Answered step by step

Verified Expert Solution

Question

1 Approved Answer

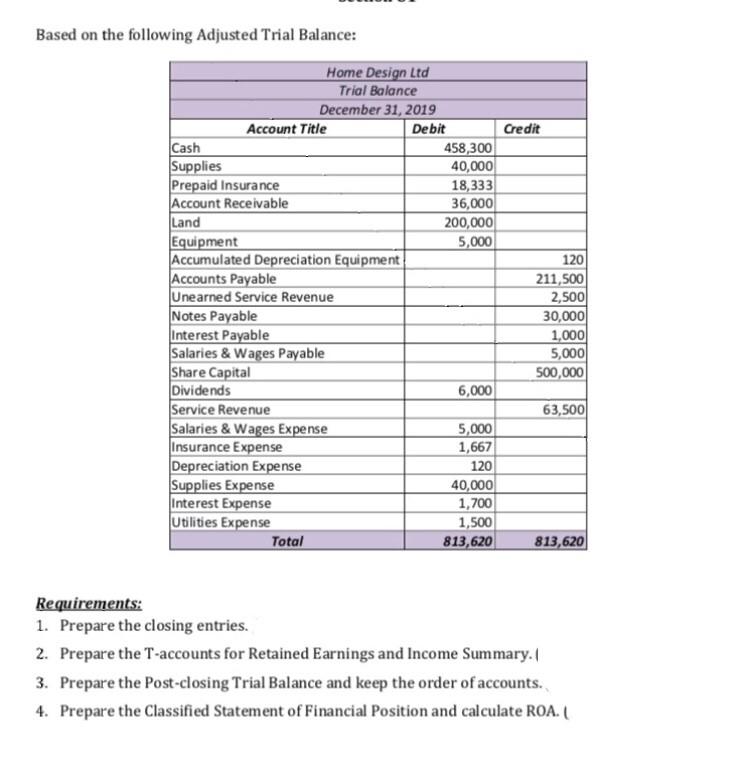

Use those tables please make sure it is correct 100% Based on the following Adjusted Trial Balance: Home Design Ltd Trial Balance December 31, 2019

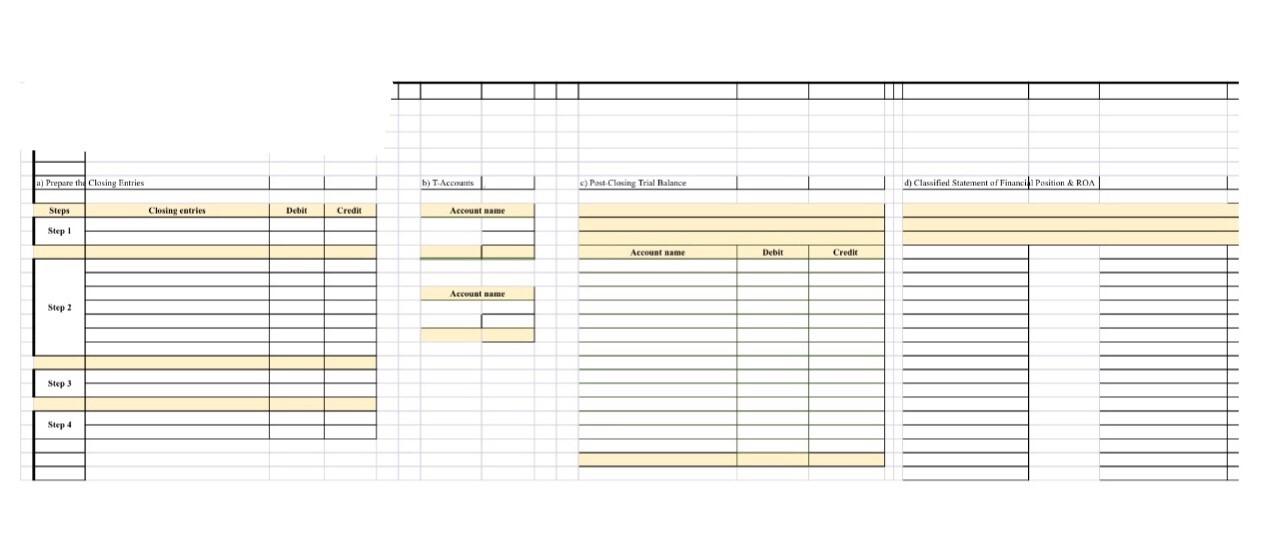

Use those tables

please make sure it is correct 100%

Based on the following Adjusted Trial Balance: Home Design Ltd Trial Balance December 31, 2019 Account Title Debit Credit Cash 458,300 Supplies 40,000 Prepaid Insurance 18,333 Account Receivable 36,000 Land 200,000 Equipment 5,000 Accumulated Depreciation Equipment 120 Accounts Payable 211,500 Unearned Service Revenue 2,500 Notes Payable 30,000 Interest Payable 1,000 Salaries & Wages Payable 5,000 Share Capital 500,000 Dividends 6,000 Service Revenue 63,500 Salaries & Wages Expense 5,000 Insurance Expense 1,667 Depreciation Expense 120 Supplies Expense 40,000 Interest Expense 1,700 Utilities Expense 1,500 Total 813,620 813,620 Requirements: 1. Prepare the closing entries. 2. Prepare the T-accounts for Retained Earnings and Income Summary 3. Prepare the Post-closing Trial Balance and keep the order of accounts. 4. Prepare the Classified Statement of Financial Position and calculate ROA. m Preth clasing ntries b) T. Ace c) Post Closing Trial Balance dClassified Statement of Financil Position & ROA Steps Closing entries Debit Credit Acoustame Step! Account Debit Credit Arcus same Step 2 Step 3 Step 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started