Question

Use Volatility from Q1 to solve Q2, Q3, Q4, Q5 Q1: Find the volatility of Aramcos Share Price Q2: using the volatility from Q1 find

Use Volatility from Q1 to solve Q2, Q3, Q4, Q5

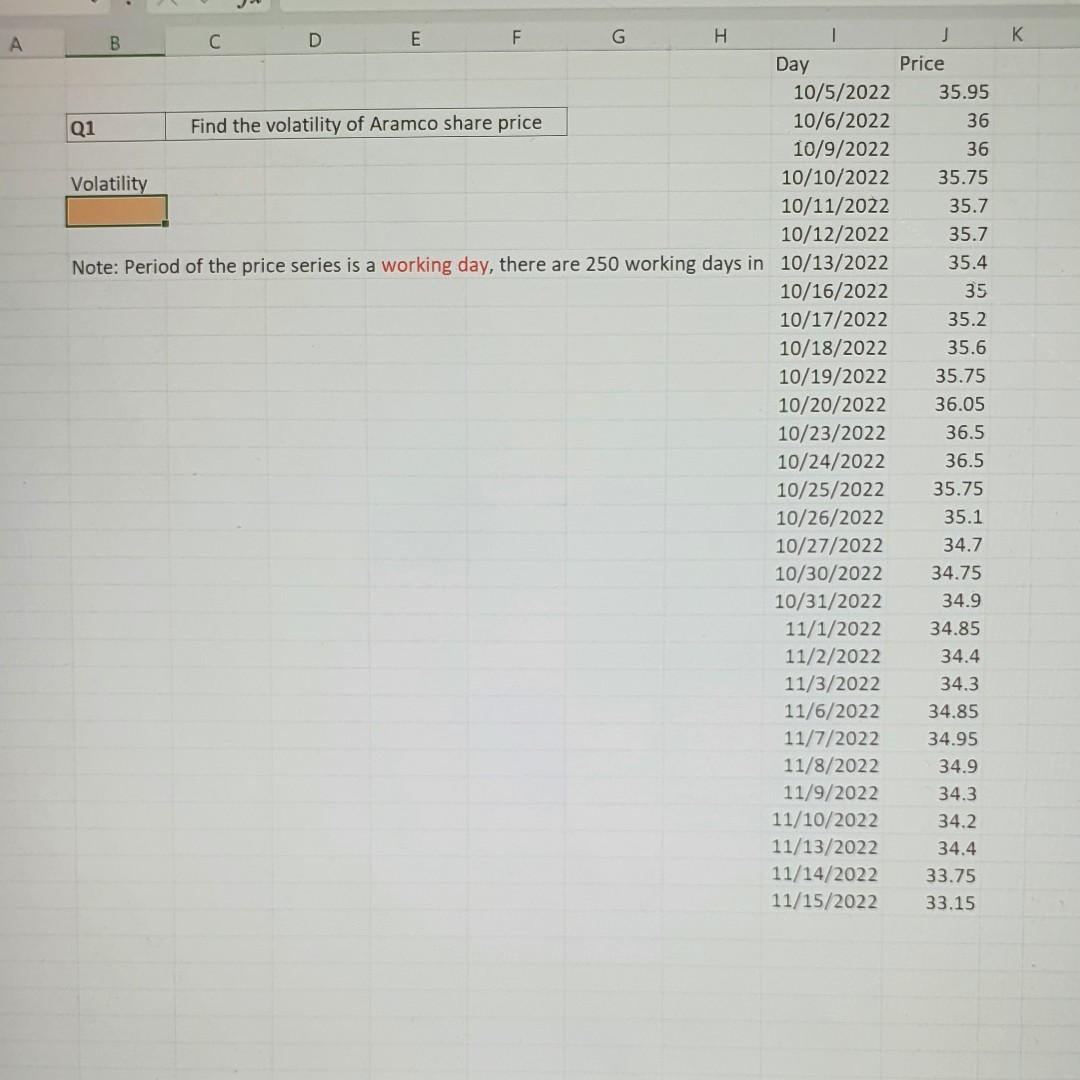

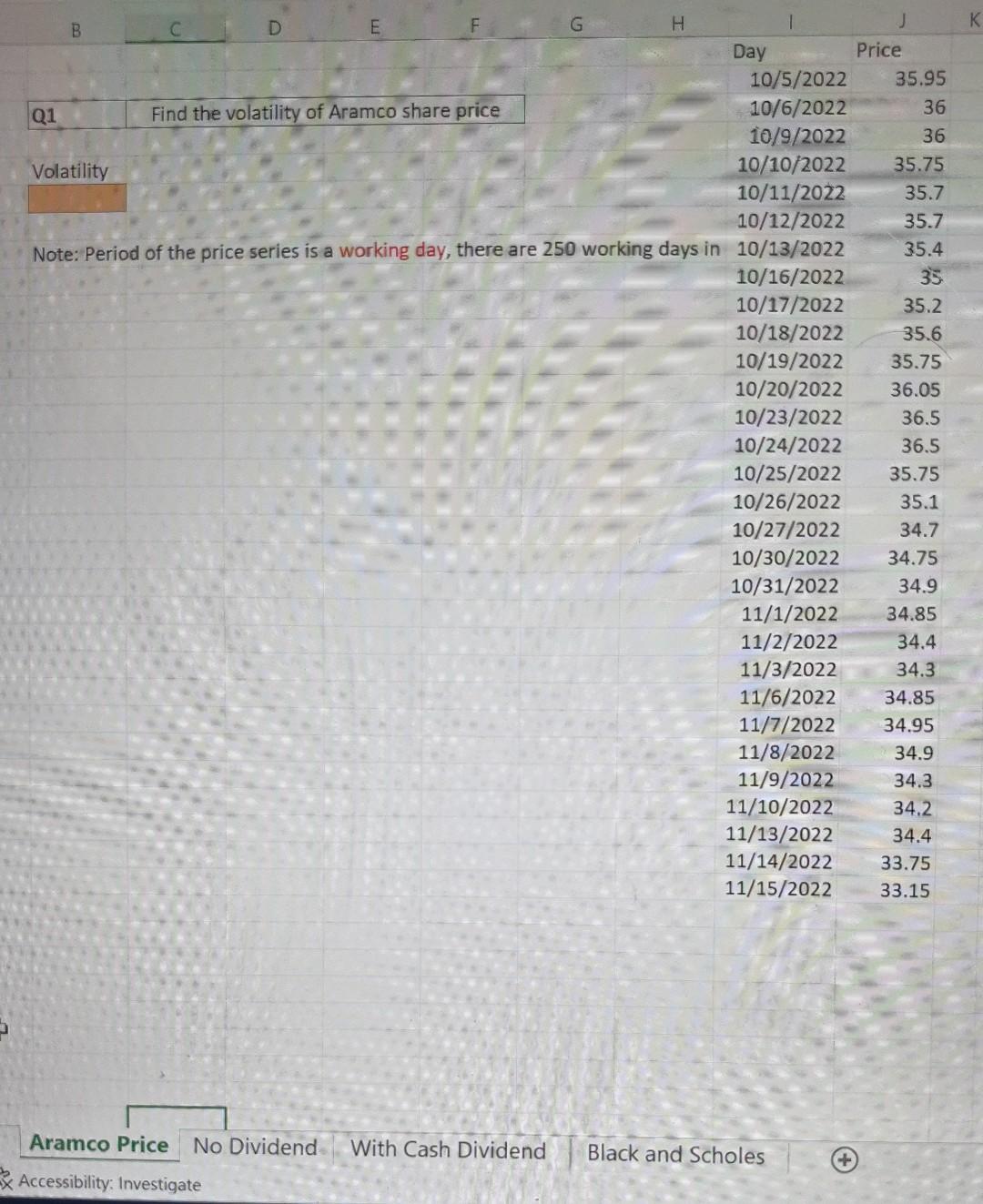

Q1: Find the volatility of Aramcos Share Price

