Answered step by step

Verified Expert Solution

Question

1 Approved Answer

use the values from this question do not copy from chegg the values are different Employee A started working for Company A in Alberta on

use the values from this question

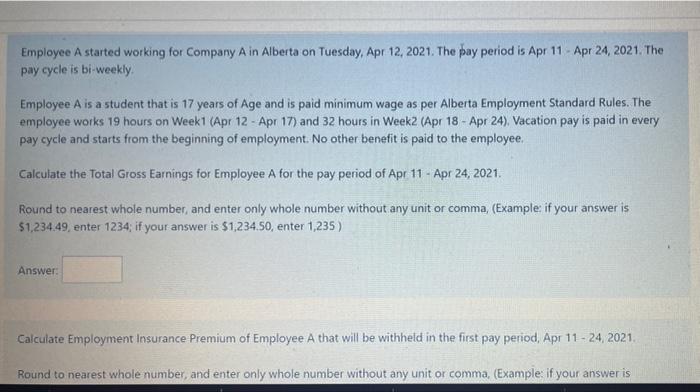

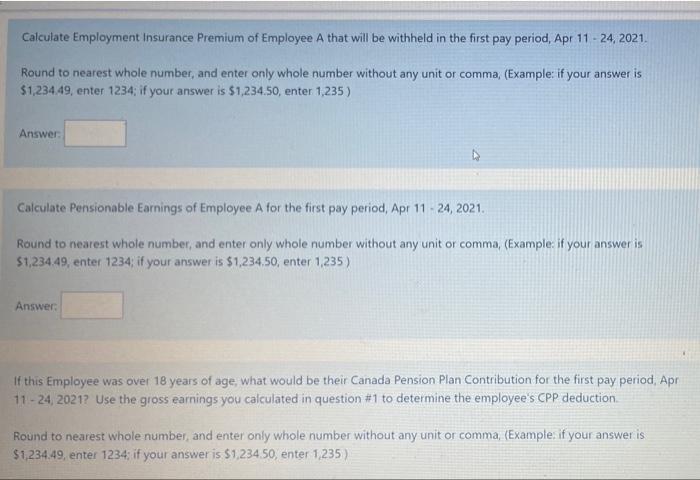

Employee A started working for Company A in Alberta on Tuesday, Apr 12, 2021. The pay period is Apr 11 Apr 24, 2021. The pay cycle is bi-weekly Employee A is a student that is 17 years of Age and is paid minimum wage as per Alberta Employment Standard Rules. The employee works 19 hours on Week1 (Apr 12 - Apr 17) and 32 hours in Week2 (Apr 18 - Apr 24). Vacation pay is paid in every pay cycle and starts from the beginning of employment. No other benefit is paid to the employee. Calculate the Total Gross Earnings for Employee A for the pay period of Apr 11 - Apr 24, 2021. Round to nearest whole number and enter only whole number without any unit or comma, (Example if your answer is $1,234.49, enter 1234; if your answer is $1,234.50, enter 1,235) Answer: Calculate Employment Insurance Premium of Employee A that will be withheld in the first pay period, Apr 11 - 24, 2021 Round to nearest whole number, and enter only whole number without any unit or comma (Example: if your answer is Calculate Employment Insurance Premium of Employee A that will be withheld in the first pay period, Apr 11 -24. 2021 Round to nearest whole number, and enter only whole number without any unit or comma, (Example: if your answer is $1,234,49, enter 1234; if your answer is $1,234,50, enter 1,235) Answer: Calculate Pensionable Earnings of Employee A for the first pay period, Apr 11 - 24, 2021. Round to nearest whole number, and enter only whole number without any unit or comma, (Example, if your answer is $1,234.49, enter 1234; if your answer is $1,234,50, enter 1235) Answer: If this Employee was over 18 years of age, what would be their Canada Pension Plan Contribution for the first pay period, Apr 11-24 2021? Use the gross earnings you calculated in question #1 to determine the employee's CPP deduction Round to nearest whole number, and enter only whole number without any unit or comma, (Example if your answer is $1.234.49, enter 1234; if your answer is $1,234 50, enter 1235) do not copy from chegg the values are different

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started