Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use Work sheet 11.2 to help Max and Heidi Wood, a married couple in their early 30s, evaluate their securities portfolio, which includes these holdings.

Use Work sheet 11.2 to help Max and Heidi Wood, a married couple in their early 30s, evaluate their securities portfolio, which includes these holdings. a. IBM. (NYSE; symbol IBM): 100 shares bought in 2011 for $170.40 per share. b. Procter & Gamble (NYSE; symbol PG): 150 shares purchased in 2010 at $61.85 per share. c. Google (NASDAQ; symbol, GOOG): 200 shares purchased in 2014 at $519.98 per share

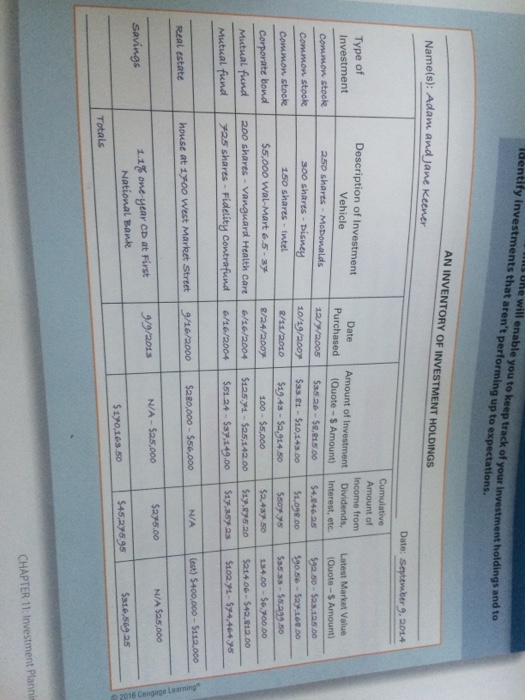

Identify Investments that aren't performing up to expectations. one will enable you to keep track of your investment holdings and AN INVENTORY OF INVESTMENT HOLDINGS Name(s): Adam and Jane Keener Date: September 9, 2014 Type of Investment concnon stool Common stock Common stock Corporate bond Mutual fund Description of Investment Vehicle 2.50 shares - MoDonalds 300 shares - Disney 150 shares - Intel $5,000 Wal-Mart 6.5-37 200 shares - Vanguard Health Care 25 shares - Fidelity Contrafund Date Purchased 12/9/2005 10/19/2007 8/11/2010 8/24/2007 6/16/2004 6/16/2004 Amount of Investment (Quote - $ Amount) $35.26 - $8.815.00 $33.61 - $10,143.00 $19.48 - Sa.914.50 100 - $5,000 $12571 - $25,142.00 $51.24 - S .149.00 Cumulative Amount of Income from Dividends, Interest, etc. $4,846 25 $1,098.00 Soyy $2.43750 $19. 5.20 $1,35 23 Latest Market Value Quotes Amount $92.50 - $23.125.00 $90.56 - 52.168.00 $35.33 - $5.299.50 184.00 - $6.900.00 591406-542,812.00 $100 -$74,464 Mutual find 1 NA (est) $400,000 - $112.000 9/16/2000 $280,000 - $56,000 house at 1700 West Market Street REAL estate $275.00 N/A $2.5.000 NA - $25,000 2018 Cangage Learning 9/9/2013 Savings 1.1% one-year CD at First National Bank $ 190,168.50 $45,275.95 S1,569.25 Totals CHAPTER 11: Investment Plannin Identify Investments that aren't performing up to expectations. one will enable you to keep track of your investment holdings and AN INVENTORY OF INVESTMENT HOLDINGS Name(s): Adam and Jane Keener Date: September 9, 2014 Type of Investment concnon stool Common stock Common stock Corporate bond Mutual fund Description of Investment Vehicle 2.50 shares - MoDonalds 300 shares - Disney 150 shares - Intel $5,000 Wal-Mart 6.5-37 200 shares - Vanguard Health Care 25 shares - Fidelity Contrafund Date Purchased 12/9/2005 10/19/2007 8/11/2010 8/24/2007 6/16/2004 6/16/2004 Amount of Investment (Quote - $ Amount) $35.26 - $8.815.00 $33.61 - $10,143.00 $19.48 - Sa.914.50 100 - $5,000 $12571 - $25,142.00 $51.24 - S .149.00 Cumulative Amount of Income from Dividends, Interest, etc. $4,846 25 $1,098.00 Soyy $2.43750 $19. 5.20 $1,35 23 Latest Market Value Quotes Amount $92.50 - $23.125.00 $90.56 - 52.168.00 $35.33 - $5.299.50 184.00 - $6.900.00 591406-542,812.00 $100 -$74,464 Mutual find 1 NA (est) $400,000 - $112.000 9/16/2000 $280,000 - $56,000 house at 1700 West Market Street REAL estate $275.00 N/A $2.5.000 NA - $25,000 2018 Cangage Learning 9/9/2013 Savings 1.1% one-year CD at First National Bank $ 190,168.50 $45,275.95 S1,569.25 Totals CHAPTER 11: Investment PlanninStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started