Answered step by step

Verified Expert Solution

Question

1 Approved Answer

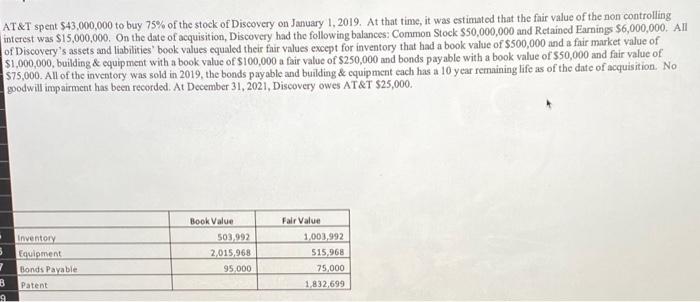

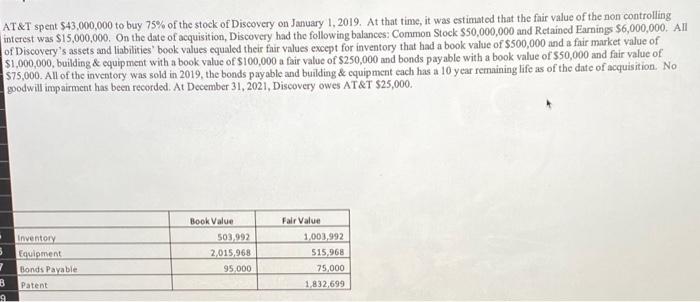

use values in the table to complete differential table. AT&T spent $43,000,000 to buy 75% of the stock of Discovery on January 1, 2019. At

use values in the table to complete differential table.