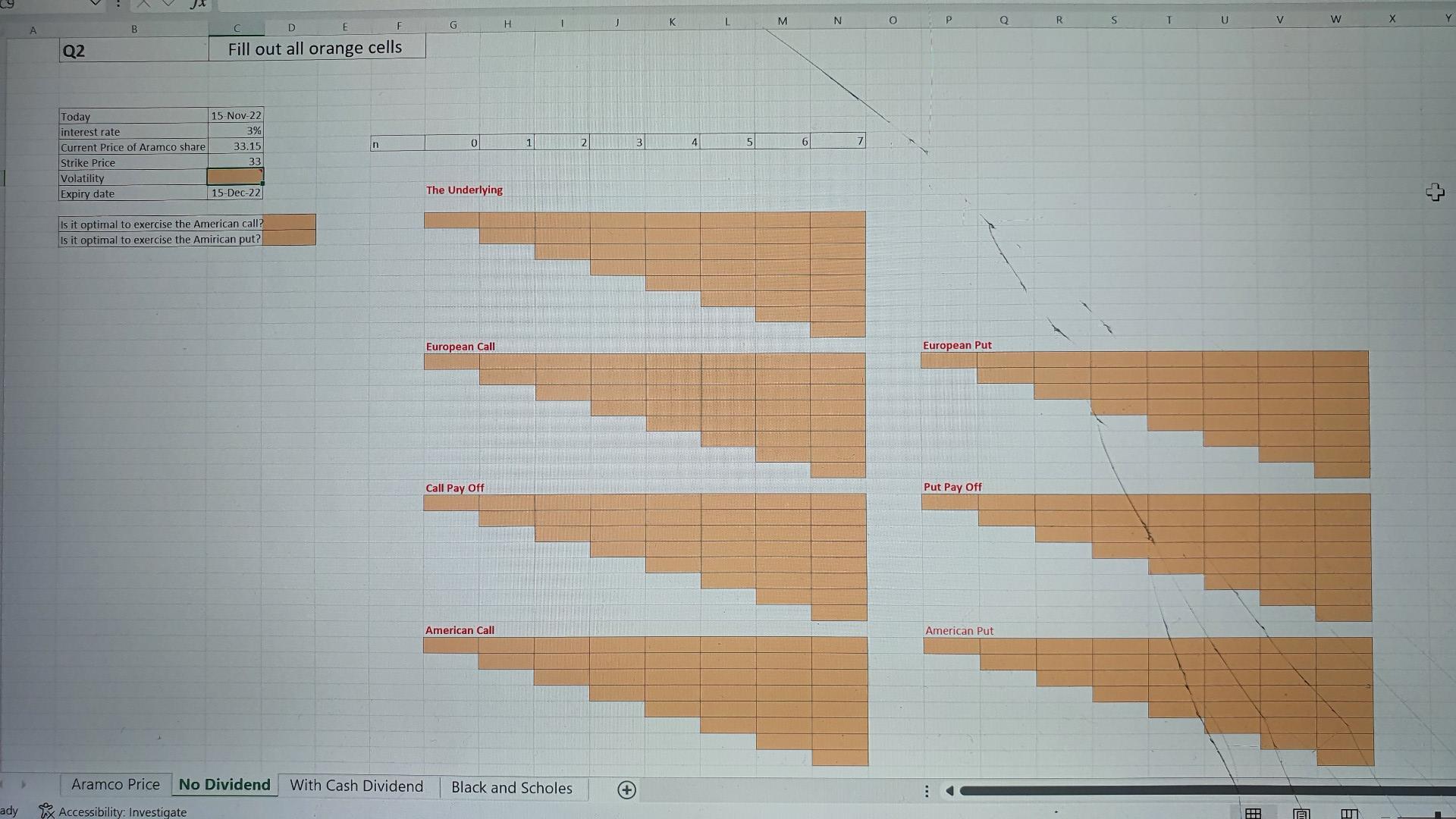

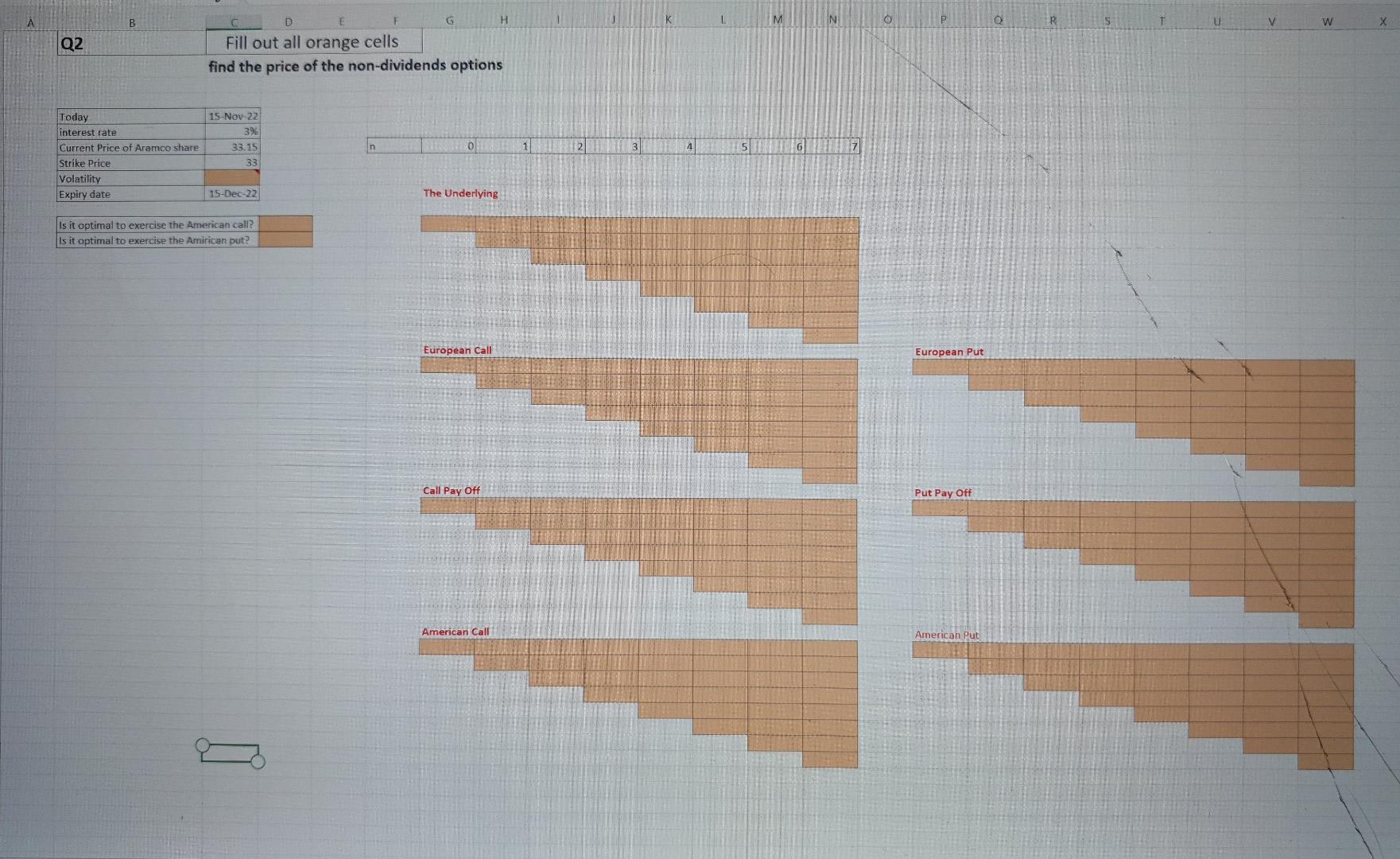

Q2: using the volatility from Q1 find the Price of the underlying Asset, and the American and European non-dividend options (call & put)?

and what is optimal to use (American or European) options?

