Answered step by step

Verified Expert Solution

Question

1 Approved Answer

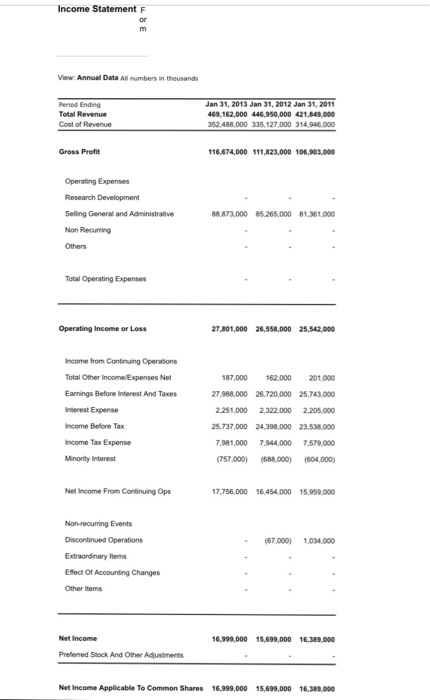

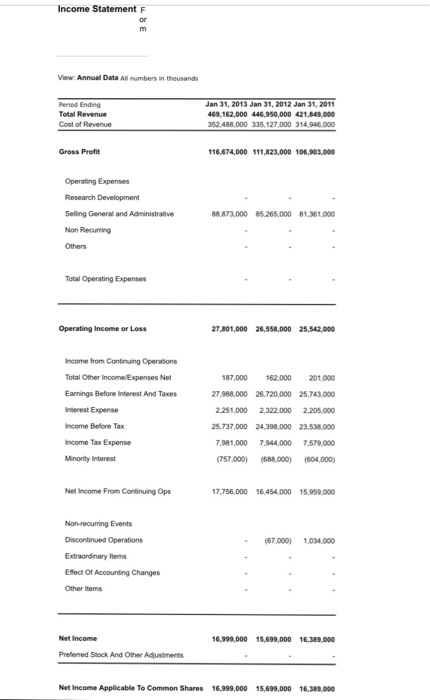

Use Walmarts financial statements to compute the following ratios for the year ended January 31, 2013. 13. Price-earnings (P-E) ratio (assume the market price per

Use Walmarts financial statements to compute the following ratios for the year ended January 31, 2013.

Income Statement View Annual Data All numbers in thousands Peried Ending Total Revenue Cost of Revenue Jan 31, 2013 Jan 31, 2012 Jan 31, 2011 469,162,000 446,950,000 421,849.000 4,946.000 00 335,127 Gross Profit 116,674,000 111,823,000 106,903 00O Operating Expenses Research Development Selling General and Administrative Non Recurring Others 88,873,000 85.265,000 81,361.000 Total Operating Expenses Operating Income or Loss 27,801,000 26,558,000 25,542.000 Income from Continuing Operations Total Other IncomelExpenses Net Eamings Before Interest And Taxes eterest Expense Income Before Tax Income Tax Expense Minority Interest 87,000 162.000 201.000 27.988.000 26,720,000 25,743.000 2,251,000 2,322,000 2.205,000 25,737,000 24,398,000 23.538.000 981,000 7,944000 7,579 000 757,000) (688,000) (604,000) Net Income From Continuing Ops 17,756,000 16.454,000 15,959.000 Non-recuming Events (67,000) 1,034,000 Extraordinary Items Effect Of Accounting Changes Other items 16,999,000 15,699,000 16,389,000 Prefersed Stock And Other Adjustments Net Income Applicable To Common Shares 16,999,000 15,699,000 16,389,000 13. Price-earnings (P-E) ratio (assume the market price per share is $74.75 and the earnings per share is $4.25)

