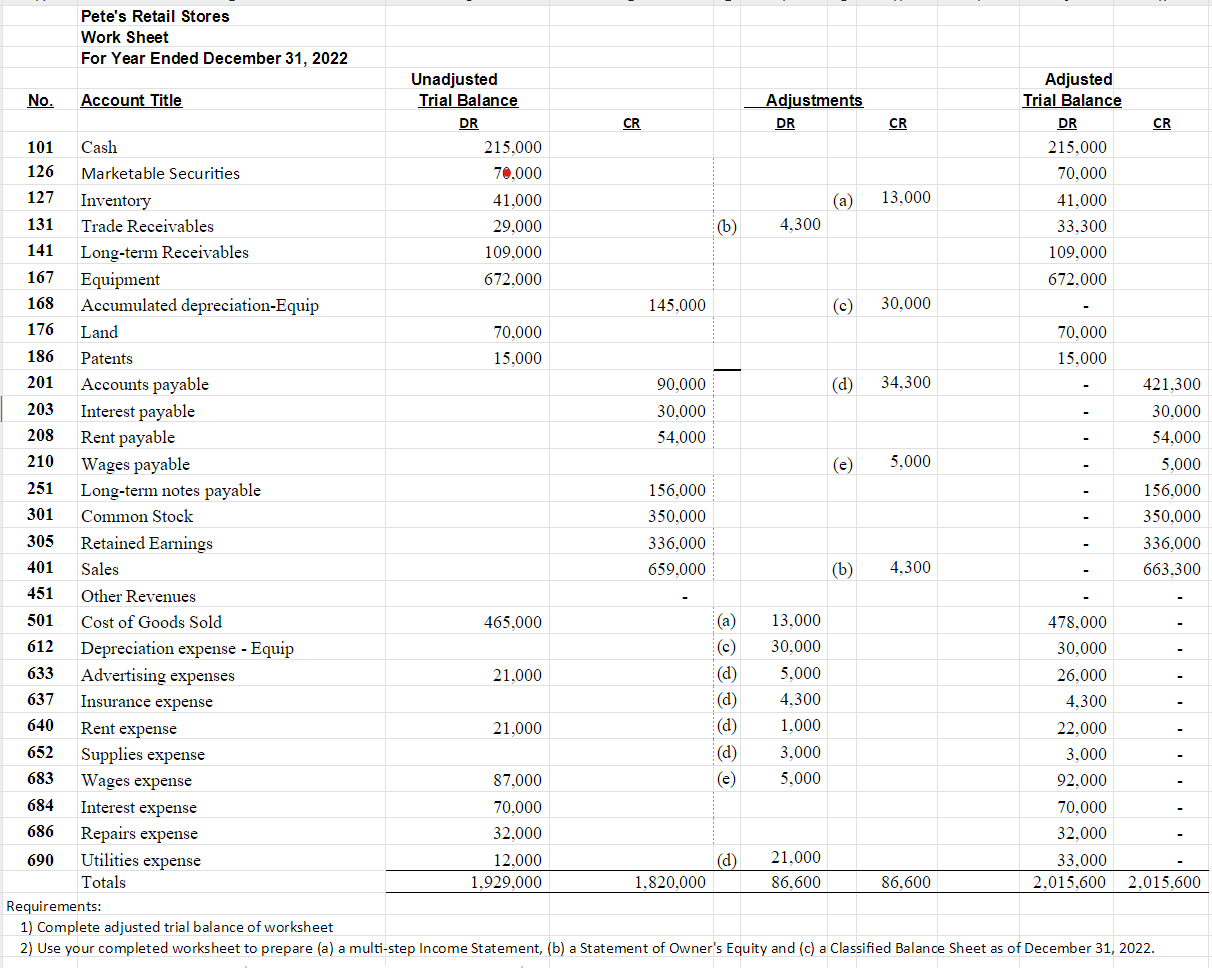

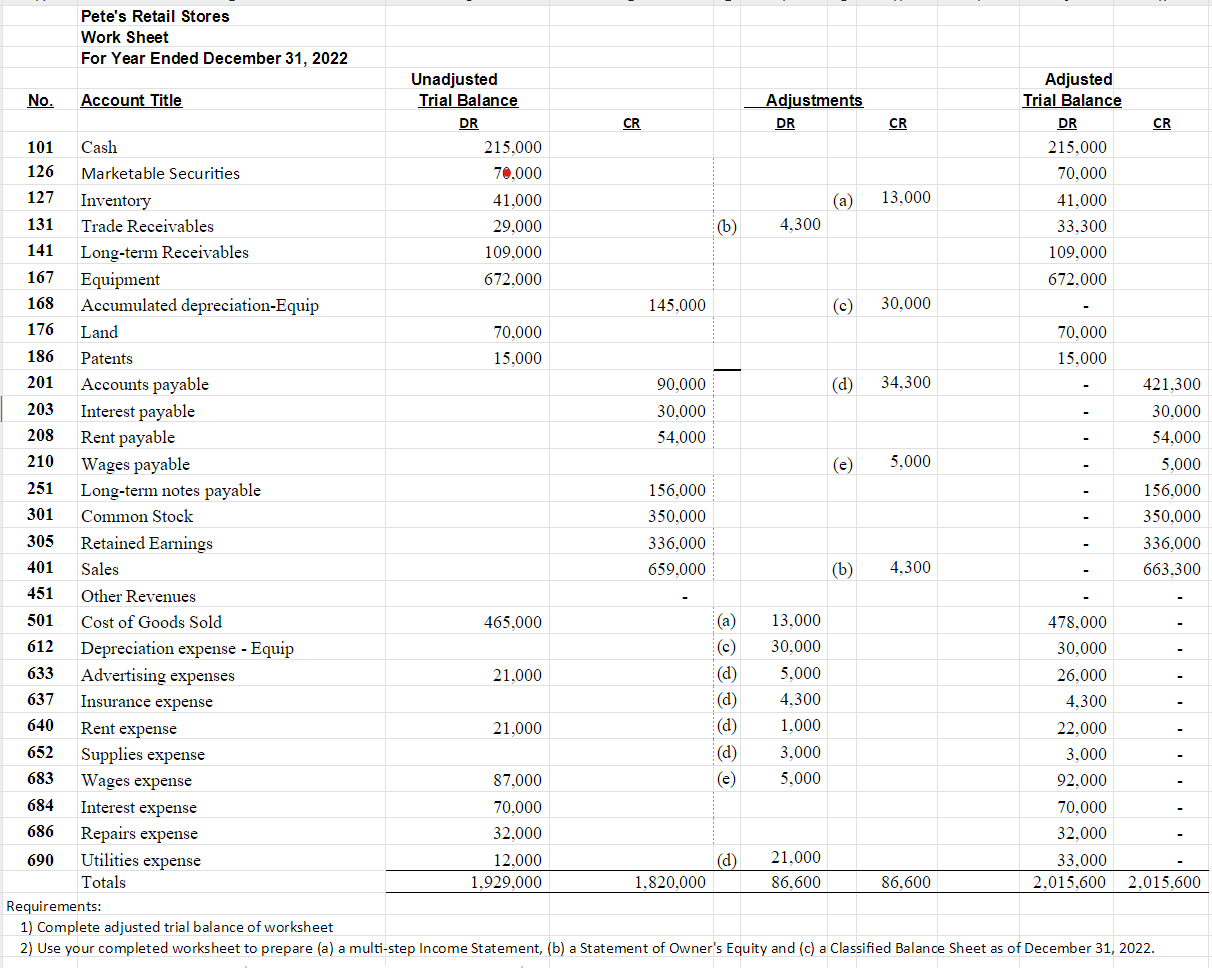

Use your completed worksheet to prepare a a multistep Income Statement, b a Statement of Owner's Equity and c a Classified Balance Sheet as of December 31, 2022

\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & \multirow{3}{*}{\begin{tabular}{l} Pete's Retail Stores \\ Work Sheet \end{tabular}} & & & & & \\ \hline & & & & & & & & & \\ \hline & & & & & & & & & \\ \hline & For Year Ended December 31, 2022 & & & & & & & & \\ \hline \multirow{3}{*}{ No. } & & Unadjusted & & & & & & \multirow{2}{*}{\multicolumn{2}{|c|}{\begin{tabular}{c} Adjusted \\ Trial Balance \end{tabular}}} \\ \hline & Account Title & Trial Balance & & & \multicolumn{3}{|c|}{ Adjustments } & & \\ \hline & & DR & CR & & DR & & CR & DR & CR \\ \hline 101 & Cash & 215,000 & & & & & & 215,000 & \\ \hline 126 & Marketable Securities & 70,000 & & & & & & 70,000 & \\ \hline 127 & Inventory & 41,000 & & & & (a) & 13,000 & 41,000 & \\ \hline 131 & Trade Receivables & 29,000 & & (b) & 4,300 & & & 33,300 & \\ \hline 141 & Long-term Receivables & 109,000 & & & & & & 109,000 & \\ \hline 167 & Equipment & 672,000 & & & & & & 672,000 & \\ \hline 168 & Accumulated depreciation-Equip & & 145,000 & & & (c) & 30,000 & - & \\ \hline 176 & Land & 70,000 & & & & & & 70,000 & \\ \hline 186 & Patents & 15,000 & & & & & & 15,000 & \\ \hline 201 & Accounts payable & & 90,000 & & & (d) & 34,300 & - & 421,300 \\ \hline 203 & Interest payable & & 30,000 & & & & & - & 30,000 \\ \hline 208 & Rent payable & & 54,000 & & & & & - & 54,000 \\ \hline 210 & Wages payable & & & & & (e) & 5,000 & - & 5,000 \\ \hline 251 & Long-term notes payable & & 156,000 & & & & & - & 156,000 \\ \hline 301 & Common Stock & & 350,000 & & & & & - & 350,000 \\ \hline 305 & Retained Earnings & & 336,000 & & & & & - & 336,000 \\ \hline 401 & Sales & & 659,000 & & & (b) & 4,300 & - & 663,300 \\ \hline 451 & Other Revenues & & - & & & & & - & - \\ \hline 