Answered step by step

Verified Expert Solution

Question

1 Approved Answer

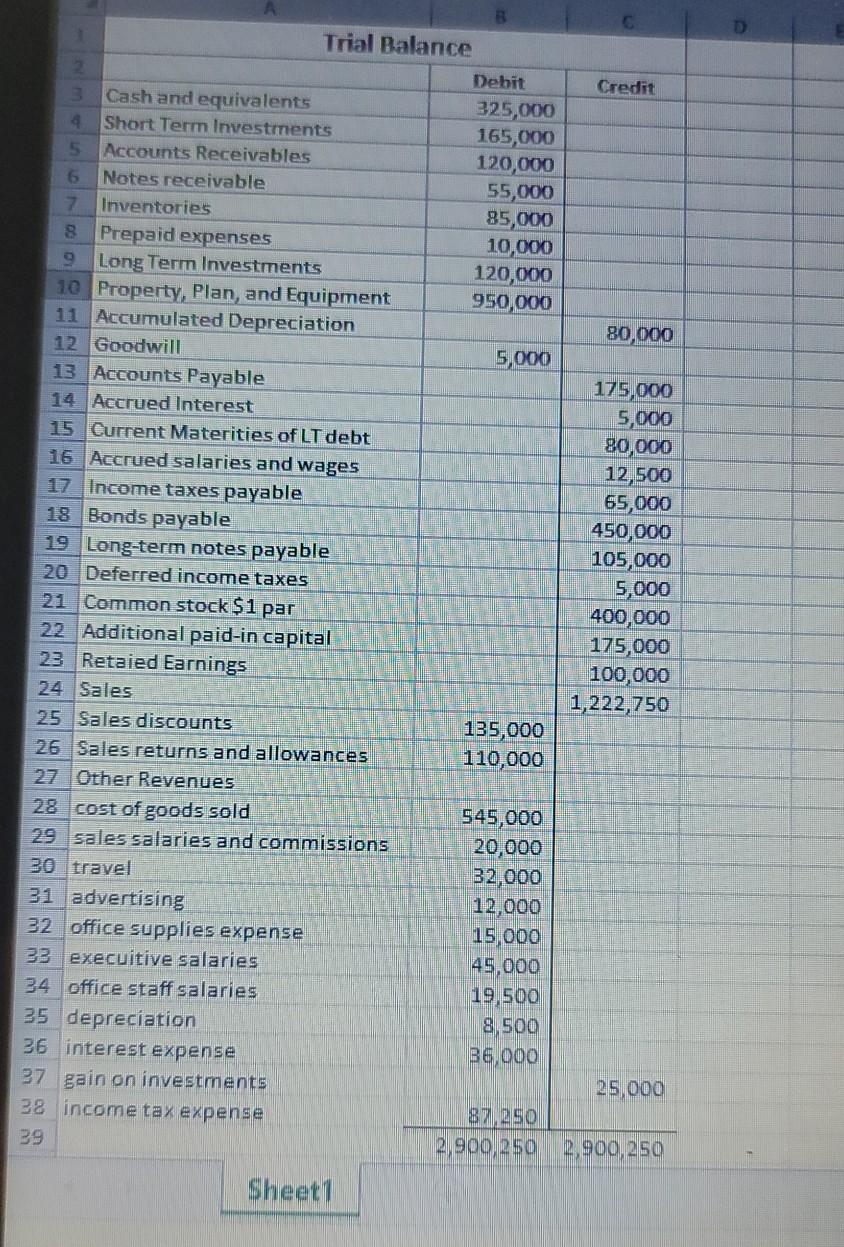

Use this trial balance to complete the balance sheet and income statement by inserting the correct values in the given template. Trial Balance 2 Debit

Use this trial balance to complete the balance sheet and income statement by inserting the correct values in the given template.

