Answered step by step

Verified Expert Solution

Question

1 Approved Answer

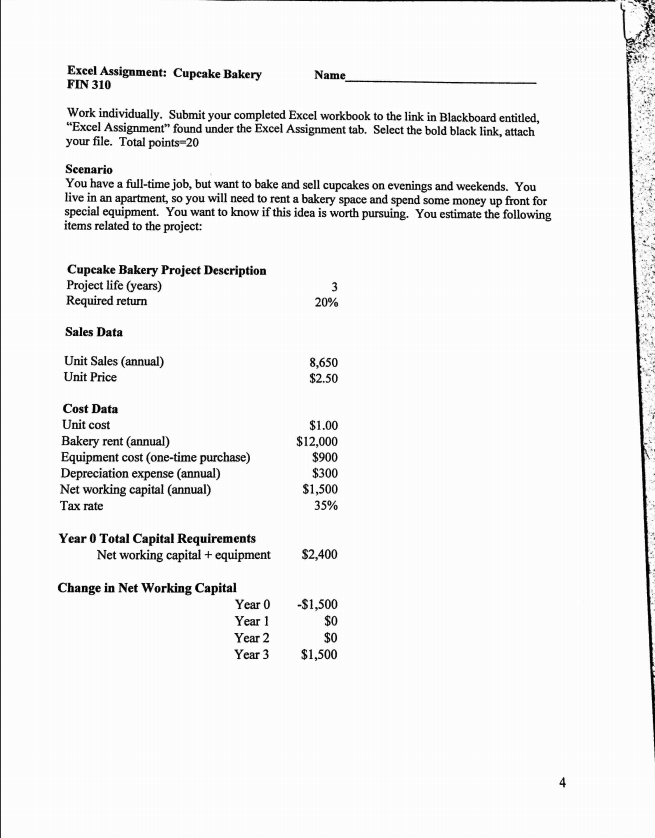

Use this Template Show formulas in excell. Excel Assignment: Cupcake Bakery Name FIN 310 Work individually. Submit your completed Excel workbook to the link in

Use this Template

Use this Template

Show formulas in excell.

