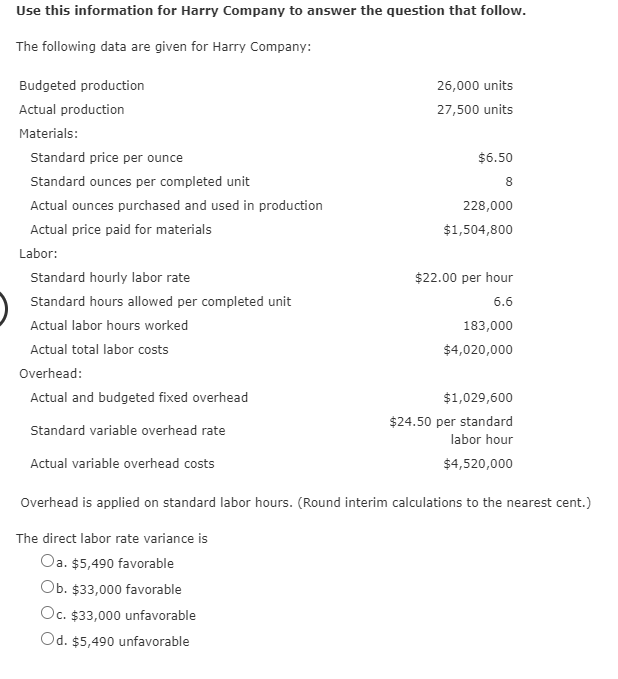

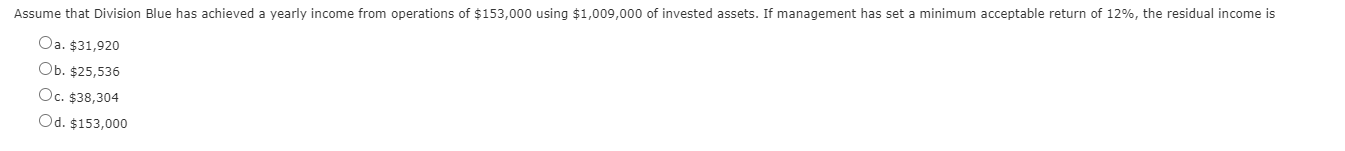

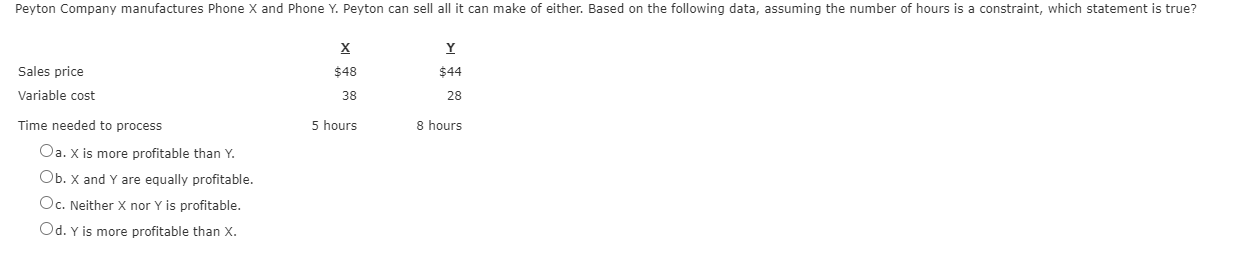

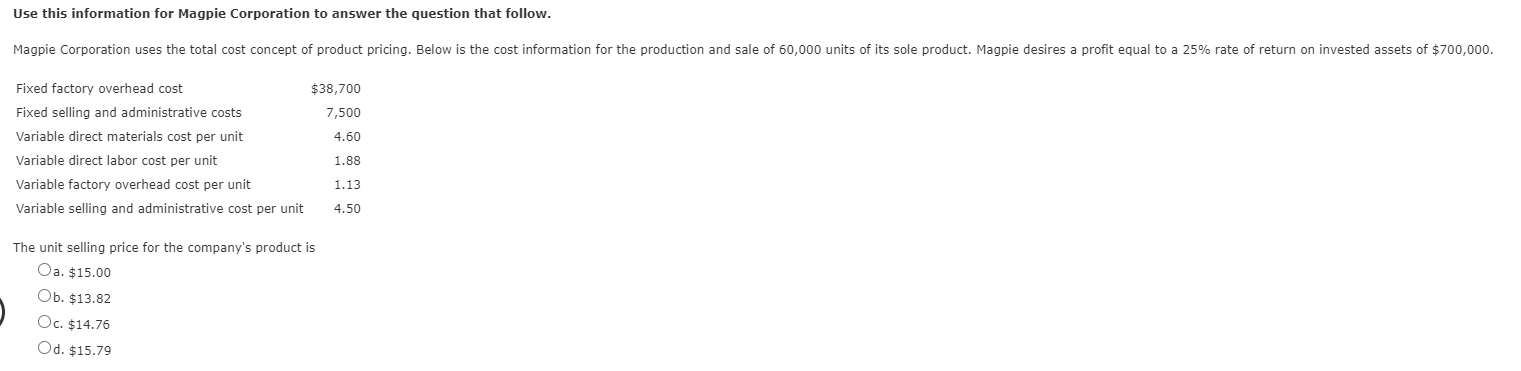

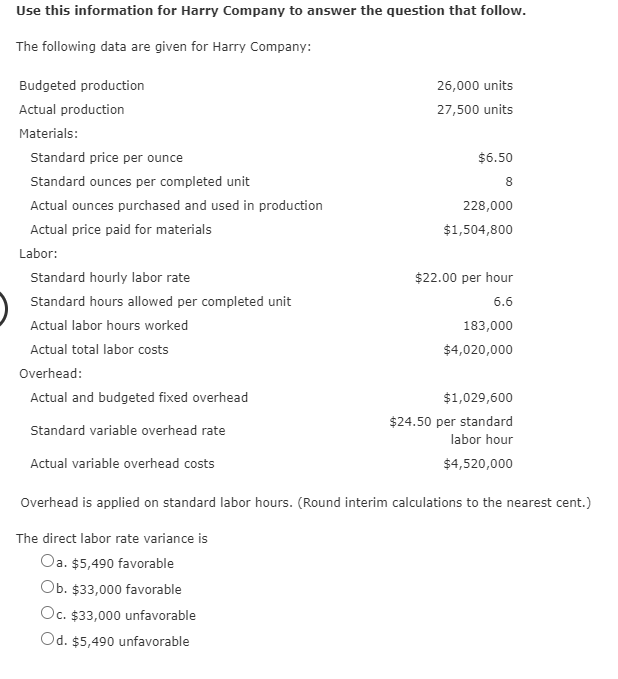

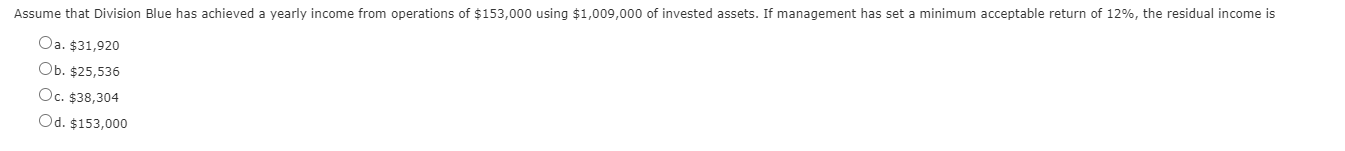

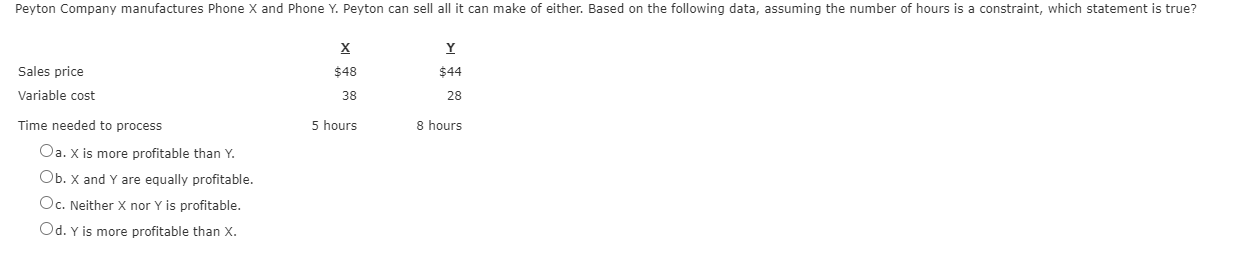

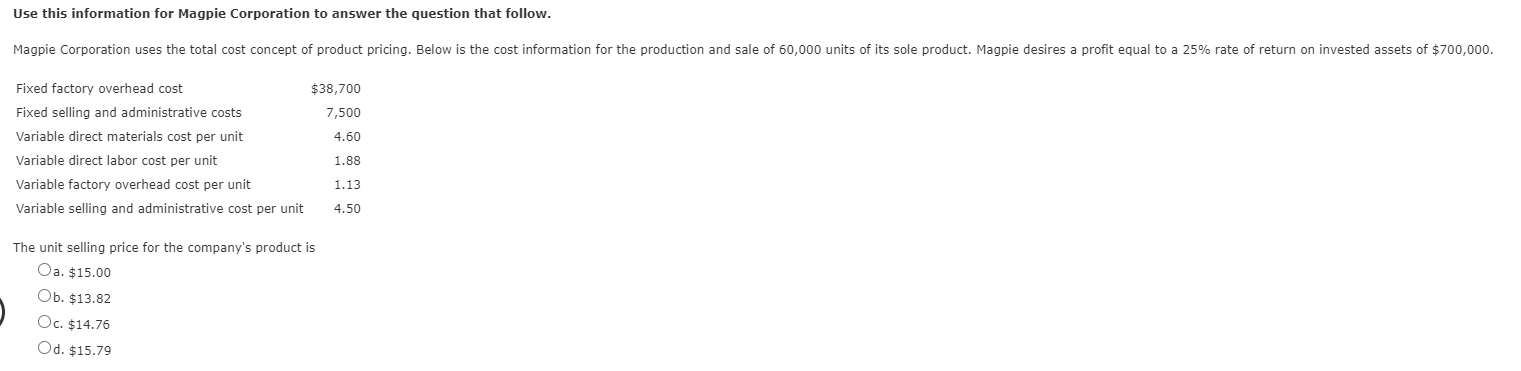

Use this information for Harry Company to answer the question that follow. The following data are given for Harry Company: 26,000 units 27,500 units $6.50 8 228,000 $1,504,800 Budgeted production Actual production Materials: Standard price per ounce Standard ounces per completed unit Actual ounces purchased and used in production Actual price paid for materials Labor: Standard hourly labor rate Standard hours allowed per completed unit Actual labor hours worked Actual total labor costs Overhead: Actual and budgeted fixed