Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use these facts for this and the following three questions. A company is financed equally by $1 million in debt and $2 million in equity.

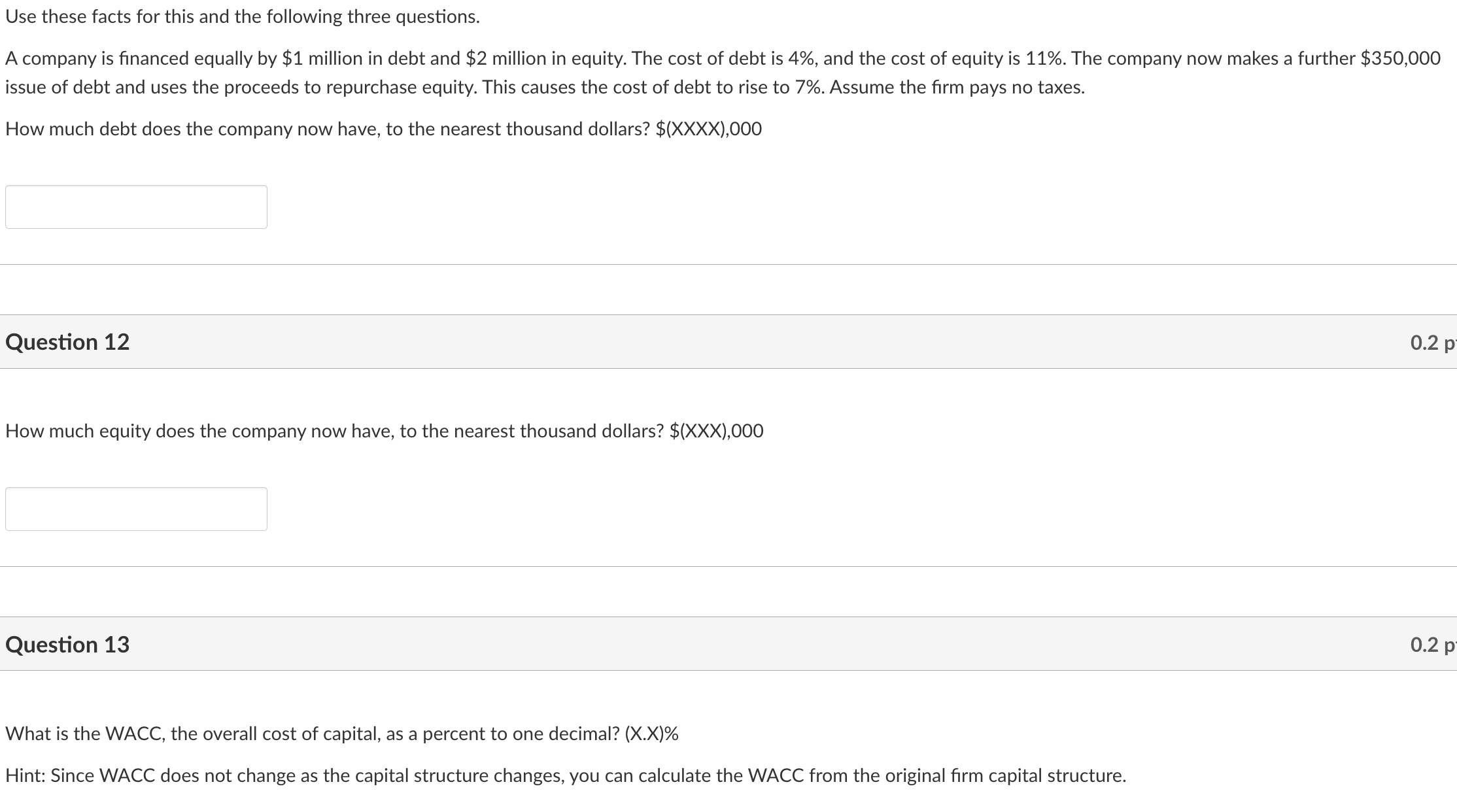

Use these facts for this and the following three questions. A company is financed equally by $1 million in debt and $2 million in equity. The cost of debt is 4%, and the cost of equity is 11%. The company now makes a further $350,000 issue of debt and uses the proceeds to repurchase equity. This causes the cost of debt to rise to 7%. Assume the firm pays no taxes. How much debt does the company now have, to the nearest thousand dollars? $(XXXX),000 Question 12 How much equity does the company now have, to the nearest thousand dollars? $(XXX),000 Question 13 What is the WACC, the overall cost of capital, as a percent to one decimal? (X.X)\% Hint: Since WACC does not change as the capital structure changes, you can calculate the WACC from the original firm capital structure

Use these facts for this and the following three questions. A company is financed equally by $1 million in debt and $2 million in equity. The cost of debt is 4%, and the cost of equity is 11%. The company now makes a further $350,000 issue of debt and uses the proceeds to repurchase equity. This causes the cost of debt to rise to 7%. Assume the firm pays no taxes. How much debt does the company now have, to the nearest thousand dollars? $(XXXX),000 Question 12 How much equity does the company now have, to the nearest thousand dollars? $(XXX),000 Question 13 What is the WACC, the overall cost of capital, as a percent to one decimal? (X.X)\% Hint: Since WACC does not change as the capital structure changes, you can calculate the WACC from the original firm capital structure Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started