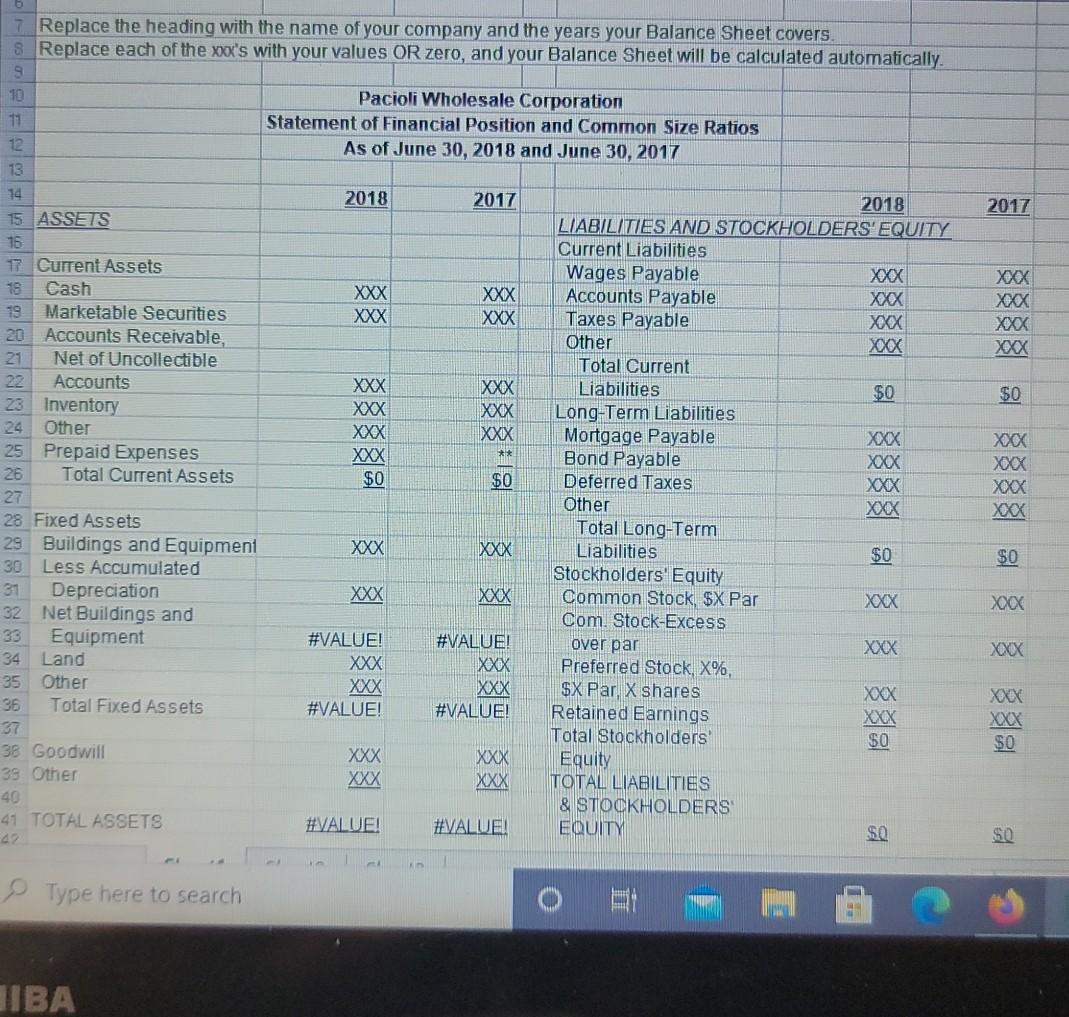

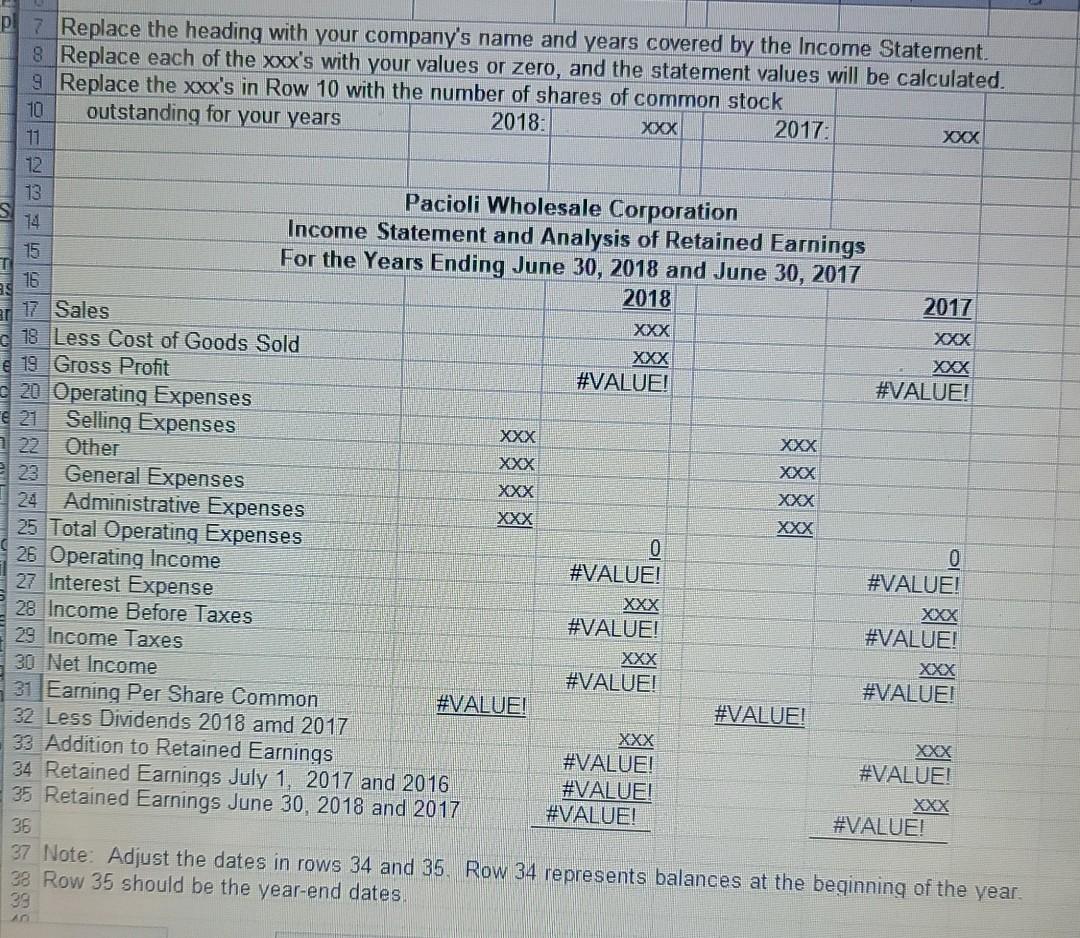

Trial Balance 2 Debit Credit 3 Cash and equivalents 325,000 4 Short Term Investments 165,000 5 Accounts Receivables 120,000 6 Notes receivable 55,000 7 Inventories 85,000 8 Prepaid expenses 10,000 Long Term Investments 120,000 10 Property, Plan, and Equipment 950,000 11 Accumulated Depreciation 80,000 12 Goodwill 5.000 13 Accounts Payable 175,000 14 Accrued Interest 5,000 15 Current Materities of LT debt 80,000 16 Accrued salaries and wages 12,500 17 Income taxes payable 65,000 18 Bonds payable 450,000 19 Long-term notes payable 105,000 20 Deferred income taxes 5,000 21 Common stock $1 par 400,000 22 Additional paid-in capital 175,000 23 Retaied Earnings 100,000 24 Sales 1,222,750 25 Sales discounts 135,000 26 Sales returns and allowances 110,000 27 Other Revenues 28 cost of goods sold 545,000 29 sales salaries and commissions 20,000 30 travel 32,000 31 advertising 12,000 32 office supplies expense 15,000 33 execuitive salaries 45,000 34 office staff salaries 19,500 35 depreciation 8,500 36 interest expense 36,000 37 gain on investments 25,000 38 income tax expense 87,250 39 2 2,900,250 2.900,250 Sheet1 2017 Xocx Xxx XXXC Xxx XXX XXX $0 7 Replace the heading with the name of your company and the years your Balance Sheet covers. 8 Replace each of the xoo's with your values OR zero, and your Balance Sheet will be calculated automatically 9 10 Pacioli Wholesale Corporation 11 Statement of Financial Position and Common Size Ratios 12 As of June 30, 2018 and June 30, 2017 13 14 2018 2017 2018 15 ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY 16 Current Liabilities 17 Current Assets Wages Payable XXX 18 Cash XXX XXX Accounts Payable XXX Marketable Securities XXX XXX Taxes Payable XOOX 20 Accounts Receivable, Other 21 Net of Uncollectible Total Current Accounts XXX Liabilities $0 23 Inventory XXX Long-Term Liabilities 24 Other XXX Mortgage Payable XXX 25 Prepaid