Answered step by step

Verified Expert Solution

Question

1 Approved Answer

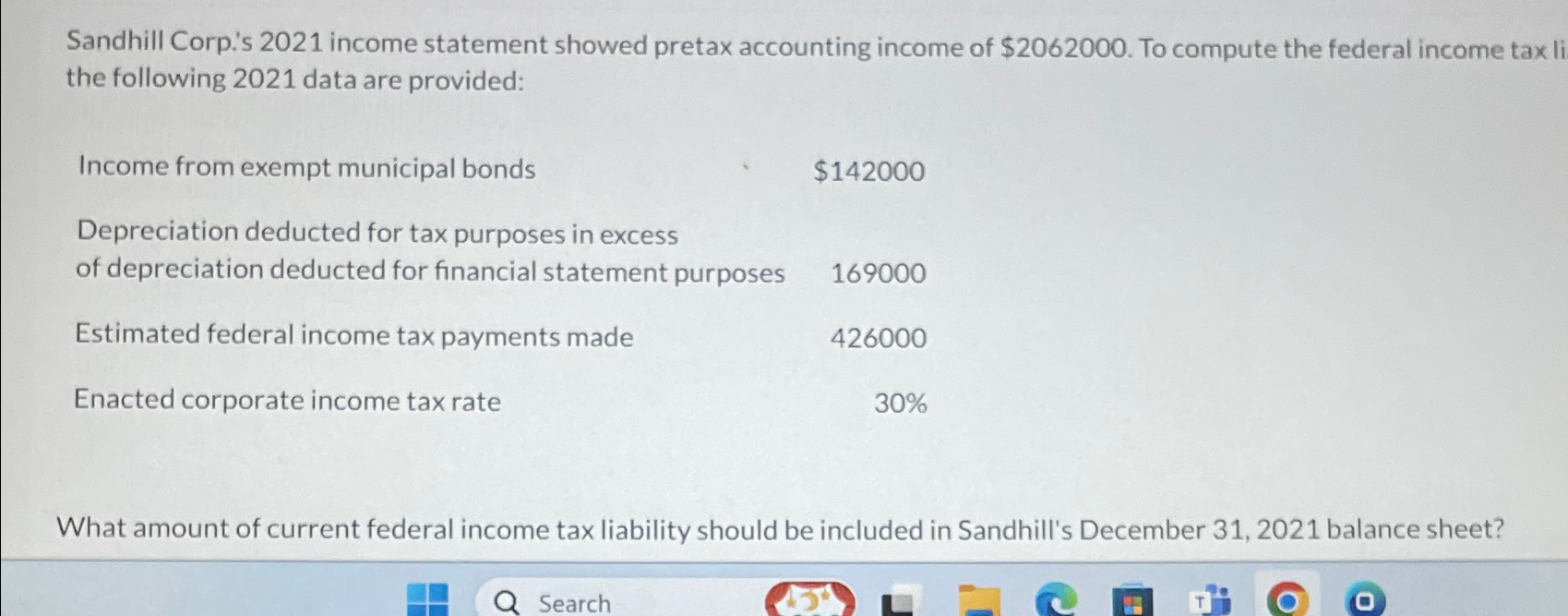

Sandhill Corp. ' s 2 0 2 1 income statement showed pretax accounting income of $ 2 0 6 2 0 0 0 . To

Sandhill Corp.s income statement showed pretax accounting income of $ To compute the federal income tax li the following data are provided:

Income from exempt municipal bonds

$

Depreciation deducted for tax purposes in excess

of depreciation deducted for financial statement purposes

Estimated federal income tax payments made

Enacted corporate income tax rate

What amount of current federal income tax liability should be included in Sandhill's December balance sheet?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started