Answered step by step

Verified Expert Solution

Question

1 Approved Answer

UServation of a client's 11. Red Corporation had a temporary cash squeeze near its balance-sheet date. It needed cash badly for a seasonal dip in

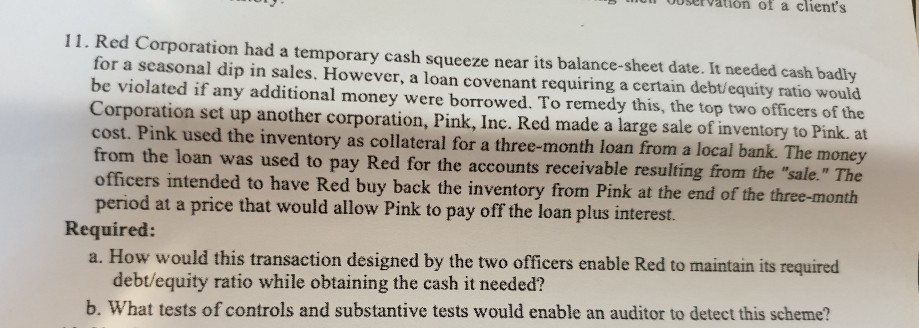

UServation of a client's 11. Red Corporation had a temporary cash squeeze near its balance-sheet date. It needed cash badly for a seasonal dip in sales. However, a loan covenant requiring a certain debt/equity ratio would be violated if any additional money were borrowed. To remedy this, the top two officers of the Corporation set up another corporation, Pink, Inc. Red made a large sale of inventory to Pink. at cost. Pink used the inventory as collateral for a three-month loan from a local bank. The money from the loan was used to pay Red for the accounts receivable resulting from the "sale." The officers intended to have Red buy back the inventory from Pink at the end of the three-month period at a price that would allow Pink to pay off the loan plus interest. Required: a. How would this transaction designed by the two officers enable Red to maintain its required debt/equity ratio while obtaining the cash it needed? b. What tests of controls and substantive tests would enable an auditor to detect this scheme

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started