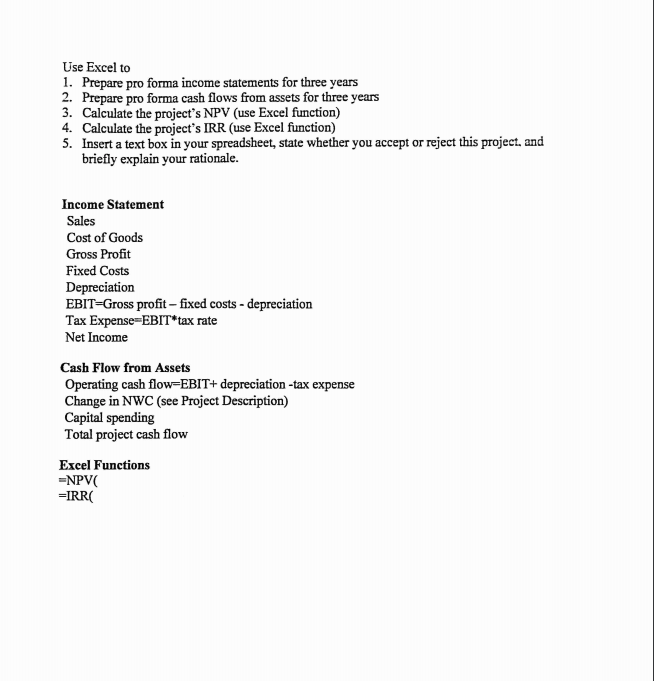

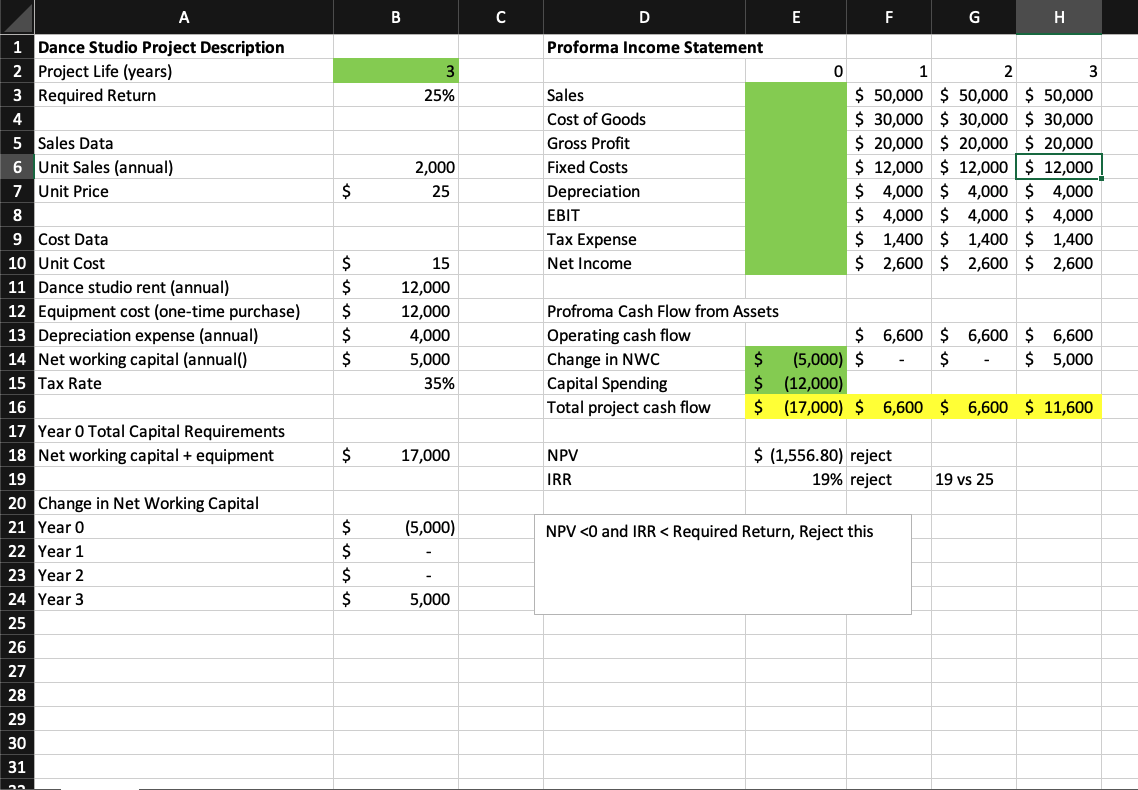

Excel Assignment: Cupcake Bakery Name FIN 310 Work individually. Submit your completed Excel workbook to the link in Blackboard entitled, "Excel Assignment" found under the Excel Assignment tab. Select the bold black link, attach your file. Total points=20 Scenario You have a full-time job, but want to bake and sell cupcakes on evenings and weekends. You live in an apartment, so you will need to rent a bakery space and spend some money up front for special equipment. You want to know if this idea is worth pursuing. You estimate the following items related to the project: Cupcake Bakery Project Description Project life (years) Required return 3 20% Sales Data Unit Sales (annual) Unit Price 8,650 $2.50 Cost Data Unit cost Bakery rent (annual) Equipment cost (one-time purchase) Depreciation expense (annual) Net working capital (annual) Tax rate $1.00 $12,000 $900 $300 $1,500 35% $2,400 Year 0 Total Capital Requirements Net working capital + equipment Change in Net Working Capital Year 0 Year 1 Year 2 Year 3 -$1,500 $0 $0 $1,500 Use Excel to 1. Prepare pro forma income statements for three years 2. Prepare pro forma cash flows from assets for three years 3. Calculate the project's NPV (use Excel function) 4. Calculate the project's IRR (use Excel function) 5. Insert a text box in your spreadsheet, state whether you accept or reject this project, and briefly explain your rationale. Income Statement Sales Cost of Goods Gross Profit Fixed Costs Depreciation EBIT=Gross profit - fixed costs - depreciation Tax Expense=EBIT*tax rate Net Income Cash Flow from Assets Operating cash flow=EBIT+ depreciation -tax expense Change in NWC (see Project Description) Capital spending Total project cash flow Excel Functions =NPVC =IRRC B C E F G Proforma Income Statement 3 0 1 25% 2,000 25 Sales Cost of Goods Gross Profit Fixed Costs Depreciation EBIT Tax Expense Net Income 2 3 $ 50,000 $ 50,000 $ 50,000 $ 30,000 $ 30,000 $ 30,000 $ 20,000 $ 20,000 $ 20,000 $ 12,000 $ 12,000 $ 12,000 $ 4,000 $ 4,000 $ 4,000 $ 4,000 $ 4,000 $ 4,000 $ 1,400 $ 1,400 $ 1,400 2,600 $ 2,600 $ 2,600 $ $ $ $ $ $ $ 15 12,000 12,000 4,000 5,000 35% 1 Dance Studio Project Description 2 Project Life (years) 3 Required Return 4 5 Sales Data 6 Unit Sales (annual) 7 Unit Price 8 9 Cost Data 10 Unit Cost 11 Dance studio rent (annual) 12 Equipment cost (one-time purchase) 13 Depreciation expense (annual) 14 Net working capital (annual() 15 Tax Rate 16 17 Year 0 Total Capital Requirements 18 Net working capital + equipment 19 20 Change in Net Working Capital 21 Year 0 22 Year 1 23 Year 2 24 Year 3 25 26 27 28 29 30 31 Profroma Cash Flow from Assets Operating cash flow $ 6,600 $ 6,600 $ 6,600 Change in NWC $ (5,000) $ $ 5,000 Capital Spending $ (12,000) Total project cash flow $ (17,000) $ 6,600 $ 6,600 $ 11,600 $ 17,000 NPV IRR $ (1,556.80) reject 19% reject 19 vs 25 (5,000) NPVStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started