Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use your solution to the following problem to answer questions. Assume that it is now Jan. 2020. UAC Inc. (US) expects to receive cash dividends

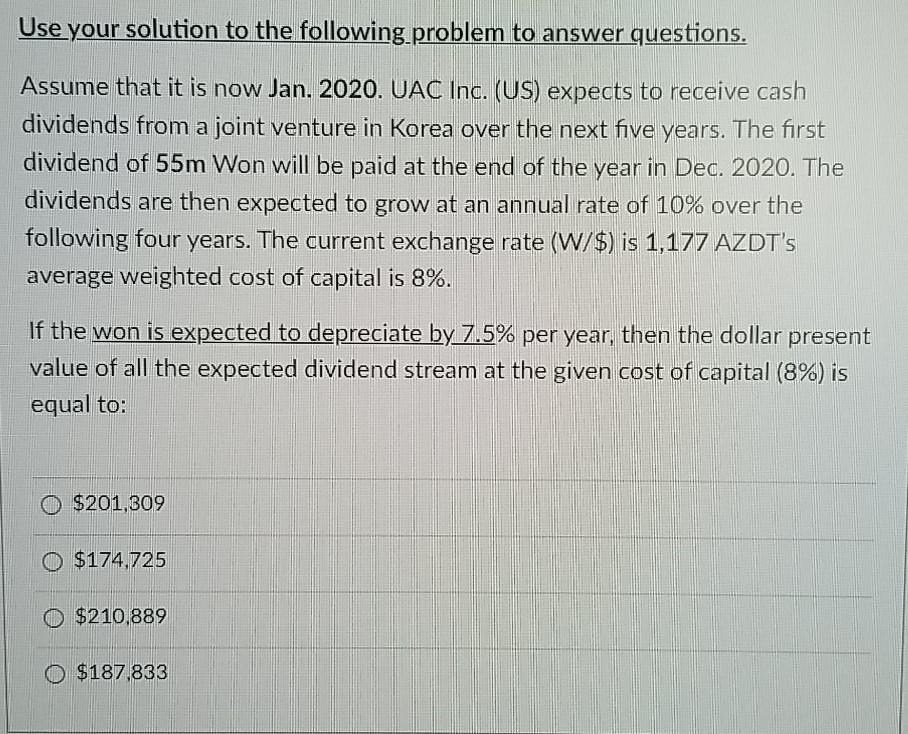

Use your solution to the following problem to answer questions. Assume that it is now Jan. 2020. UAC Inc. (US) expects to receive cash dividends from a joint venture in Korea over the next five years. The first dividend of 55m Won will be paid at the end of the year in Dec. 2020. The dividends are then expected to grow at an annual rate of 10% over the following four years. The current exchange rate (W/$) is 1,177 AZDT's average weighted cost of capital is 8%. If the won is expected to depreciate by 7.5% per year, then the dollar present value of all the expected dividend stream at the given cost of capital (8%) is equal to: O $201.309 O $174,725 O $210.889 O $187.833

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started