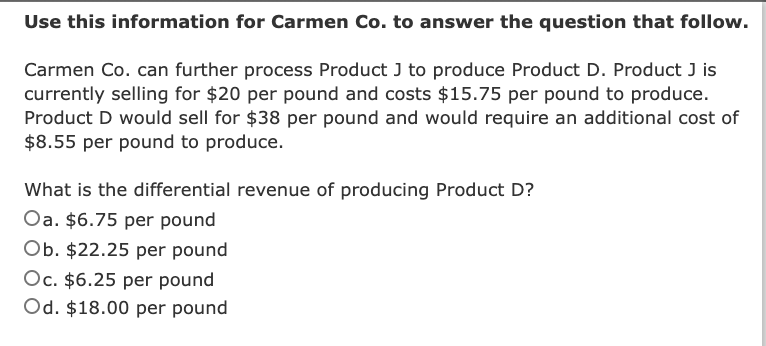

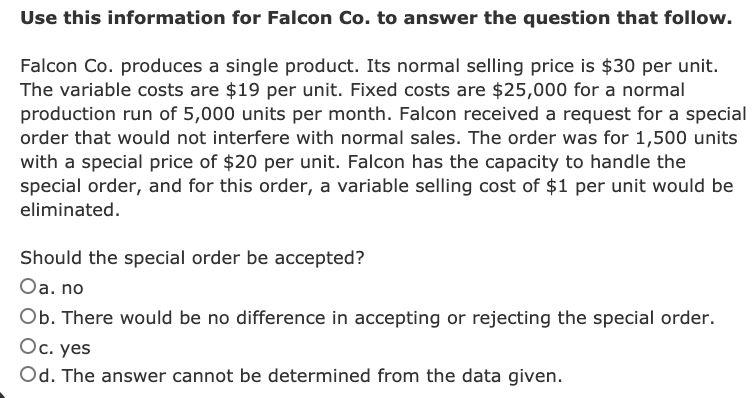

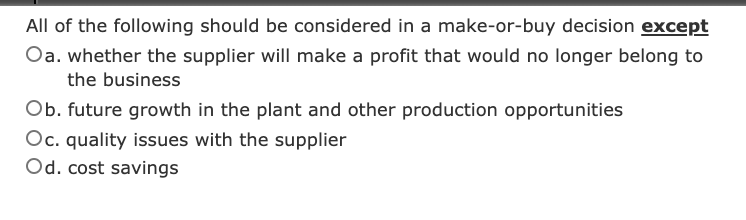

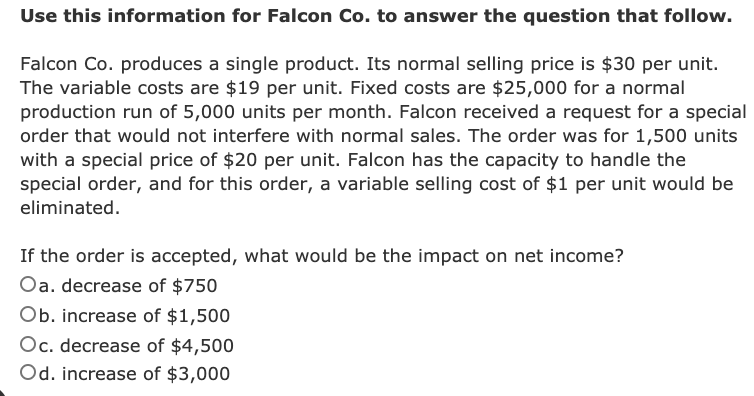

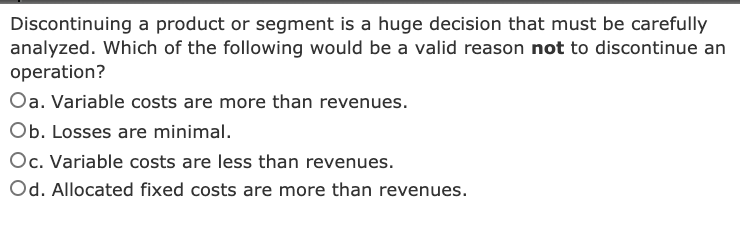

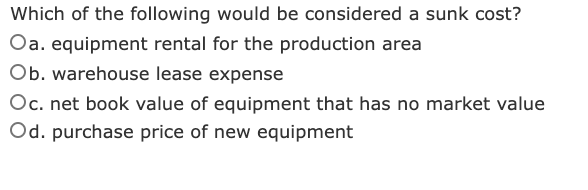

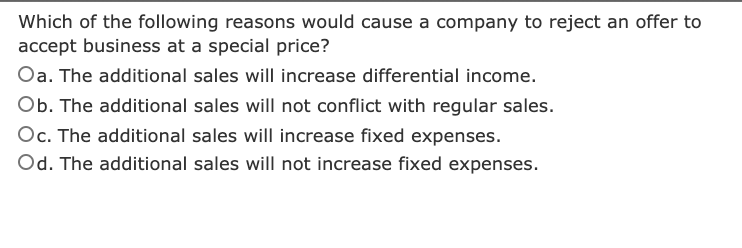

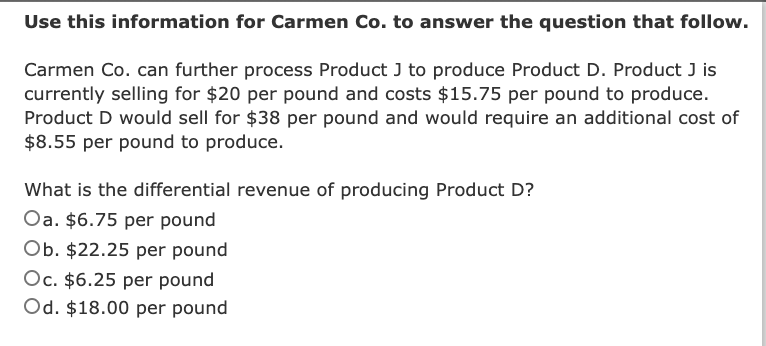

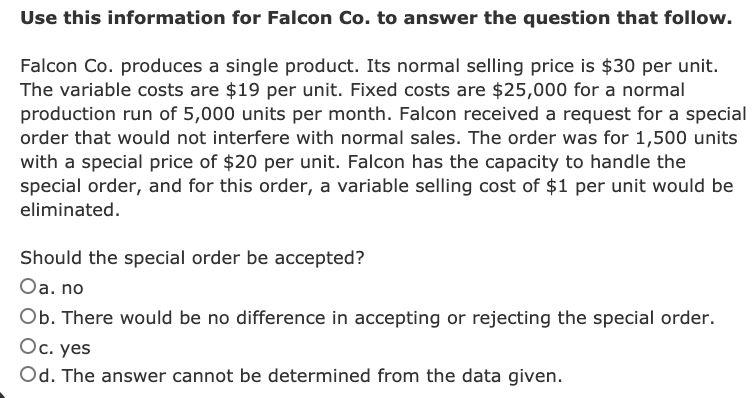

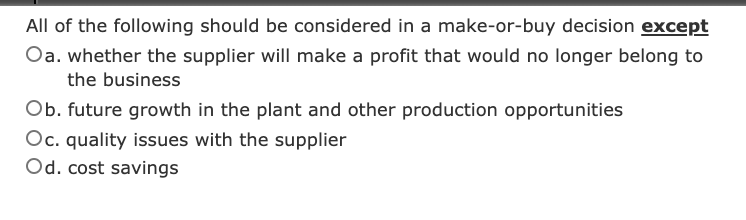

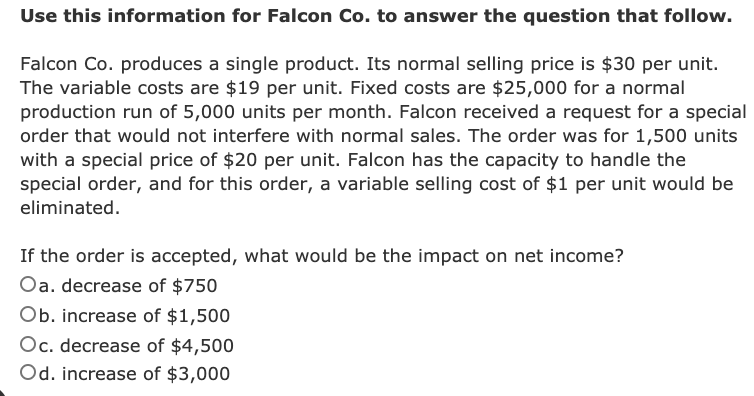

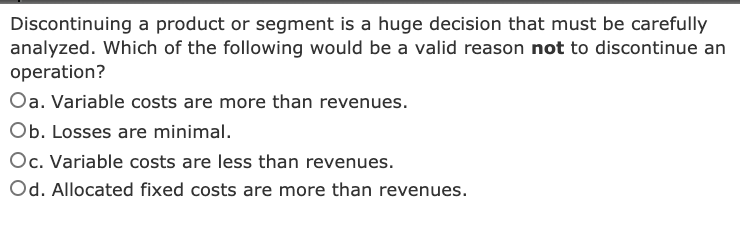

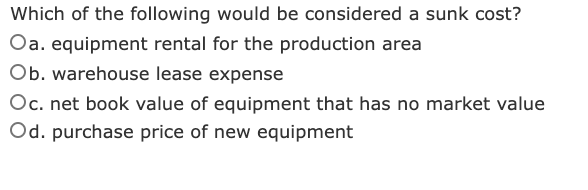

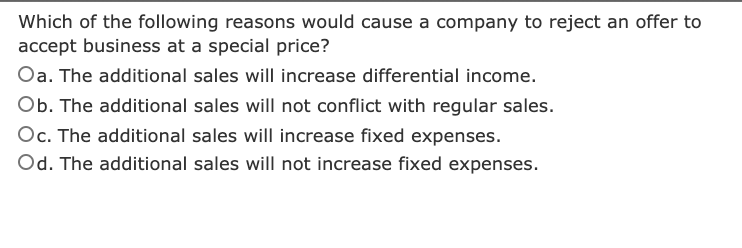

Use this information for Carmen Co. to answer the question that follow. Carmen Co. can further process Product ) to produce Product D. Product ) is currently selling for $20 per pound and costs $15.75 per pound to produce. Product D would sell for $38 per pound and would require an additional cost of $8.55 per pound to produce. What is the differential revenue of producing Product D? Oa. $6.75 per pound Ob. $22.25 per pound Oc. $6.25 per pound Od. $18.00 per pound Use this information for Falcon Co. to answer the question that follow. Falcon Co. produces a single product. Its normal selling price is $30 per unit. The variable costs are $19 per unit. Fixed costs are $25,000 for a normal production run of 5,000 units per month. Falcon received a request for a special order that would not interfere with normal sales. The order was for 1,500 units with a special price of $20 per unit. Falcon has the capacity to handle the special order, and for this order, a variable selling cost of $1 per unit would be eliminated. Should the special order be accepted? Oa.no Ob. There would be no difference in accepting or rejecting the special order. Oc. yes Od. The answer cannot be determined from the data given. All of the following should be considered in a make-or-buy decision except Oa. whether the supplier will make a profit that would no longer belong to the business Ob. future growth in the plant and other production opportunities Oc. quality issues with the supplier Od cost savings Use this information for Falcon Co. to answer the question that follow. Falcon Co. produces a single product. Its normal selling price is $30 per unit. The variable costs are $19 per unit. Fixed costs are $25,000 for a normal production run of 5,000 units per month. Falcon received a request for a special order that would not interfere with normal sales. The order was for 1,500 units with a special price of $20 per unit. Falcon has the capacity to handle the special order, and for this order, a variable selling cost of $1 per unit would be eliminated. If the order is accepted, what would be the impact on net income? Oa. decrease of $750 Ob. increase of $1,500 Oc. decrease of $4,500 Od. increase of $3,000 Discontinuing a product or segment is a huge decision that must be carefully analyzed. Which of the following would be a valid reason not to discontinue an operation? Oa. Variable costs are more than revenues. Ob. Losses are minimal. Oc. Variable costs are less than revenues. Od. Allocated fixed costs are more than revenues. Which of the following would be considered a sunk cost? Oa. equipment rental for the production area Ob. warehouse lease expense Oc. net book value of equipment that has no market value Od. purchase price of new equipment Which of the following reasons would cause a company to reject an offer to accept business at a special price? Oa. The additional sales will increase differential income. Ob. The additional sales will not conflict with regular sales. Oc. The additional sales will increase fixed expenses. Od. The additional sales will not increase fixed expenses