Answered step by step

Verified Expert Solution

Question

1 Approved Answer

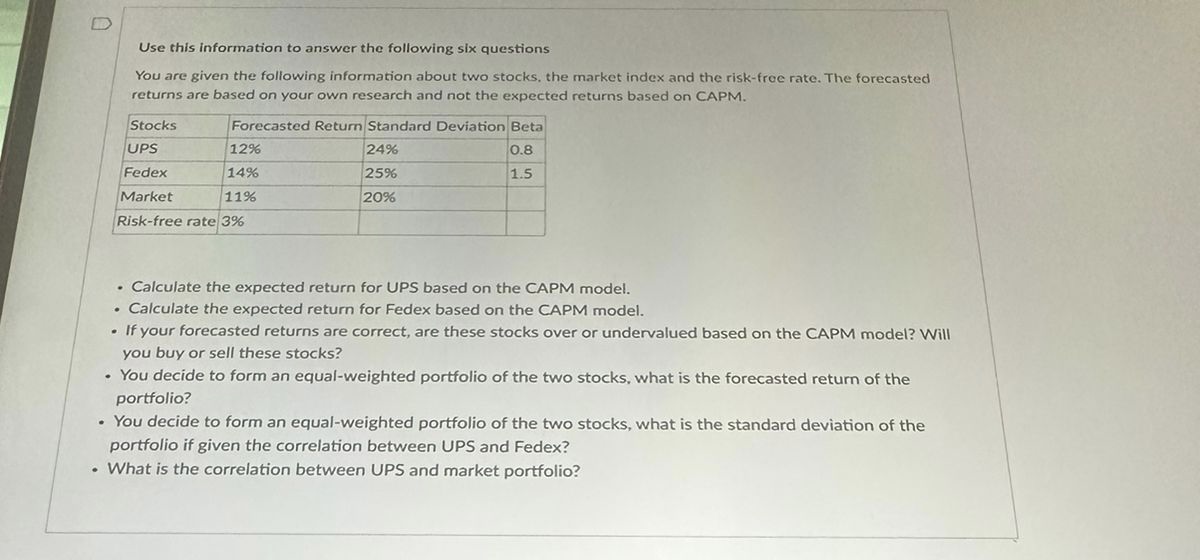

Use this information to answer the following six questions You are given the following information about two stocks, the market index and the risk-free rate.

Use this information to answer the following six questions You are given the following information about two stocks, the market index and the risk-free rate. The forecasted returns are based on your own research and not the expected returns based on CAPM. - Calculate the expected return for UPS based on the CAPM model. - Calculate the expected return for Fedex based on the CAPM model. - If your forecasted returns are correct, are these stocks over or undervalued based on the CAPM model? Will you buy or sell these stocks? - You decide to form an equal-weighted portfolio of the two stocks, what is the forecasted return of the portfolio? - You decide to form an equal-weighted portfolio of the two stocks, what is the standard deviation of the portfolio if given the correlation between UPS and Fedex? What is the correlation between UPS and market portfolio

Use this information to answer the following six questions You are given the following information about two stocks, the market index and the risk-free rate. The forecasted returns are based on your own research and not the expected returns based on CAPM. - Calculate the expected return for UPS based on the CAPM model. - Calculate the expected return for Fedex based on the CAPM model. - If your forecasted returns are correct, are these stocks over or undervalued based on the CAPM model? Will you buy or sell these stocks? - You decide to form an equal-weighted portfolio of the two stocks, what is the forecasted return of the portfolio? - You decide to form an equal-weighted portfolio of the two stocks, what is the standard deviation of the portfolio if given the correlation between UPS and Fedex? What is the correlation between UPS and market portfolio Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started