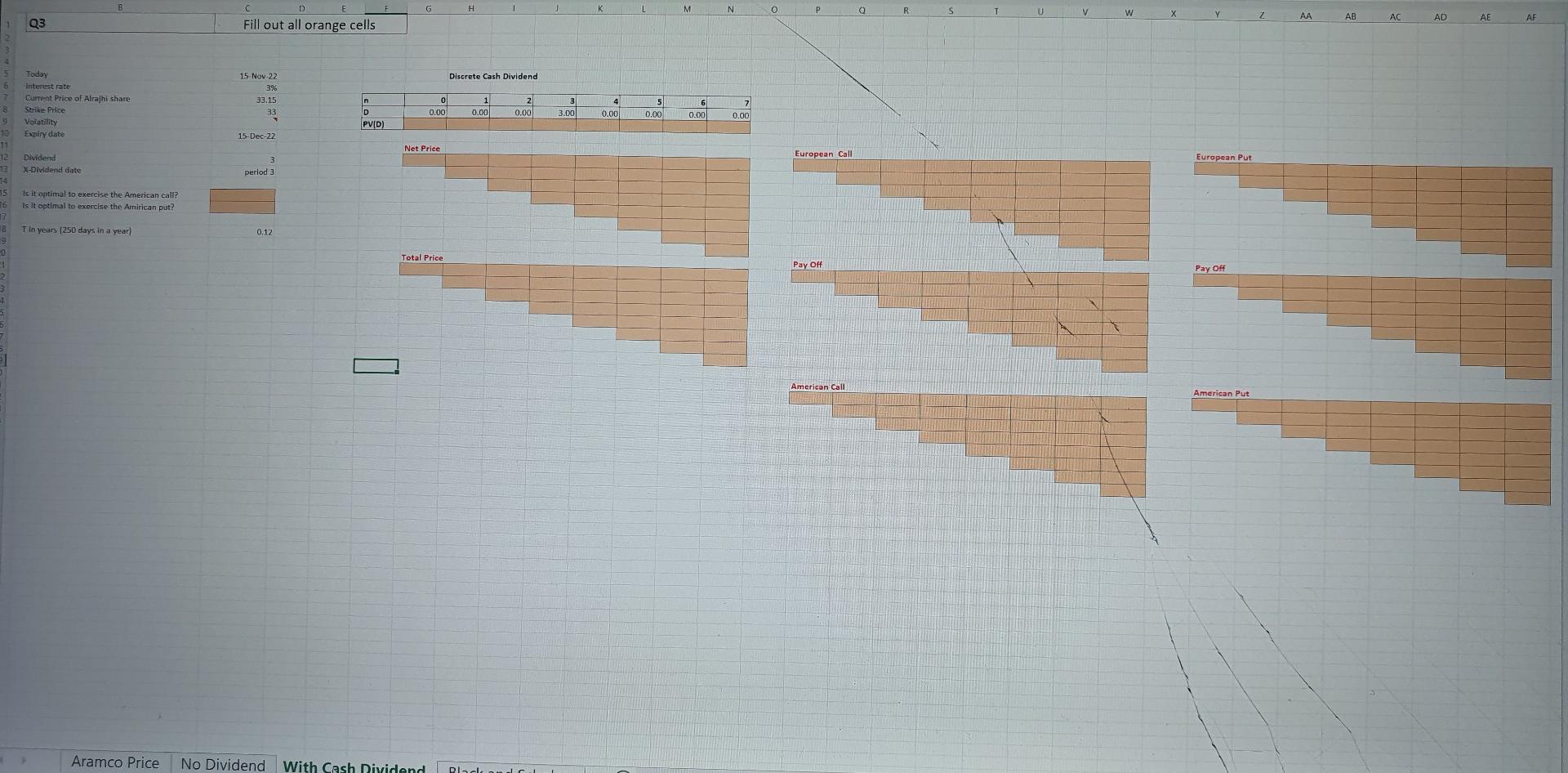

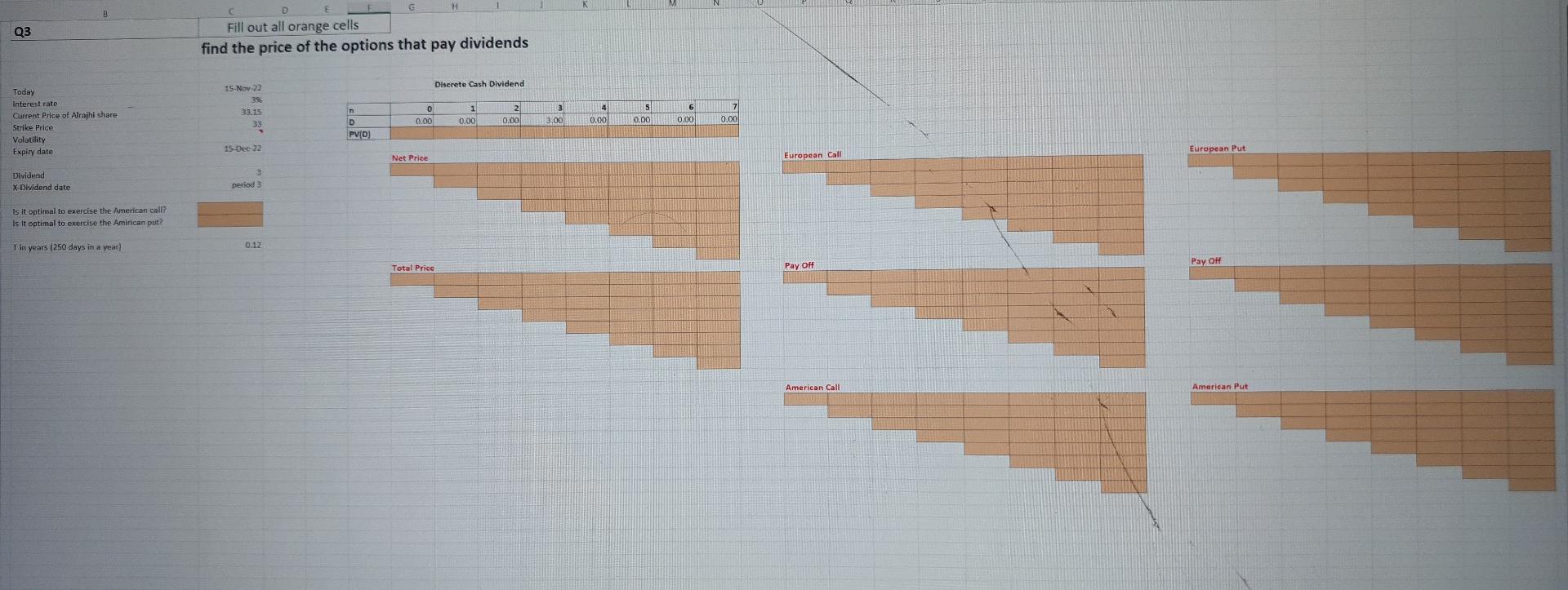

Q3: using the volatility from Q1 find the present value of the descete dividends and the net and total Price of the underlying Asset, and the American and European (dividend options) (call & put)?

and what is optimal to use (American or European) options?