overhead Standard variable overhead rate $22.00 per hour 6.6 183,000 $4,020,000 $1,029,600 $24.50 per standard labor hour $4,520,000 Actual variable overhead costs Overhead is applied on standard labor hours. (Round interim calculations to the nearest cent.) The direct labor rate variance is Oa. $5,490 favorable Ob. $33,000 favorable Oc. $33,000 unfavorable Od. $5,490 unfavorable Assume that Division Blue has achieved a yearly income from operations of $153,000 using $1,009,000 of invested assets. If management has set a minimum acceptable return of 12%, the residual income is Oa. $31,920 Ob. $25,536 Oc. $38,304 Od. $153,000 Peyton Company manufactures Phone X and Phone Y. Peyton can sell all it can make of either. Based on the following data, assuming the number of hours is a constraint, which statement is true? Y $48 $44 Sales price Variable cost 38 28 Time needed to process 5 hours 8 hours Oa. X is more profitable than Y. Ob. X and Y are equally profitable. Oc. Neither X nor Y is profitable. Od. Y is more profitable than X. Use this information for Magpie Corporation to answer the question that follow. Magpie Corporation uses the total cost concept of product pricing. Below is the cost information for the production and sale of 60,000 units of its sole product. Magpie desires a profit equal to a 25% rate of return on invested assets of $700,000. $38,700 7,500 4.60 Fixed factory overhead cost Fixed selling and administrative costs Variable direct materials cost per unit Variable direct labor cost per unit Variable factory overhead cost per unit Variable selling and administrative cost per unit 1.88 1.13 4.50 The unit selling price for the company's product is Oa. $15.00 Ob. $13.82 Oc. $14.76 Od. $15.79