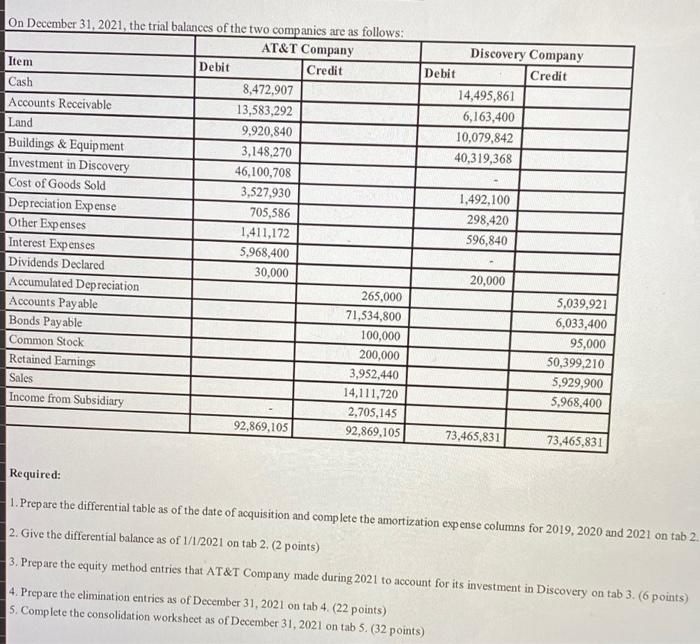

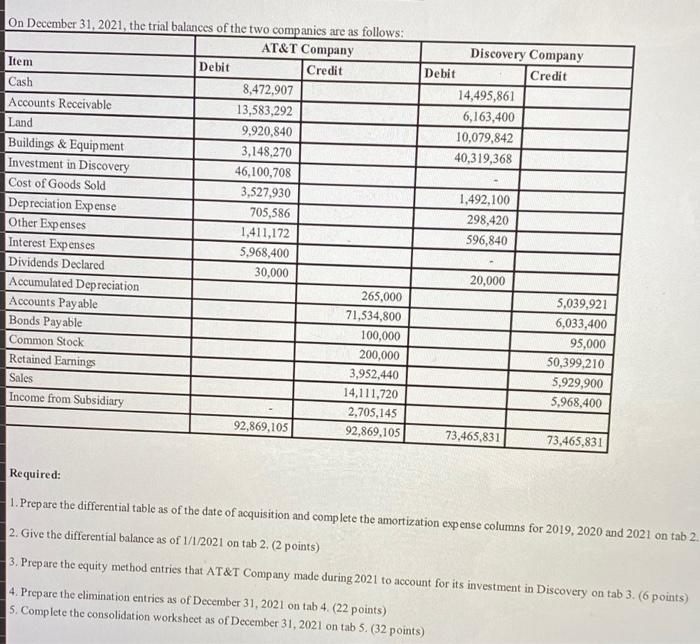

AT&T spent $43,000,000 to buy 75% of the stock of Discovery on January 1, 2019. At that time, it was estimated that the fair value of the non controlling interest was $15,000,000. On the date of acquisition, Discovery had the following balances: Common Stock $50,000,000 and Retained Earnings $6,000,000. All of Discovery's assets and liabilities' book values equaled their frit values except for inventory that had a book value of $500,000 and a fair market value of $1,000,000, building & equipment with a book value of S100,000 a fair value of $250,000 and bonds payable with a book value of $50,000 and fair value of $75,000. All of the inventory was sold in 2019, the bonds payable and building & equipment cach has a 10 year remaining life as of the date of acquisition. No goodwill impairment has been recorded. At December 31, 2021, Discovery owes AT&T $25,000. . Book Value 503,992 2,015,968 95.000 Inventory Equipment Bonds Payable Patent 5 Fair Value 1,003,992 515,968 75,000 1,832,699 2 8 19. Discovery Company Debit Credit 14,495,861 6,163,400 10,079,842 40,319,368 On December 31, 2021, the trial balances of the two companies are as follows: AT&T Company Item Debit Credit Cash 8,472,907 Accounts Receivable 13,583,292 Land 9,920,840 Buildings & Equipment 3,148,270 Investment in Discovery 46,100,708 Cost of Goods Sold 3,527,930 Depreciation Expense 705,586 Other Expenses 1,411,172 Interest Expenses 5,968,400 Dividends Declared 30,000 Accumulated Depreciation 265,000 Accounts Payable 71,534,800 Bonds Payable 100,000 Common Stock 200,000 Retained Earnings 3,952,440 Sales 14,111,720 Income from Subsidiary 2,705,145 92,869,105 92,869,105 1,492,100 298,420 596,840 20,000 5,039,921 6,033,400 95,000 50,399,210 5,929,900 5,968,400 73,465,831 73,465,831 Required: 1. Prepare the differential table as of the date of acquisition and complete the amortization expense columns for 2019, 2020 and 2021 on tab 2. 2. Give the differential balance as of 1/1/2021 on tab 2. (2 points) 3. Prepare the equity method entries that AT&T Company made during 2021 to account for its investment in Discovery on tab 3. (6 points) 4. Prepare the elimination entries as of December 31, 2021 on tab 4. (22 points) 5. Complete the consolidation worksheet as of December 31, 2021 on tab 5. (32 points) AT&T spent $43,000,000 to buy 75% of the stock of Discovery on January 1, 2019. At that time, it was estimated that the fair value of the non controlling interest was $15,000,000. On the date of acquisition, Discovery had the following balances: Common Stock $50,000,000 and Retained Earnings $6,000,000. All of Discovery's assets and liabilities' book values equaled their frit values except for inventory that had a book value of $500,000 and a fair market value of $1,000,000, building & equipment with a book value of S100,000 a fair value of $250,000 and bonds payable with a book value of $50,000 and fair value of $75,000. All of the inventory was sold in 2019, the bonds payable and building & equipment cach has a 10 year remaining life as of the date of acquisition. No goodwill impairment has been recorded. At December 31, 2021, Discovery owes AT&T $25,000. . Book Value 503,992 2,015,968 95.000 Inventory Equipment Bonds Payable Patent 5 Fair Value 1,003,992 515,968 75,000 1,832,699 2 8 19. Discovery Company Debit Credit 14,495,861 6,163,400 10,079,842 40,319,368 On December 31, 2021, the trial balances of the two companies are as follows: AT&T Company Item Debit Credit Cash 8,472,907 Accounts Receivable 13,583,292 Land 9,920,840 Buildings & Equipment 3,148,270 Investment in Discovery 46,100,708 Cost of Goods Sold 3,527,930 Depreciation Expense 705,586 Other Expenses 1,411,172 Interest Expenses 5,968,400 Dividends Declared 30,000 Accumulated Depreciation 265,000 Accounts Payable 71,534,800 Bonds Payable 100,000 Common Stock 200,000 Retained Earnings 3,952,440 Sales 14,111,720 Income from Subsidiary 2,705,145 92,869,105 92,869,105 1,492,100 298,420 596,840 20,000 5,039,921 6,033,400 95,000 50,399,210 5,929,900 5,968,400 73,465,831 73,465,831 Required: 1. Prepare the differential table as of the date of acquisition and complete the amortization expense columns for 2019, 2020 and 2021 on tab 2. 2. Give the differential balance as of 1/1/2021 on tab 2. (2 points) 3. Prepare the equity method entries that AT&T Company made during 2021 to account for its investment in Discovery on tab 3. (6 points) 4. Prepare the elimination entries as of December 31, 2021 on tab 4. (22 points) 5. Complete the consolidation worksheet as of December 31, 2021 on tab 5. (32 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started