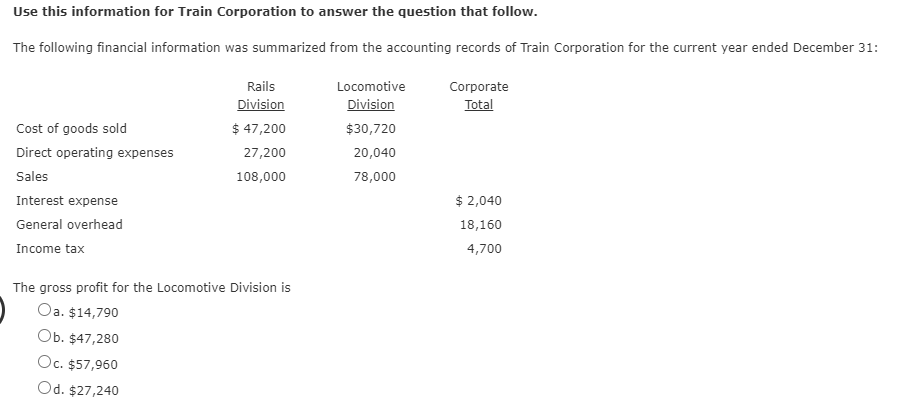

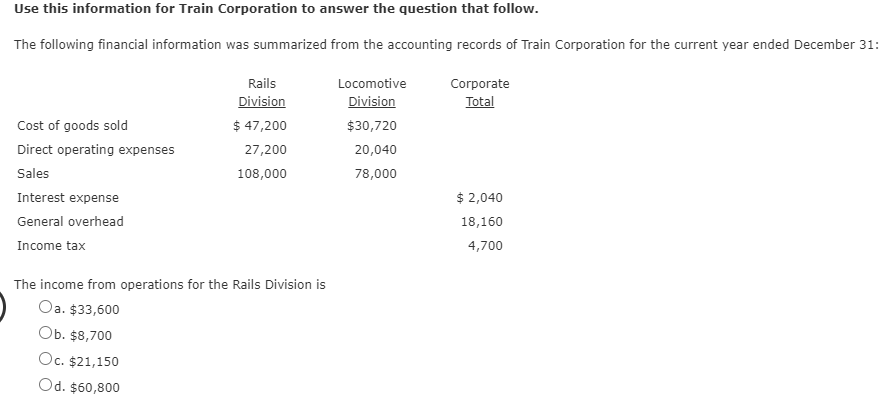

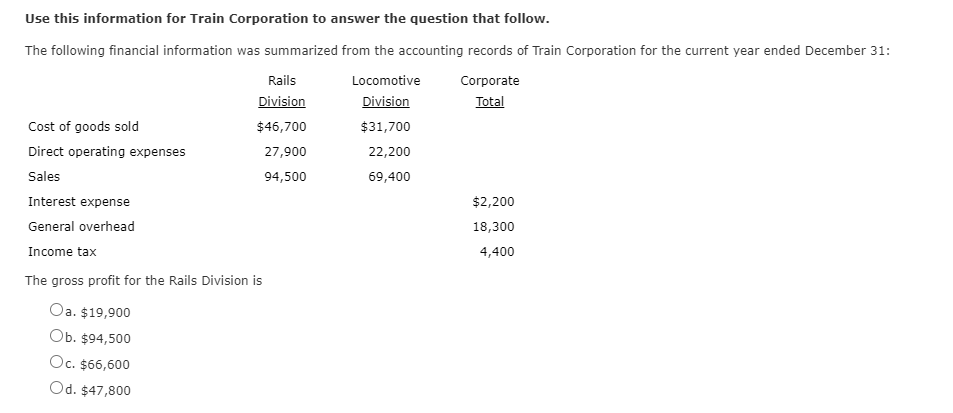

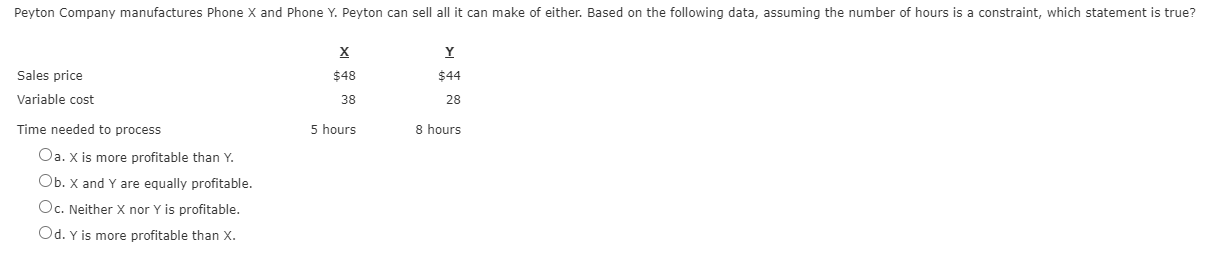

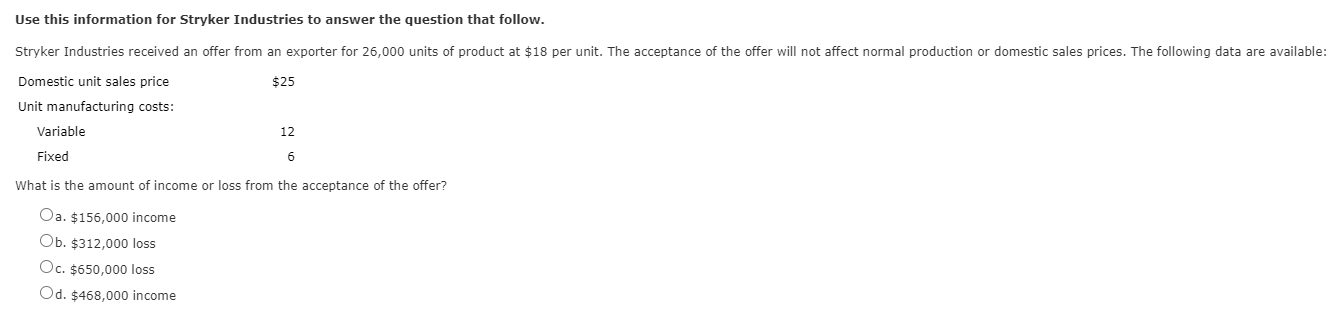

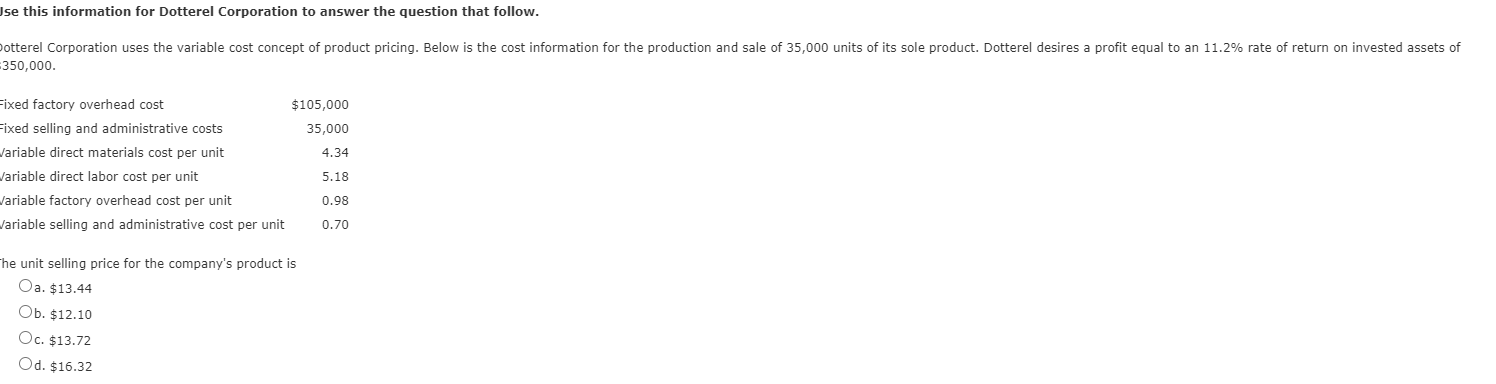

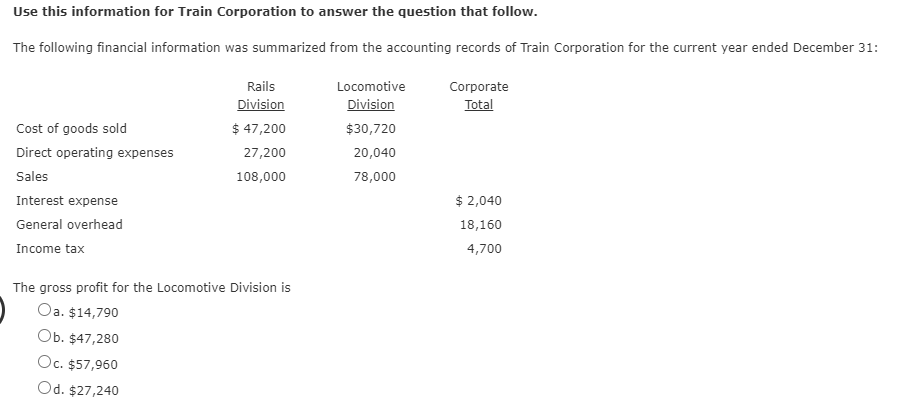

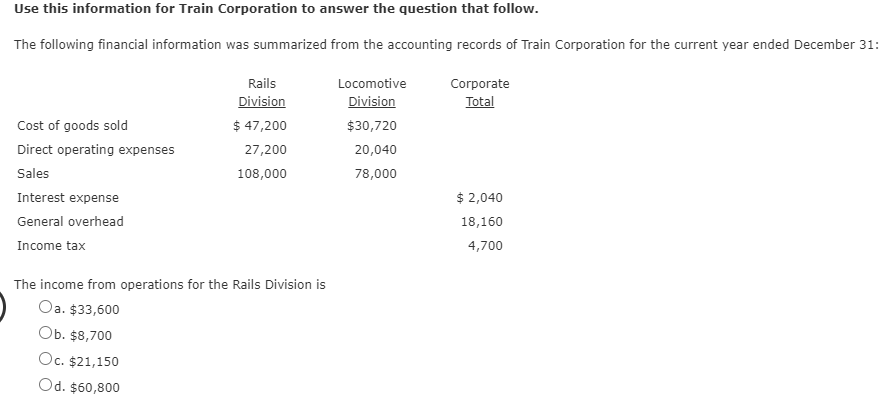

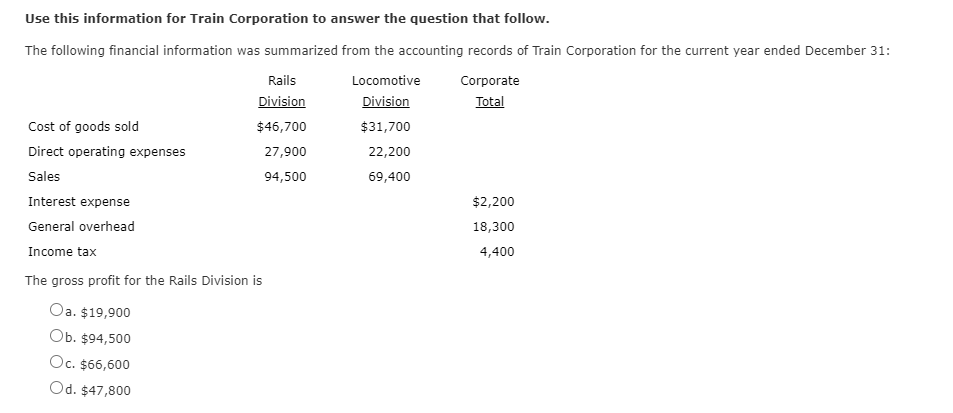

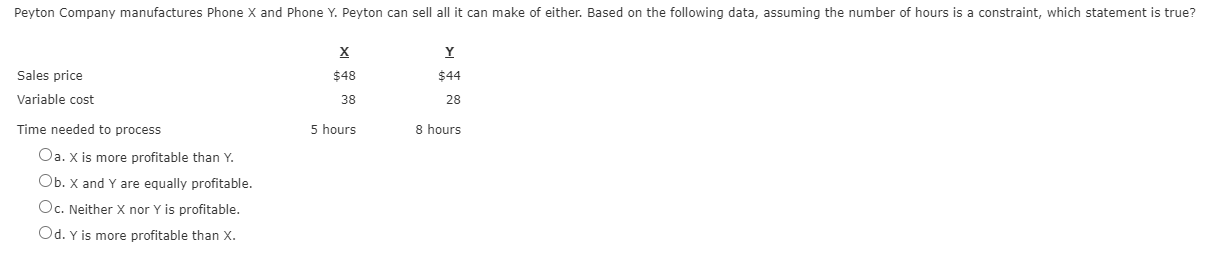

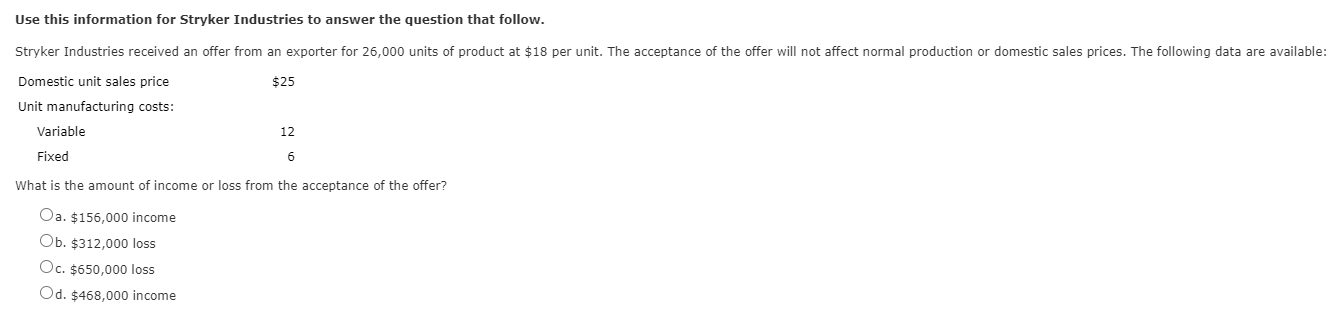

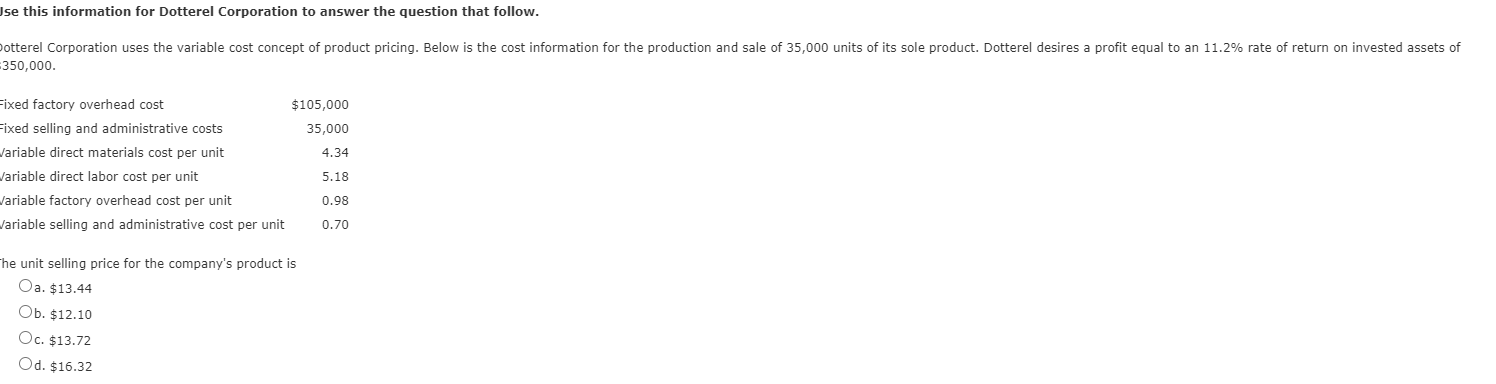

Use this information for Train Corporation to answer the question that follow. The following financial information was summarized from the accounting records of Train Corporation for the current year ended December 31: Corporate Total Cost