Answered step by step

Verified Expert Solution

Question

1 Approved Answer

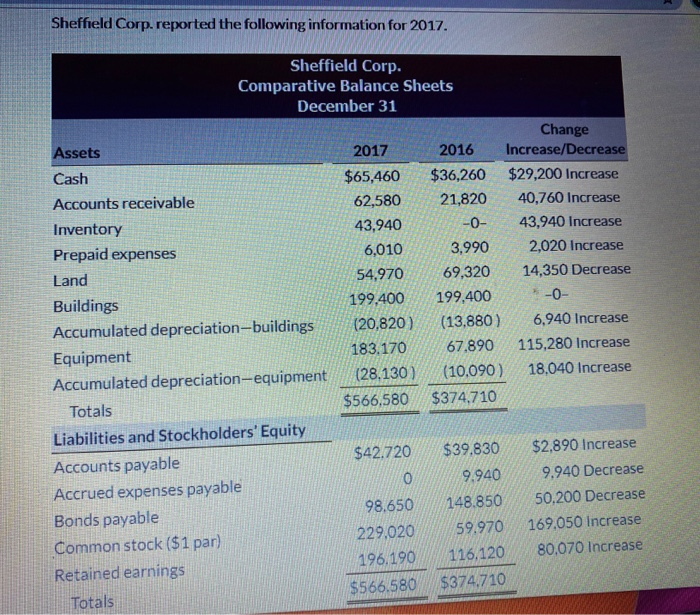

Use this information to prepare a statement of cash flows using the indirect method Sheffield Corp. reported the following information for 2017. Sheffield Corp. Comparative

Use this information to prepare a statement of cash flows using the indirect method

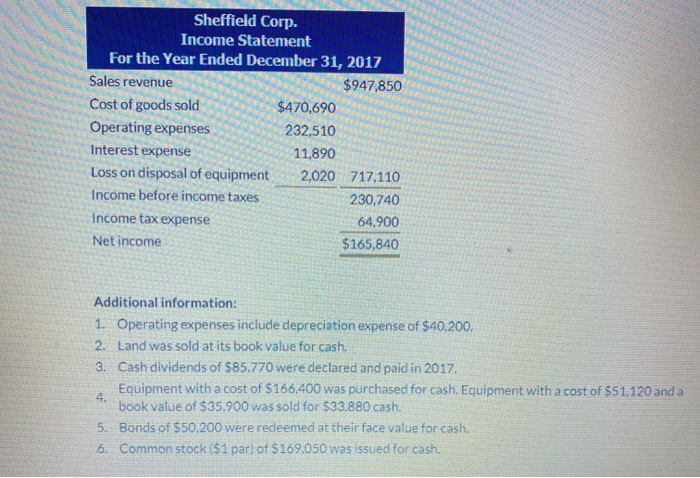

Sheffield Corp. reported the following information for 2017. Sheffield Corp. Comparative Balance Sheets December 31 Change Assets 2017 2016 Increase/Decrease Cash $65,460 $36,260 $29,200 Increase Accounts receivable 62,580 21,820 40,760 Increase Inventory 43,940 -0 43,940 Increase Prepaid expenses 6,010 3,990 2,020 Increase Land 54,970 6 9,320 14,350 Decrease Buildings 199.400 199,400 -O Accumulated depreciation-buildings (20.820) (13.880) 6,940 Increase Equipment 183.170 67.890 115,280 Increase Accumulated depreciation equipment (28.130) (10.090) 18.040 Increase Totals $566,580 $374.710 Liabilities and Stockholders' Equity $42.720 Accounts payable $39.830 $2,890 Increase 0 9.940 9.940 Decrease Accrued expenses payable 98.650 148.850 50,200 Decrease Bonds payable 229.020 59.970 169.050 Increase Common stock ($1 par) 196,190 116,120 80.070 Increase Retained earnings $566.580 $374.710 Totals 5 Sheffield Corp. Income Statement For the Year Ended December 31, 2017 Sales revenue $947,850 Cost of goods sold $470,690 Operating expenses 232,510 Interest expense 11.890 Loss on disposal of equipment 2,020 717,110 Income before income taxes 230,740 Income tax expense 64.900 Net income $165,840 Additional information: 1. Operating expenses include depreciation expense of $40,200. 2. Land was sold at its book value for cash. 3. Cash dividends of $85.770 were declared and paid in 2017. Equipment with a cost of $166,400 was purchased for cash. Equipment with a cost of $51,120 and a * book value of $35.900 was sold for $33.880 cash. 5. Bonds of $50,200 were redeemed at their face value for cash. 6. Common stock ($1 par) of $169.050 was issued for cash Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started