Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use United Corporation's financial statements to compute the required ratios below, and indicate whether the change from year to year is favourable or unfavourable. All

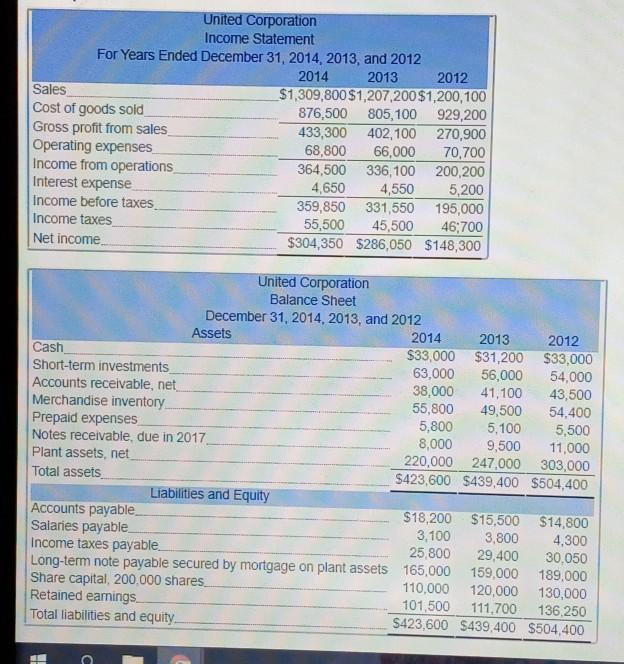

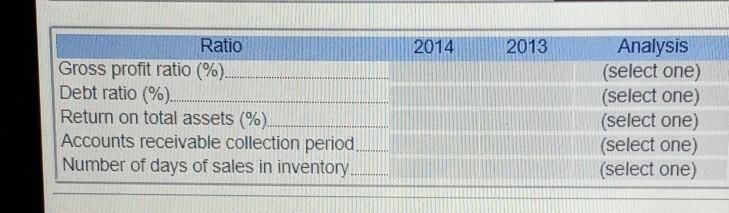

Use United Corporation's financial statements to compute the required ratios below, and indicate whether the change from year to year is favourable or unfavourable. All the sales recorded in the income statement are on credit. For your analysis, assume that all other things have remained constant. Apply your analysis in very general terms. All values should be accurate to at least two decimal places. United Corporation Income Statement For Years Ended December 31, 2014, 2013, and 2012 2014 2013 2012 Sales $1,309,800 $1,207,200 $1,200, 100 Cost of goods sold 876,500 805,100 929,200 Gross profit from sales 433,300 402,100 270,900 Operating expenses 68,800 66,000 70,700 Income from operations 364,500 336,100 200,200 Interest expense 4,650 4,550 5,200 Income before taxes 359,850 331,550 195,000 Income taxes 55,500 45,500 46;700 Net income $304,350 $286,050 $148,300 United Corporation Balance Sheet December 31, 2014, 2013, and 2012 Assets 2014 2013 2012 Cash $33,000 $31,200 $33,000 Short-term investments 63,000 56,000 54,000 Accounts receivable, net 38,000 41,100 43,500 Merchandise inventory 55,800 49,500 54,400 Prepaid expenses 5,800 5.100 5,500 Notes receivable, due in 2017 8,000 9,500 11,000 Plant assets, net 220,000 247,000 303,000 Total assets S423,600 $439,400 $504,400 Liabilities and Equity Accounts payable $18,200 $15,500 $14,800 Salaries payable 3,100 3,800 4,300 Income taxes payable 25,800 29,400 30.050 Long-term note payable secured by mortgage on plant assets 165,000 159,000 189.000 Share capital, 200,000 shares 110,000 120,000 130,000 Retained earnings 101,500 111.700 136,250 Total liabilities and equity S423,600 $439.400 $504,400 11 2014 2013 Ratio Gross profit ratio (%). Debt ratio (%). Return on total assets (%). Accounts receivable collection period Number of days of sales in inventory. Analysis (select one) (select one) (select one) (select one) (select one)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started