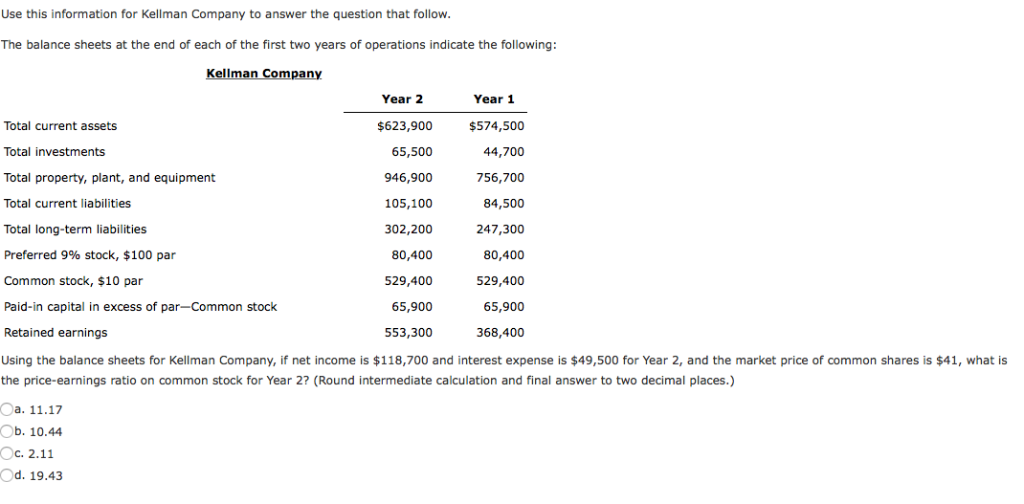

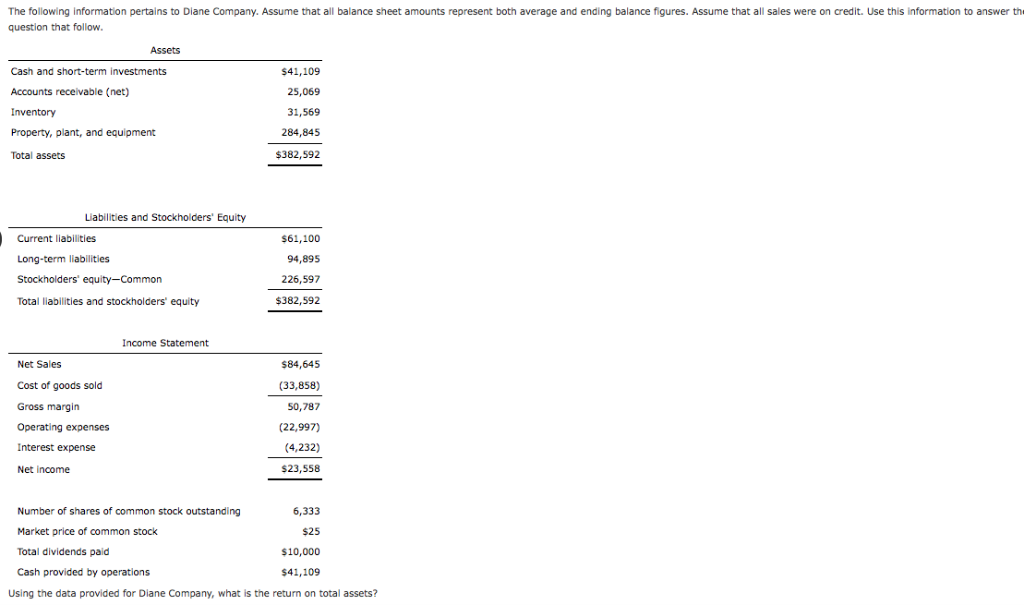

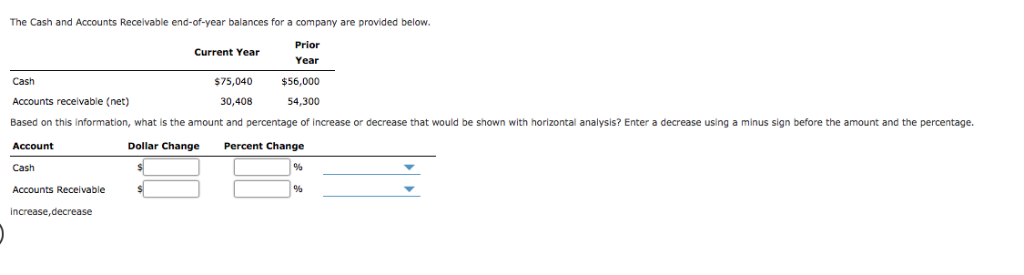

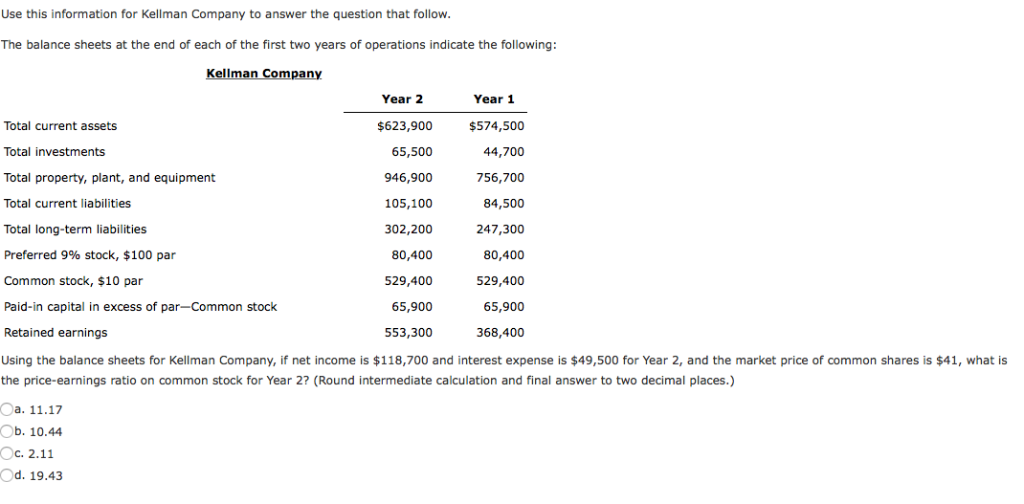

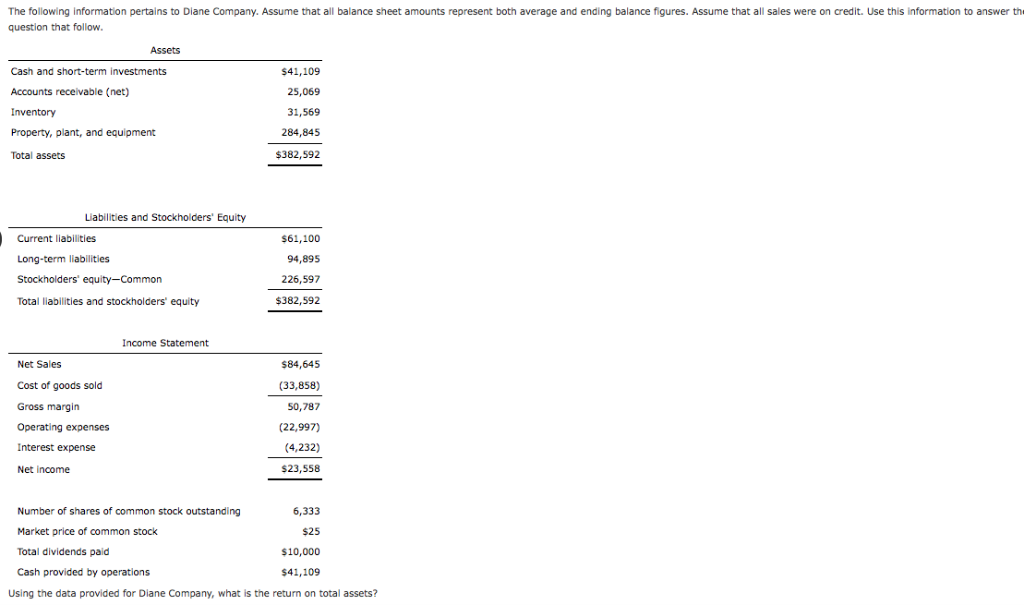

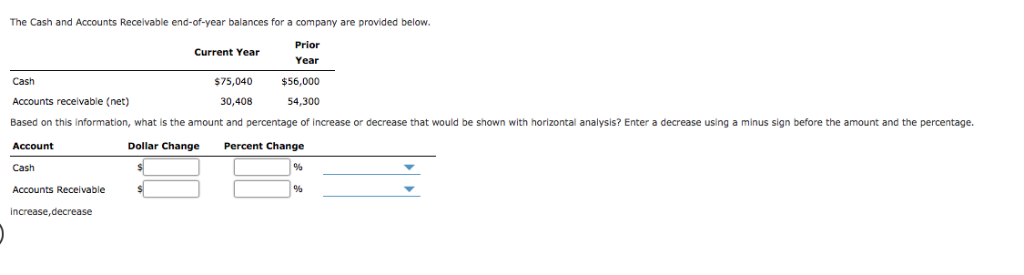

Use this information for Kellman Company to answer the question that follow The balance sheets at the end of each of the first two years of operations indicate the following: Kellman Company Year 1 Year 2 Total current assets $623,900 $574,500 65,500 Total investments 44,700 Total property, plant, and equipment 946,900 756,700 84,500 Total current liabilities 105,100 302,200 247,300 Total long-term liabilities Preferred 9% stock, $100 par 80,400 80,400 Common stock, $10 par 529,400 529,400 65,900 Paid-in capital in excess of par-Common stock 65,900 Retained earnings 553,300 368,400 Using the balance sheets for Kellman Company, if net income is $118,700 and interest expense is $49,500 for Year 2, and the market price of common shares is $41, what is the price-earnings ratio on common stock for Year 2? (Round intermediate calculation and final answer to two decimal places.) Ob. 10.44 . 2.11 Od. 19.43 The following information pertains to Diane Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit. Use this information to answer th question that follow. Assets $41,109 Cash and short-term investments Accounts receivable (net) 25,069 Inventory 31,569 284,845 Property, plant, and equipment $382,592 Total assets Liabilites and Stockholders Equity Current liabilities $61,100 Long-term liabilitles 94,895 226,597 $382,592 Total liabilities and stockholders' equity Income Statement Net Sales $84,645 Cost of goods sold (33,858) Gross margin 50,787 Operating expenses (22,997) 4,232) Interest expense $23,558 Net income Number of shares of common stock outstanding 6,333 Market price of common stock $25 $10,000 Total dividends paid Cash provided by operations $41,109 Using the data provided for Diane Company, what is the return on total assets? The Cash and Accounts Receivable end-of-year balances for a company are provided below Prior Current Year Year Cash 75,040 $56,000 Accounts recelvable (net) 30,408 54,300 Based on this information, what is the amount and percentage of increase or decrease that would be shown with horizontal analysis? Enter a decrease using a minus sign before the amount and the percentage. Dollar Change Percent Change Account Cash Accounts Receivable Increase,decrease