Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use this information for the next 2 questions: On December 3 , Creative Computers ( CC ) held an IPO for 2 0 % of

Use this information for the next questions:

On December Creative Computers CC held an IPO for of the shares of its subsidiary, Ubid UBID It announced that in months, it would spinoff the remaining of UBID shares, whereby shareholders of CC would receive shares of UBID for each share of CC Suppose that on the close of trading the day after the IPO you observe the following prices:

$$

Question

pts

What is the $ stub value of Creative Computers? eg What is the implied value the market has placed on the standalone assets of Creative Computers that are unrelated to Ubid assets

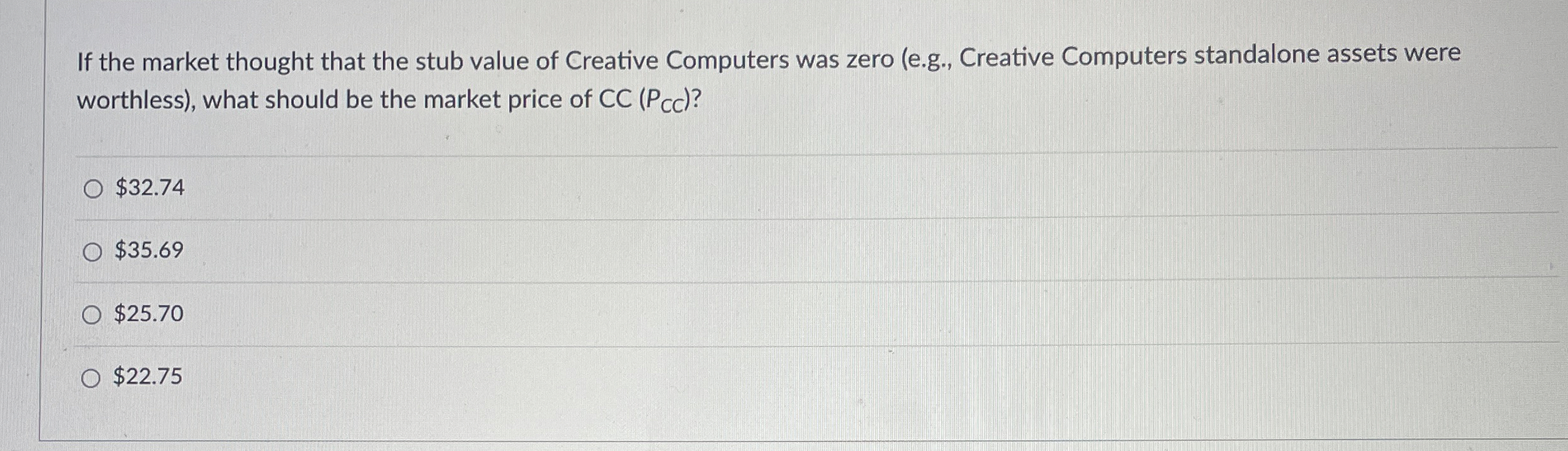

If the market thought that the stub value of Creative Computers was zero eg Creative Computers standalone assets were worthless what should be the market price of CC :

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started