Answered step by step

Verified Expert Solution

Question

1 Approved Answer

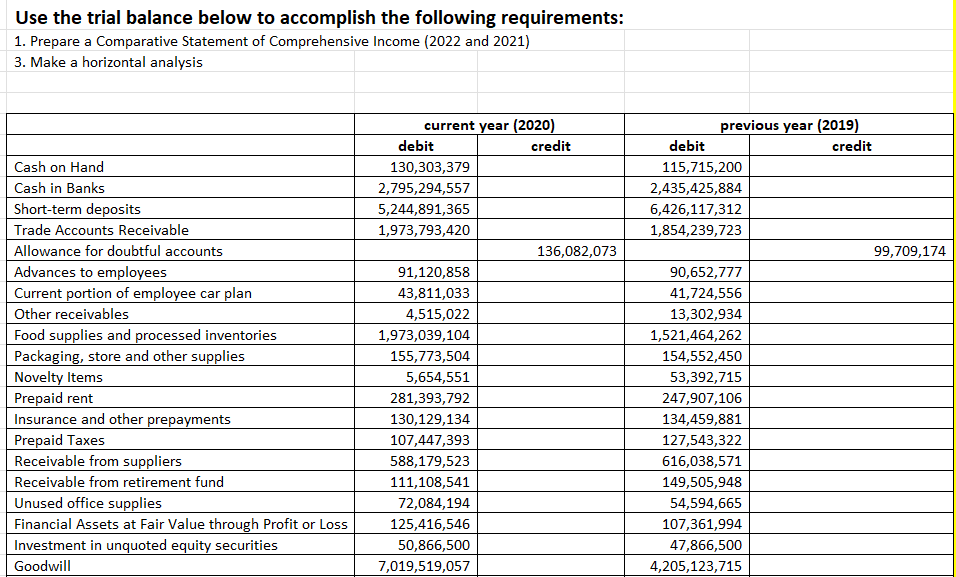

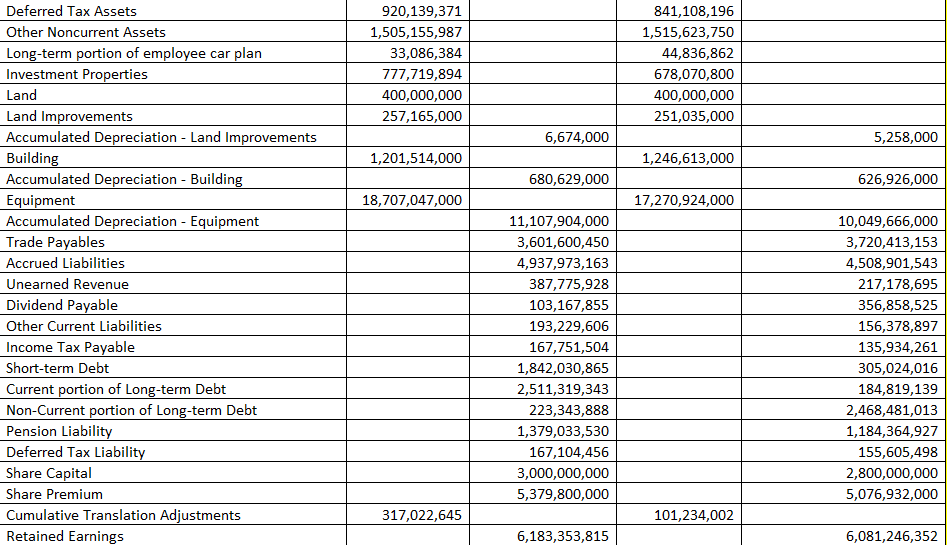

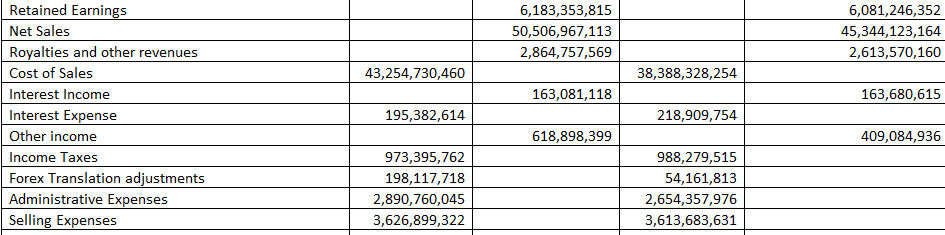

Use the trial balance below to accomplish the following requirements: 1. Prepare a Comparative Statement of Comprehensive Income (2022 and 2021) 3. Make a