Expenses XXX Bond Payable Xxcx 26 Total Current Assets $0 $0 Deferred Taxes xxx 27 Other 28 Fixed Assets Total Long-Term 29 Buildings and Equipment XXX XXX Liabilities $0 30 Less Accumulated Stockholders' Equity 31 Depreciation XXX Common Stock $X Par XXX 32 Net Buildings and Com. Stock-Excess 33 Equipment #VALUE! #VALUE! over par XXX 34 Land XXX Preferred Stock, X%, 35 Other $X Par, X shares XOX 36 Total Fixed Assets #VALUE! #VALUE! Retained Earnings 37 Total Stockholders' $0 38 Goodwill XXX XXX Equity 39 Other XXX XXX TOTAL LIABILITIES 40 & STOCKHOLDERS 41 TOTAL ASSETS #VALUE! #VALUE! EQUITY $0 * XXC XOX XXX XOX $0 XXX XXX SO Type here to search TIBA P7 Replace the heading with your company's name and years covered by the Income Statement. 8 Replace each of the xxx's with your values or zero, and the statement values will be calculated. 9 Replace the xxx's in Row 10 with the number of shares of common stock 10 outstanding for your years 2018 XXX 2017: XXX 11 12 13 Pacioli Wholesale Corporation 74 Income Statement and Analysis of Retained Earnings 15 For the Years Ending June 30, 2018 and June 30, 2017 16 2018 2017 17 Sales XXX XOX c 18 Less Cost of Goods Sold XXX e 19 Gross Profit #VALUE! #VALUE! 20 Operating Expenses Selling Expenses XXX XXX 22 Other Xxx XXX 23 General Expenses XXX XXX 24 Administrative Expenses XXX XXX 25 Total Operating Expenses 0 0 26 Operating Income #VALUE! #VALUE! 27 Interest Expense XXX 28 Income Before Taxes #VALUE! #VALUE! 29 Income Taxes XXX 30 Net Income #VALUE! #VALUE! 31 Earning Per Share Common #VALUE! #VALUE! 32 Less Dividends 2018 amd 2017 XXX 33 Addition to Retained Earnings #VALUE! #VALUE! 34 Retained Earnings July 1, 2017 and 2016 #VALUE! XXX 35 Retained Earnings June 30, 2018 and 2017 #VALUE! #VALUE! 36 37 Note: Adjust the dates in rows 34 and 35. Row 34 represents balances at the beginning of the year. 38 Row 35 should be the year-end dates. 39

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started