Answered step by step

Verified Expert Solution

Question

1 Approved Answer

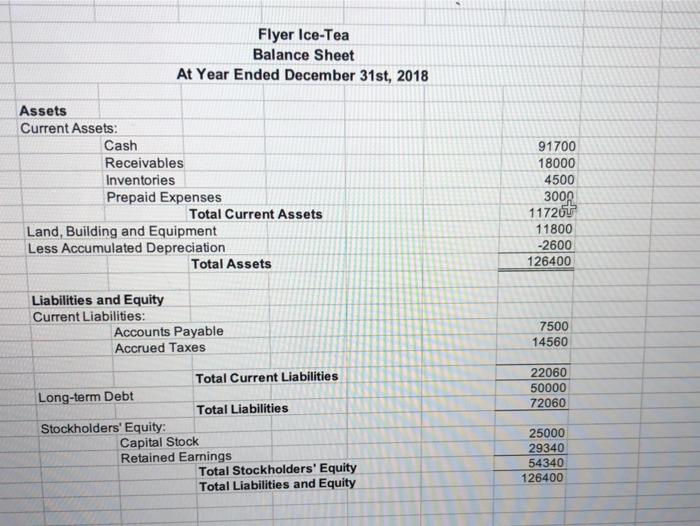

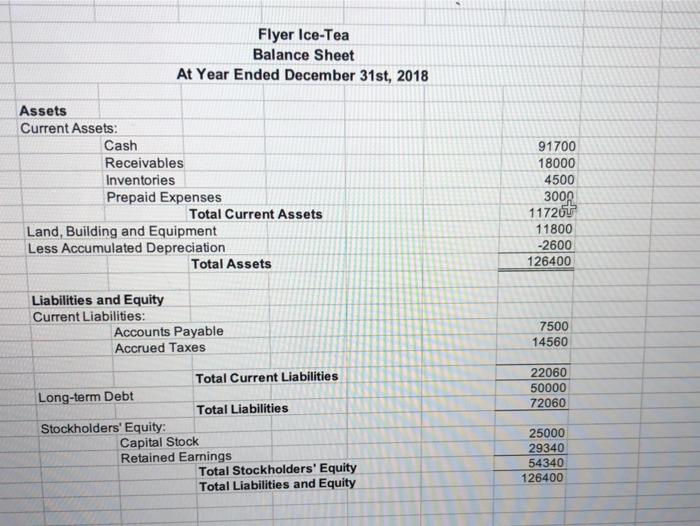

use year end value, instead of using the average of the balance sheet. Flyer Ice-Tea Balance Sheet At Year Ended December 31st, 2018 Assets Current