of goods sold Direct operating expenses Sales Interest expense General overhead Rails Division $ 47,200 27,200 108,000 Locomotive Division $30,720 20,040 78,000 $ 2,040 18,160 4,700 Income tax The gross profit for the Locomotive Division is Oa. $14,790 Ob. $47,280 Oc. $57,960 Od. $27,240 Use this information for Train Corporation to answer the question that follow. The following financial information was summarized from the accounting records of Train Corporation for the current year ended December 31: Corporate Total Rails Division $ 47,200 27,200 108,000 Locomotive Division $30,720 20,040 78,000 Cost of goods sold Direct operating expenses Sales Interest expense General overhead Income tax $ 2,040 18,160 4,700 The income from operations for the Rails Division is Oa. $33,600 Ob. $8,700 Oc. $21,150 Od. $60,800 Use this information for Train Corporation to answer the question that follow. The following financial information was summarized from the accounting records of Train Corporation for the current year ended December 31: Rails Locomotive Corporate Division Division Total Cost of goods sold $46,700 $31,700 Direct operating expenses 27,900 22,200 Sales 94,500 69,400 Interest expense $2,200 General overhead 18,300 Income tax 4,400 The gross profit for the Rails Division is Oa. $19,900 Ob. $94,500 Oc. $66,600 Od. $47,800 Peyton Company manufactures Phone X and Phone Y. Peyton can sell all it can make of either. Based on the following data, assuming the number of hours