Use the trial balance below to accomplish the following requirements: 1. Prepare a Comparative Statement of Comprehensive Income (2022 and 2021) 3. Make a horizontal analysis current year (2020) previous year (2019) debit credit debit credit Cash on Hand Cash in Banks Short-term deposits 130,303,379 115,715,200 2,795,294,557 2,435,425,884 5,244,891,365 6,426,117,312 Trade Accounts Receivable 1,973,793,420 1,854,239,723 Allowance for doubtful accounts 136,082,073 Advances to employees 91,120,858 Current portion of employee car plan 43,811,033 90,652,777 41,724,556 99,709,174 Other receivables 4,515,022 13,302,934 Food supplies and processed inventories 1,973,039,104 Packaging, store and other supplies Novelty Items 155,773,504 5,654,551 1,521,464,262 154,552,450 53,392,715 Prepaid rent 281,393,792 247,907,106 Insurance and other prepayments 130,129,134 134,459,881 Prepaid Taxes 107,447,393 127,543,322 Receivable from suppliers 588,179,523 616,038,571 Receivable from retirement fund 111,108,541 149,505,948 Unused office supplies 72,084,194 54,594,665 Financial Assets at Fair Value through Profit or Loss 125,416,546 107,361,994 Investment in unquoted equity securities 50,866,500 47,866,500 Goodwill 7,019,519,057 4,205,123,715 Deferred Tax Assets 920,139,371 Other Noncurrent Assets 1,505,155,987 Long-term portion of employee car plan 33,086,384 Investment Properties 777,719,894 Land 400,000,000 Land Improvements 257,165,000 841,108,196 1,515,623,750 44,836,862 678,070,800 400,000,000 251,035,000 Accumulated Depreciation - Land Improvements 6,674,000 5,258,000 Building 1,201,514,000 1,246,613,000 Accumulated Depreciation - Building 680,629,000 626,926,000 Equipment Accumulated Depreciation - Equipment Trade Payables Accrued Liabilities Unearned Revenue Dividend Payable Other Current Liabilities Income Tax Payable Short-term Debt Current portion of Long-term Debt Non-Current portion of Long-term Debt Pension Liability Deferred Tax Liability 18,707,047,000 17,270,924,000 11,107,904,000 10,049,666,000 3,601,600,450 3,720,413,153 4,937,973,163 4,508,901,543 387,775,928 217,178,695 103,167,855 356,858,525 193,229,606 156,378,897 167,751,504 135,934,261 167,104,456 Share Capital 3,000,000,000 Share Premium 5,379,800,000 1,184,364,927 155,605,498 2,800,000,000 5,076,932,000 Cumulative Translation Adjustments 317,022,645 101,234,002 Retained Earnings 6,183,353,815 6,081,246,352 1,842,030,865 2,511,319,343 223,343,888 1,379,033,530 305,024,016 184,819,139 2,468,481,013 Retained Earnings Net Sales 6,183,353,815 50,506,967,113 6,081,246,352 45,344,123,164 Royalties and other revenues 2,864,757,569 Cost of Sales 43,254,730,460 38,388,328,254 Interest Income 163,081,118 Interest Expense 195,382,614 218,909,754 Other income 618,898,399 Income Taxes 973,395,762 988,279,515 Forex Translation adjustments 198,117,718 Administrative Expenses 2,890,760,045 Selling Expenses 3,626,899,322 54,161,813 2,654,357,976 3,613,683,631 2,613,570,160 163,680,615 409,084,936

Step by Step Solution

★★★★★

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the Comparative Statement of Comprehensive Income and perform horizontal analysis well need to analyze the trial balance data for both 2022 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started