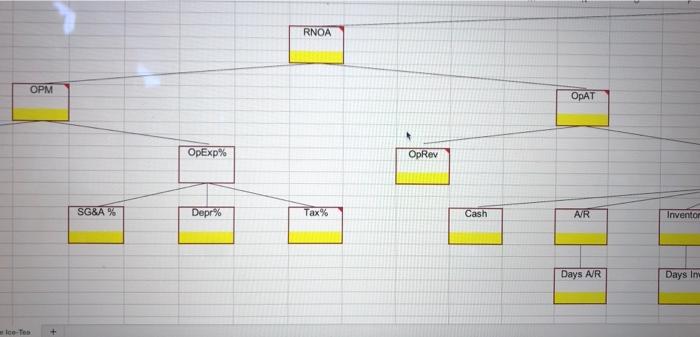

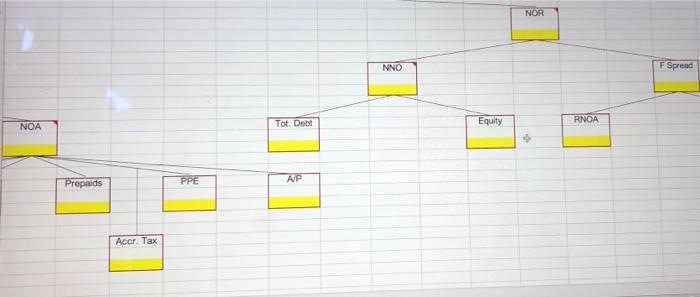

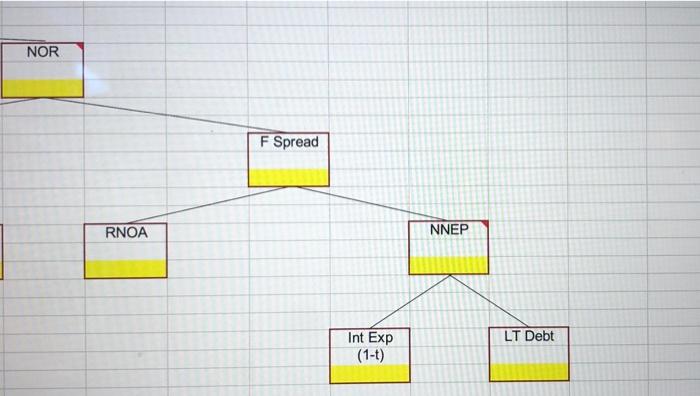

use year end value, instead of using the average of the balance sheet.