501 & Cost of Goods Sold & 465,000 & & (a) & 13,000 & & & 478,000 & - \\ \hline 612 & Depreciation expense - Equip & & & (c) & 30,000 & & & 30,000 & - \\ \hline 633 & Advertising expenses & 21,000 & & (d) & 5,000 & & & 26,000 & - \\ \hline 637 & Insurance expense & & & (d) & 4,300 & & & 4,300 & - \\ \hline 640 & Rent expense & 21,000 & & (d) & 1,000 & & & 22,000 & - \\ \hline 652 & Supplies expense & & & (d) & 3,000 & & & 3,000 & - \\ \hline 683 & Wages expense & 87,000 & & (e) & 5,000 & & & 92,000 & - \\ \hline 684 & Interest expense & 70,000 & & & & & & 70,000 & - \\ \hline 686 & Repairs expense & 32,000 & & & & & & 32,000 & - \\ \hline \multirow[t]{2}{*}{690} & Utilities expense & 12,000 & & (d) & 21,000 & & & 33,000 & - \\ \hline & Totals & 1,929,000 & 1,820,000 & & 86,600 & & 86,600 & 2,015,600 & 2,015,600 \\ \hline \multicolumn{10}{|c|}{ Requirements: } \\ \hline \multicolumn{2}{|c|}{ 1) Complete adjusted trial balance of worksheet } & & & & & & & & \\ \hline \end{tabular}