A. 10.44 times

B. 12.83 times

C. 14.35 times

D. 17.59 times

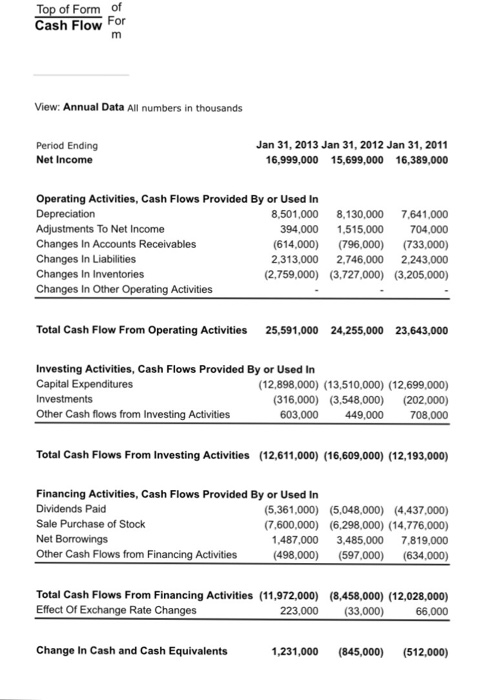

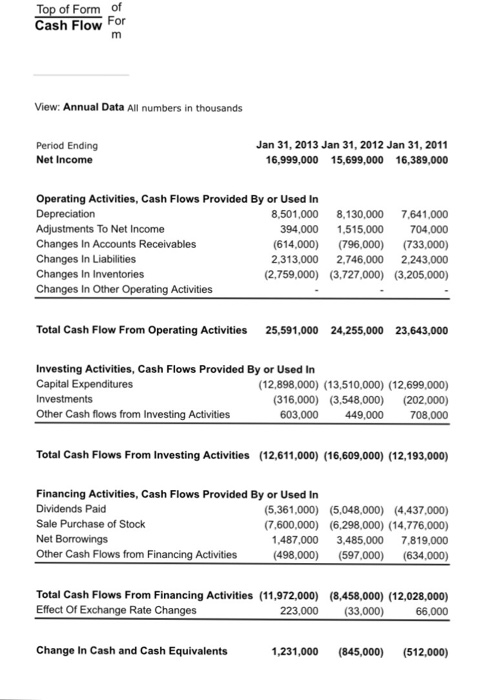

14. Payout ratio

A. 31.54%

B. 25.64%

C. 15.73%

D. 20.85%

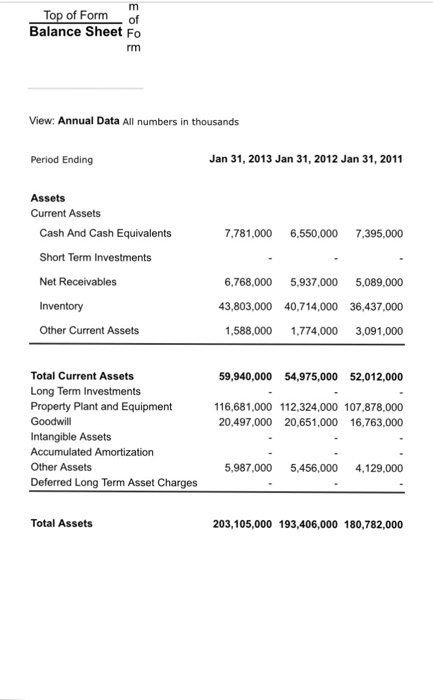

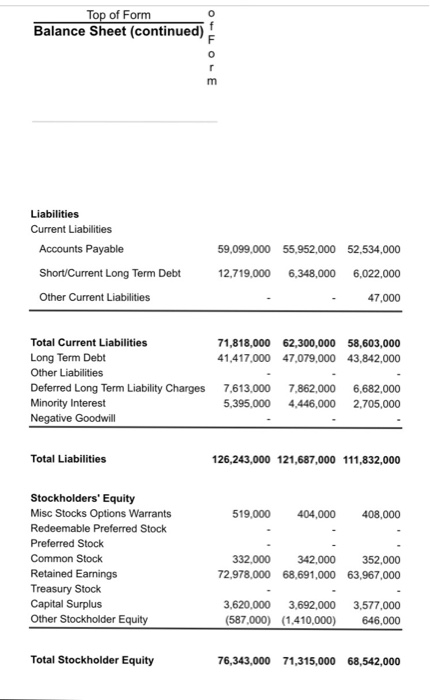

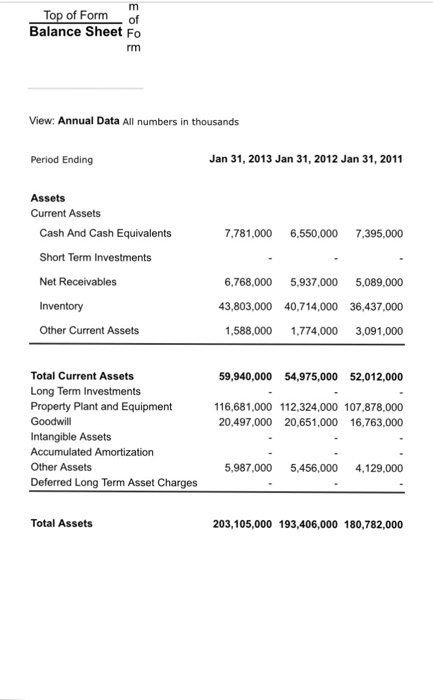

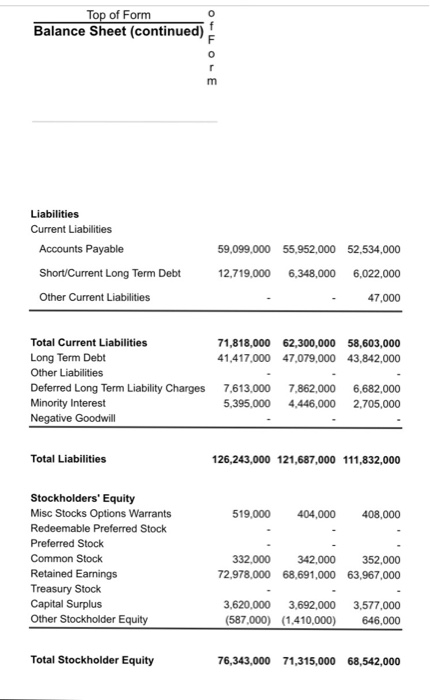

15. Debit to total assets ratio

A. 58.45%

B. 72.85%

C. 62.16%

D. 54.35%

16. Times interest earned

A. 6.48 times

B. 10.82 times

C. 8.54 times

D. 12.43 times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started