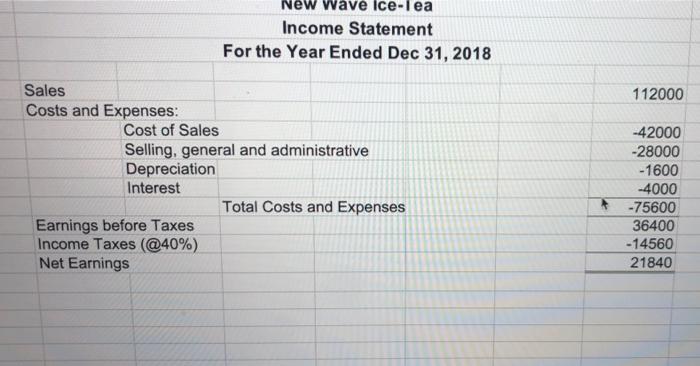

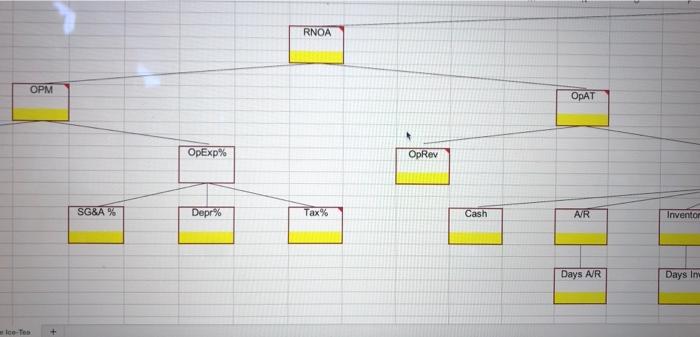

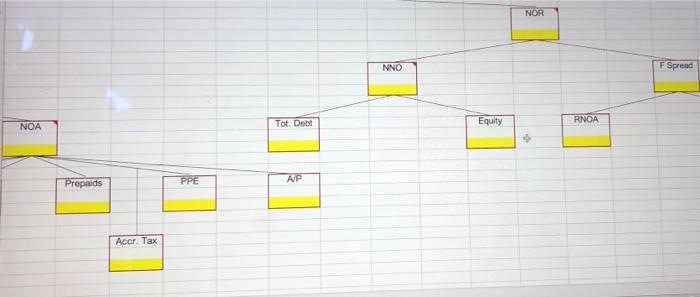

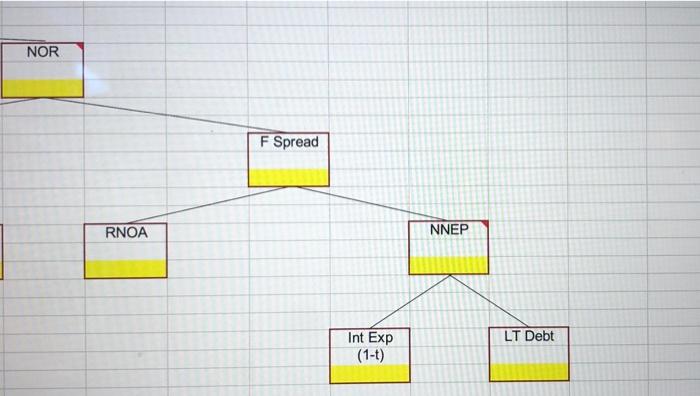

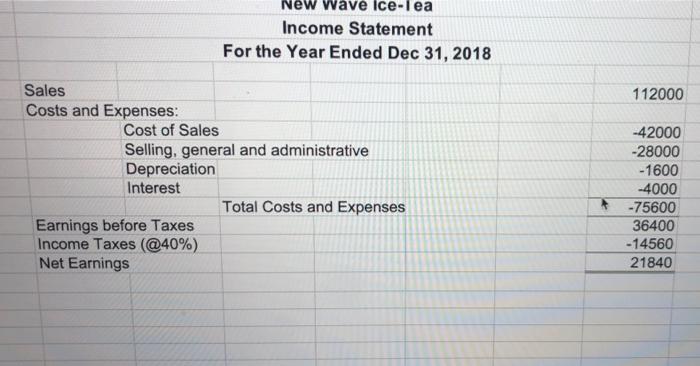

Flyer Ice-Tea Balance Sheet At Year Ended December 31st, 2018 Assets Current Assets: Cash Receivables Inventories Prepaid Expenses Total Current Assets Land, Building and Equipment Less Accumulated Depreciation Total Assets 91700 18000 4500 3004 117265 11800 -2600 126400 Liabilities and Equity Current Liabilities: Accounts Payable Accrued Taxes 7500 14560 22060 50000 72060 Total Current Liabilities Long-term Debt Total Liabilities Stockholders' Equity: Capital Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Equity 25000 29340 54340 126400 New Wave Ice-lea Income Statement For the Year Ended Dec 31, 2018 112000 Sales Costs and Expenses: Cost of Sales Selling, general and administrative Depreciation Interest Total Costs and Expenses Earnings before Taxes Income Taxes (@40%) Net Earnings -42000 -28000 -1600 -4000 -75600 36400 -14560 21840 RNOA OPM OpExp% OpRev SG&A % Depr% Tax% Cash Cash AR Inventor Days AR Days In Ice-Too + NOR NNO F Spread Equity Tot. Dobi NOA RNOA Prepaids PPE AP Acer Tax NOR F Spread RNOA NNEP LT Debt Int Exp (1-1) Flyer Ice-Tea Balance Sheet At Year Ended December 31st, 2018 Assets Current Assets: Cash Receivables Inventories Prepaid Expenses Total Current Assets Land, Building and Equipment Less Accumulated Depreciation Total Assets 91700 18000 4500 3004 117265 11800 -2600 126400 Liabilities and Equity Current Liabilities: Accounts Payable Accrued Taxes 7500 14560 22060 50000 72060 Total Current Liabilities Long-term Debt Total Liabilities Stockholders' Equity: Capital Stock Retained Earnings Total Stockholders' Equity Total Liabilities and Equity 25000 29340 54340 126400 New Wave Ice-lea Income Statement For the Year Ended Dec 31, 2018 112000 Sales Costs and Expenses: Cost of Sales Selling, general and administrative Depreciation Interest Total Costs and Expenses Earnings before Taxes Income Taxes (@40%) Net Earnings -42000 -28000 -1600 -4000 -75600 36400 -14560 21840 RNOA OPM OpExp% OpRev SG&A % Depr% Tax% Cash Cash AR Inventor Days AR Days In Ice-Too + NOR NNO F Spread Equity Tot. Dobi NOA RNOA Prepaids PPE AP Acer Tax NOR F Spread RNOA NNEP LT Debt Int Exp (1-1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started