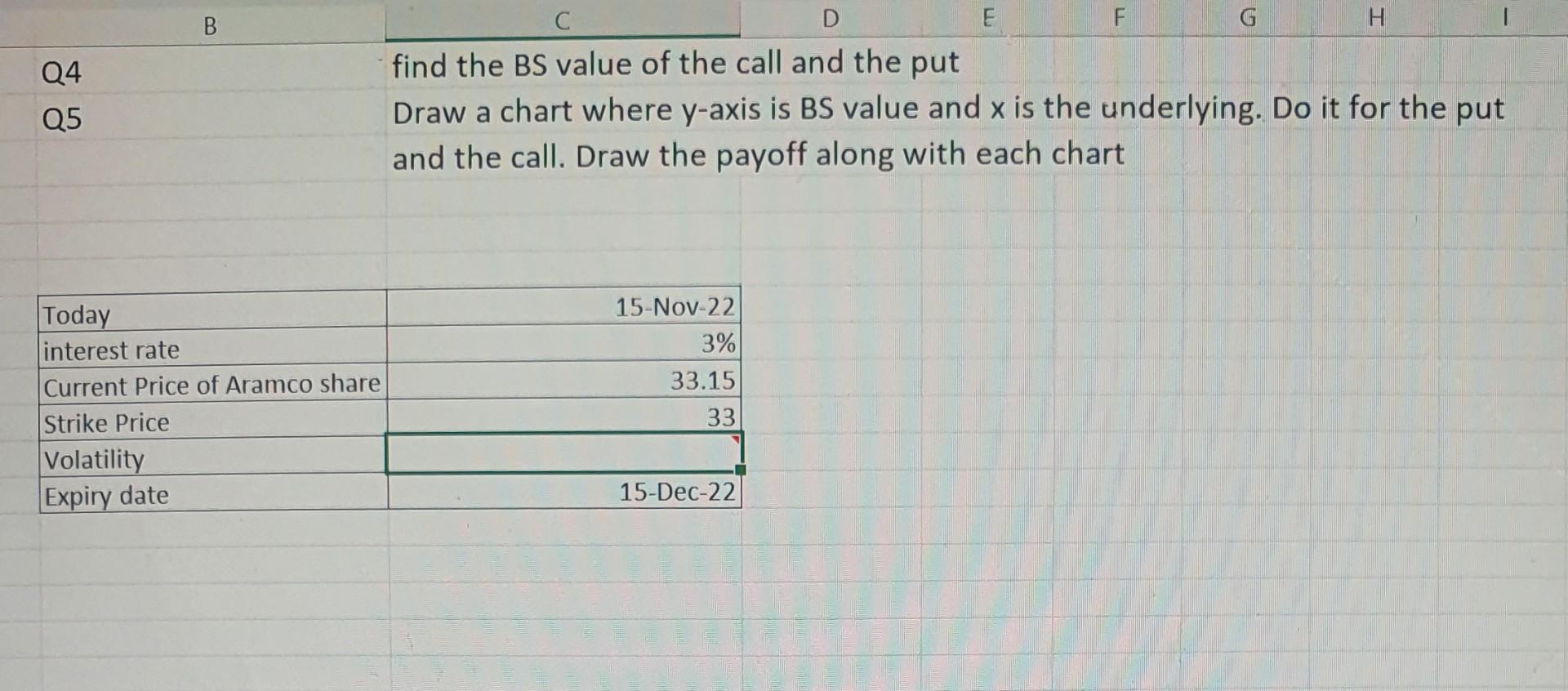

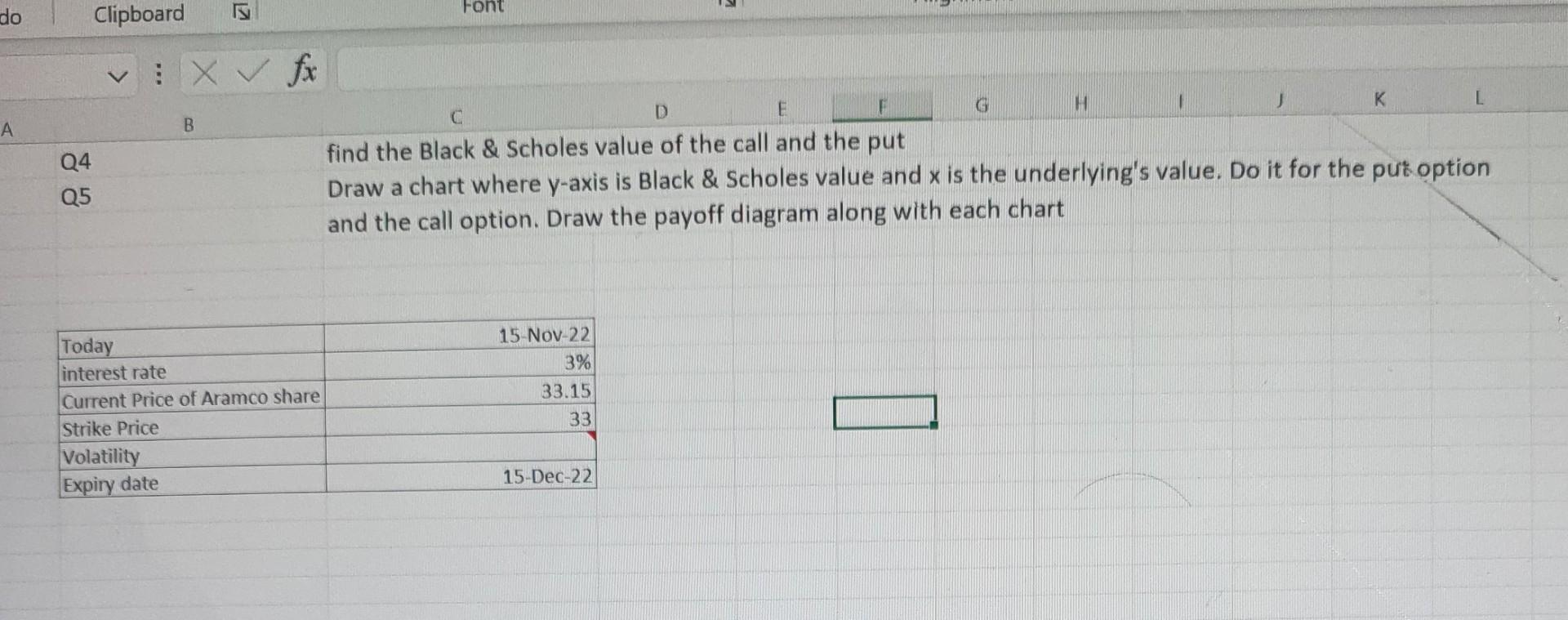

Q4-Q5: Written in the picture

Is it optimal to exercise the American call? Is it optimal to exercise the Amirican put? find the BS value of the call and the put Draw a chart where y-axis is BS value and x is the underlying. Do it for the put and the call. Draw the payoff along with each chart Aramco Price No Dividend W. With Cash Dividend I Black and Scholes Accessibility: Investigate find the price of the find the price of the options that pay dividends find the Black \& Scholes value of the call and the put Draw a chart where y-axis is Black \& Scholes value and x is the underlying's value. Do it for the put option and the call option. Draw the payoff diagram along with each chart Is it optimal to exercise the American call? Is it optimal to exercise the Amirican put? find the BS value of the call and the put Draw a chart where y-axis is BS value and x is the underlying. Do it for the put and the call. Draw the payoff along with each chart Aramco Price No Dividend W. With Cash Dividend I Black and Scholes Accessibility: Investigate find the price of the find the price of the options that pay dividends find the Black \& Scholes value of the call and the put Draw a chart where y-axis is Black \& Scholes value and x is the underlying's value. Do it for the put option and the call option. Draw the payoff diagram along with each chartStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started