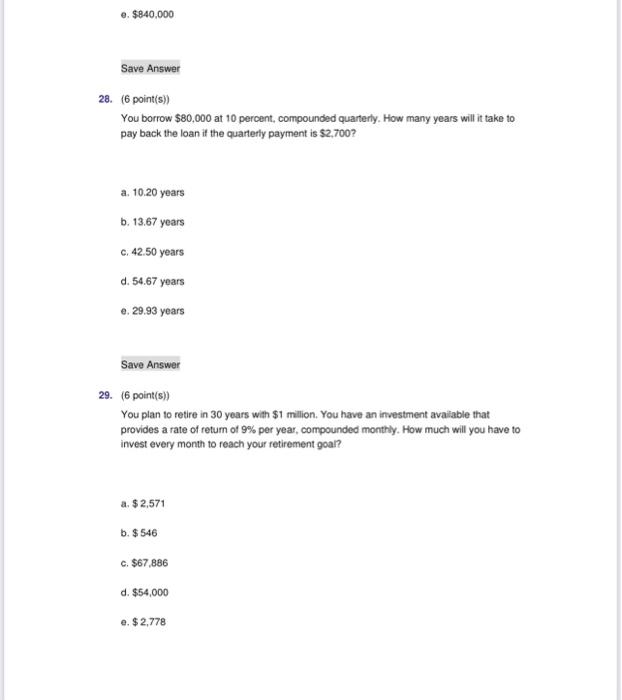

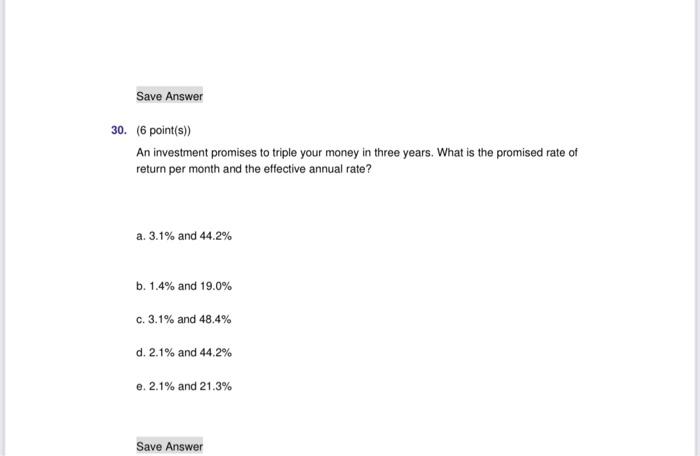

Use the tollowing information for Questions 14 so 17. Assume that prolit margin, asset turnover, and retention ratios remain constant. What is the capital intensity ratio and return on assets? a. 0.20 and 0.50 b. 0.40 and 0.24 c. 0.20 and 0.24 d. 0.40 and 0.50 e. 0.00 and 0.20 15. (6 pointisi) What is the sustainable growth rale? 16. (6 pointisi) How much new dett wil be added it the company grew al the sustainable growth rate in the foliowing year? a. $4,000 b. $3,500 D. $2.571 d. $10,714 e. 51,714 Save Antewer 17. 16 point(s)] What is the masimum rate the cempany could gow at during the foliowing year in no new deet is avalable to the cemphey? a. 89.2% b. 21.3% c. 19.0% d. 667% e. 4.5.6% Save Answer 18. (6 paintisi) You nich uncie has let a will that will pary you $500,000 anes 10 years. You can bertow money boday at 4.5% compounded arnusily. How much can you borrow todiay to pay of weth your uncie's money afher 10 years? (Ariswers are rounded) a. 5500,000 b. 492.777 C. 9451.429 d. $272,419 . 3321,994 19. (6 point(s)) Your have\$2,000 in an investment, and expect it to grow to $4,000 in 5 years. What rate of return do you expect to earn on your investment? (Answers are rounded.) a. 12.9% b. 14.9% c. 7.8% d. 8.9% e. 10.6% Save Answer 20. (6 point(s)) You inherit a trust of $35,000 eaming 4%. Trust conditions state that you can withdraw the money only after it has tripled in value. How long will you have to wait to withdraw the money? (Answers are rounded.) A. 31 years b. 21 years c. 28 years d. 18 years e. 25 years 21. (6 point(s)) Today, your roommate purchased an annual perpetuity of $1,000. The payments on his perpetuity will begin in one year. You purchased an annual perpetuity of $1,000. Your payments begin immediately. Assuming a 10% discount rate for these perpetulties, which of the tollowing statements is true? a. Your perpetuity is worth $1,000 more than the rocmmate's. b. Your perpetulty is worth $909.09 more than the roommate's. c. The roommate's perpetulity is worth $909.09 more than yours. d. The roommate's perpetuity is worth $1,000 more than yours. e. The perpetuities are of equal value today. 22. (6 point(s)) You invest $2,000 in an account which pays 9,5% compounded quarterty and $2,500 in an account paying 8% compounded quarterly. If you leave the money in the accounts, how many years will it take for the two accounts to have equal values? a. 42.50 years b. 15.20 years c. 60.80 years d. 19.75 years e. 29.93 years 23. (6 point(s)) If you deposit $2,500 at the end of each six months into an account that pays 5.5% interest compounded quartelly, how much will be in the account in 5 years? a. $28,357 b. $26,605 c. $16,931 d. $13,953 . $32.188 Save Answer 24. (6 point(s)) You just won the lottery! You wish to put enough money away so that you can withdraw $6.000 per month for 40 years. You can eam 9% rate on any funds you deposit. How much will you have to deposit now to meet your goal? (Note: Compounding matches the withdrawal trequency. Answers are rounded.) a. $745,700 b. $2,160,000 c. $2,880,000 d. $777,900 e. $1,440,000 25. (6 pointsi) In 1947, your grandiather bought a painting for \$1 milion. in 2005, you sold a tor 960 milion. What annual retum on itvestment did you eam on your grandather's purchase? a. 890% b. 9.595 c. 7.31% d. 6.96% e. 9.995 Strve Arawor 26. (6 pointisi) You purchased a car tor $40,000 with no down peymert. You plan to paty it of with montry payment 5900 in 5 years. What is the eflective anmul rate of interest on the ban? 12.50% 11.67% 12.75% 1235% 1325% Savo Answer 27. (6 poincisy) An investment offers to pay you 57.000 per month for the next 10 years (The paymerts stact a month atier you purchase the investmenth. II you require 12% rate of retum how much thould you pay for this investment? (Anwwers are rounded] $976.200 2. $250.000 9485,400 I. $487900 e. $840,000 28. (6 point(s)) You borrow $80,000 at 10 percent, compounded quarterly. How many years will it take to pay back the loan it the quarterly payment is $2,700 ? a. 10.20 years b. 13.67 years c. 42.50 years d. 54.67 years e. 29.93 years Save Answer 29. (6 point(s)) You plan to retire in 30 years with $1 million. You have an investment avaliable that provides a rate of retum of 9% per year, compounded monthly. How much will you have to invest every month to reach your retirement goal? a. $2,571 b. $546 c. $67,886 d. $54,000 e. $2,778 30. (6 point(s)) An investment promises to triple your money in three years. What is the promised rate of return per month and the effective annual rate? a. 3.1% and 44.2% b. 1.4% and 19.0% c. 3.1% and 48.4% d. 2.1% and 44.2% e. 2.1% and 21.3%