is a constraint, which statement is true? X Y $48 $44 Sales price Variable cost 38 28 5 hours 8 hours Time needed to process Oa. X is more profitable than Y. Ob. X and Y are equally profitable. Oc. Neither X nor Y is profitable. Od. Y is more profitable than X. Use this information for Stryker Industries to answer the question that follow. Stryker Industries received an offer from an exporter for 26,000 units of product at $18 per unit. The acceptance of the offer will not affect normal production or domestic sales prices. The following data are available: $25 Domestic unit sales price Unit manufacturing costs: Variable 12 Fixed 6 What is the amount of income or loss from the acceptance of the offer? Oa. $156,000 income Ob. $312,000 loss Oc. $650,000 loss Od. $468,000 income Use this information for Dotterel Corporation to answer the question that follow. potterel Corporation uses the variable cost concept of product pricing. Below is the cost information for the production and sale of 35,000 units of its sole product. Dotterel desires a profit equal to an 11.2% rate of return on invested assets of 350,000 $105,000 35,000 4.34 Fixed factory overhead cost Fixed selling and administrative costs Variable direct materials cost per unit Variable direct labor cost per unit Variable factory overhead cost per unit Variable selling and administrative cost per unit 5.18 0.98 0.70 the unit selling price for the company's product is Oa. $13.44 Ob. $12.10 Oc. $13.72 Od. $16.32