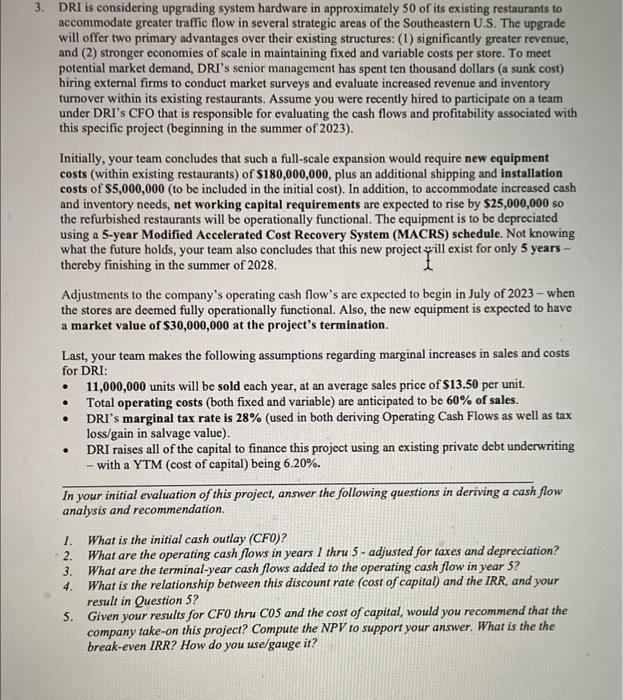

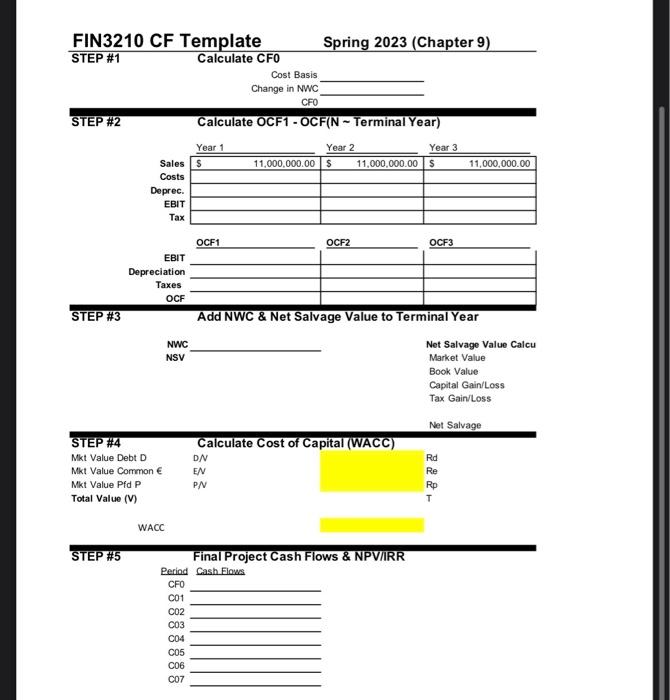

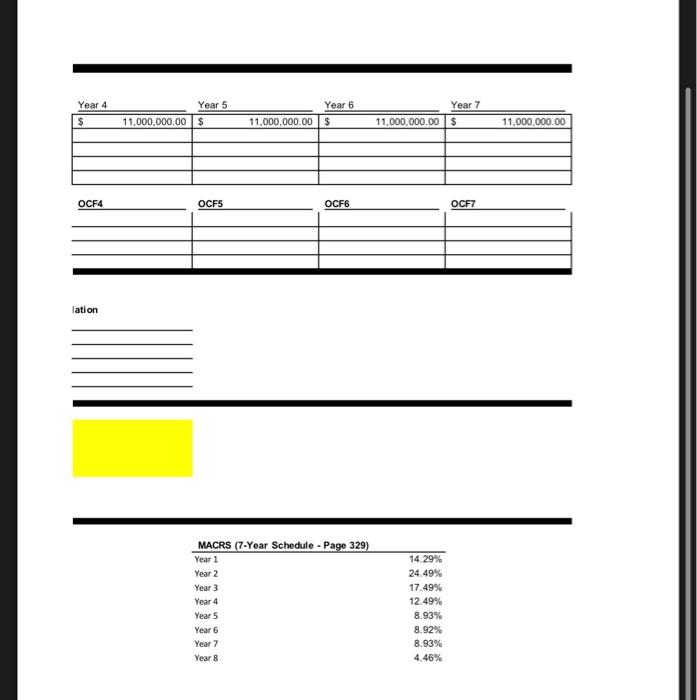

DRI is considering upgrading system hardware in approximately 50 of its existing restaurants to accommodate greater traffic flow in several strategic areas of the Southeastern U.S. The upgrade will offer two primary advantages over their existing structures: (1) significantly greater revenue, and (2) stronger economies of scale in maintaining fixed and variable costs per store. To meet potential market demand, DRI's senior management has spent ten thousand dollars (a sunk cost) hiring external firms to conduct market surveys and evaluate increased revenue and inventory turnover within its existing restaurants. Assume you were recently hired to participate on a team under DRI's CFO that is responsible for evaluating the cash flows and profitability associated with this specific project (beginning in the summer of 2023). Initially, your team concludes that such a full-scale expansion would require new equipment costs (within existing restaurants) of $180,000,000, plus an additional shipping and installation costs of $5,000,000 (to be included in the initial cost). In addition, to accommodate increased cash and inventory needs, net working capital requirements are expected to rise by $25,000,000 so the refurbished restaurants will be operationally functional. The equipment is to be depreciated using a 5-year Modified Accelerated Cost Recovery System (MACRS) schedule. Not knowing what the future holds, your team also concludes that this new project ill exist for only 5 years thereby finishing in the summer of 2028. Adjustments to the company's operating cash flow's are expected to begin in July of 2023 - when the stores are deemed fully operationally functional. Also, the new equipment is expected to have a market value of $$0,000,000 at the project's termination. Last, your team makes the following assumptions regarding marginal increases in sales and costs for DRI: - 11,000,000 units will be sold each year, at an average sales price of $13.50 per unit. - Total operating costs (both fixed and variable) are anticipated to be 60% of sales. - DRI's marginal tax rate is 28% (used in both deriving Operating Cash Flows as well as tax loss/gain in salvage value). - DRI raises all of the capital to finance this project using an existing private debt underwriting - with a YTM (cost of capital) being 6.20%. In your initial evaluation of this project, answer the following questions in deriving a cash flow analysis and recommendation. 1. What is the initial cash outlay (CFO)? 2. What are the operating cash flows in years 1 thru 5 - adjusted for taxes and depreciation? 3. What are the terminal-year cash flows added to the operating cash flow in year 5 ? 4. What is the relationship between this discount rate (cost of capital) and the IRR, and your result in Question 5 ? 5. Given your results for CFO thru COS and the cost of capital, would you recommend that the company take-on this project? Compute the NPV to support your answer. What is the the break-even IRR? How do you use/gauge it? FIN3210CFTemplateSTEP#1Spring2023(Chapter9)CalculateCF0 Cost Basis Change in NWC CFO STEP \#2 Calculate OCF1 - OCF (N Terminal Year ) STEP \#3 Add NWC \& Net Salvage Value to Terminal Year WACC STEP \#5 Final Project Cash Flows \& NPVIIRR Perind Cash Flows CFO C01 C02 CO3 CO4 cos C06 C07