Answered step by step

Verified Expert Solution

Question

1 Approved Answer

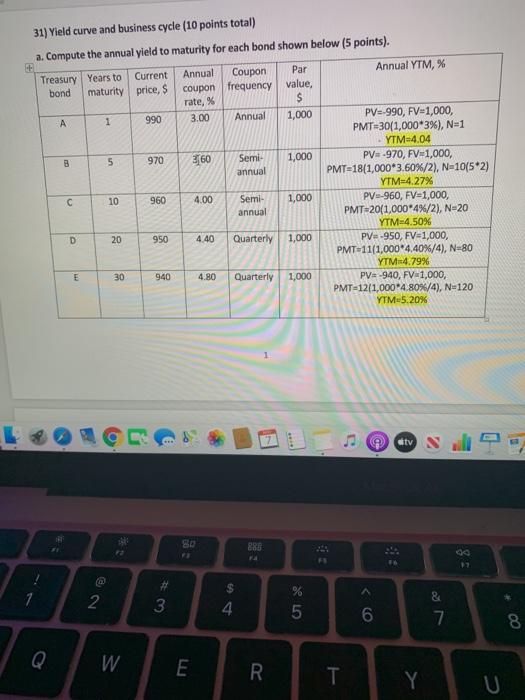

Use this information to plot a Treasury Yield Curve 970 31) Yield curve and business cycle (10 points total) a. Compute the annual yield to

Use this information to plot a Treasury Yield Curve

970 31) Yield curve and business cycle (10 points total) a. Compute the annual yield to maturity for each bond shown below (5 points). Current Treasury Years to Annual Par Coupon Annual YTM, % bond maturity price, coupon frequency value, rate, % $ 1 990 3.00 Annual 1,000 PV=-990, FV=1,000, PMT=30(1,000*3%), N=1 YTM-4.04 B 5 360 Semi- 1,000 PV=-970, FV=1,000, annual PMT=18(1,000*3.60%/2), N=1015*2) YTM-4.27% 10 960 4.00 Semi- 1,000 PV--960, FV=1,000, annual PMT-20(1,000*4%/2), N=20 YTM-4.50% D 20 950 4.40 Quarterly 1,000 PV=-950, FV=1,000, PMT-11(1,000*4,40%/4), N-80 YTM4.79% 30 940 4.80 Quarterly 1,000 PV=-940, FV 1,000, PMT-12/1,000*4.80%/4), N=120 YTM-5.20% E Gtv go 888 00 @ 2 $ 1 3 4 % 5 6 7 8 Q W E R T Y U b. Use the above results to plot a Treasury yield curve (3 points). c. Describe the above yield curve, then explain what future economic conditions the yield curve predicts and why (2 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started