Answered step by step

Verified Expert Solution

Question

1 Approved Answer

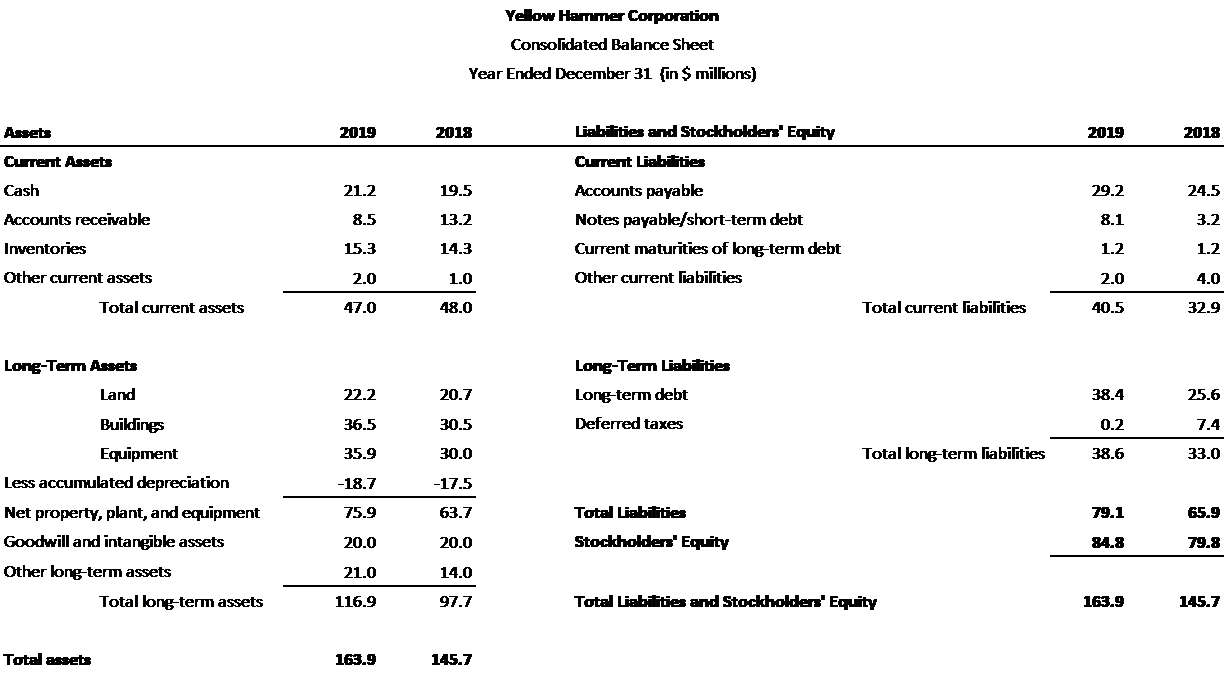

Use the Yellow Hammer Quiz 2 document on the class Canvas site. Assess Yellow Hammers leverage by calculating the debt to total capitalization ratio for

Use the Yellow Hammer Quiz 2 document on the class Canvas site. Assess Yellow Hammers leverage by calculating the debt to total capitalization ratio for 2019.

Use the Yellow Hammer Quiz 2 document on the class Canvas site. Assess Yellow Hammers leverage by calculating the debt to total capitalization ratio for 2019.

Group of answer choices

36%

19%

45%

28%

Yellow Hammer Corporation Consolidated Balance Sheet Year Ended December 31 (in $ millions) Assets 2019 2018 2019 2018 19.5 Current Assets Cash Accounts receivable Inventories Other current assets Liabilities and Stockholders' Equity Current Liabilities Accounts payable Notes payable/short-term debt Current maturities of long-term debt Other current liabilities 21.2 8.5 15.3 2.0 24.5 3.2 13.2 14.3 1.0 29.2 8.1 1.2 2.0 1.2 4.0 32.9 Total current assets 47.0 48.0 Total current liabilities 40.5 Long-Term Liabilities 22.2 20.7 25.6 Long-term debt Deferred taxes 36.5 30.5 38.4 0.2 38.6 7.4 33.0 35.9 30.0 Total long-term liabilities Long-Term Assets Land Buildings Equipment Less accumulated depreciation Net property, plant, and equipment Goodwill and intangible assets Other long-term assets Total long-term assets -18.7 -17.5 63.7 79.1 65.9 75.9 20.0 21.0 Total Liabilities Stockholders' Equity 20.0 84.8 79.8 14.0 116.9 97.7 Total Liabilities and Stockholders' Equity 163.9 145.7 Total assets 163.9 145.7Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started