Answered step by step

Verified Expert Solution

Question

1 Approved Answer

uses section 25-5 to answer question 25-5 When Do Financial Leases Pay? We have examined the value of a lease from the viewpoint of the

uses section 25-5 to answer question

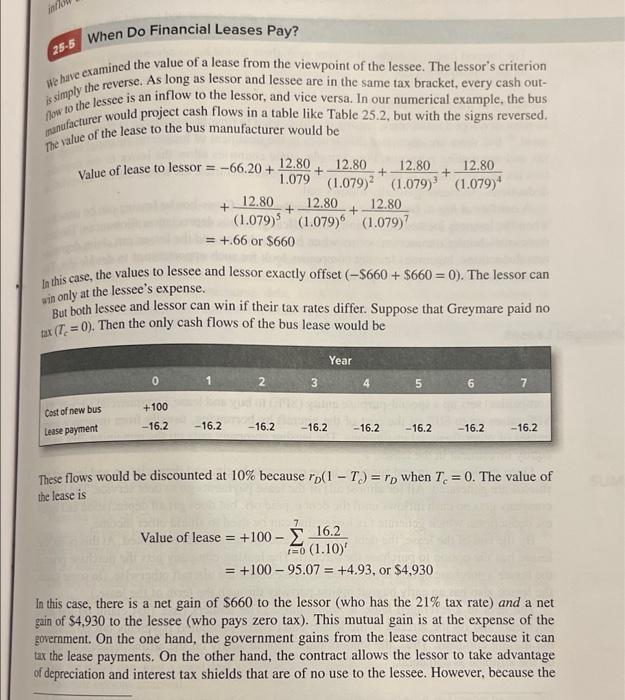

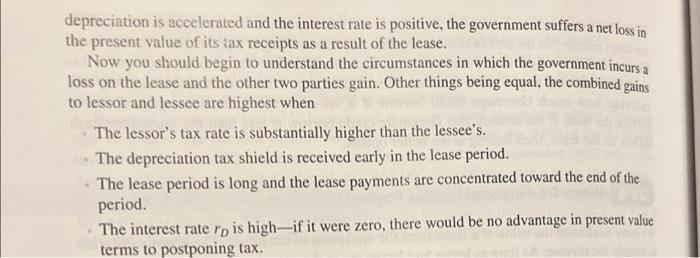

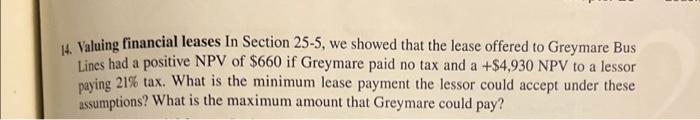

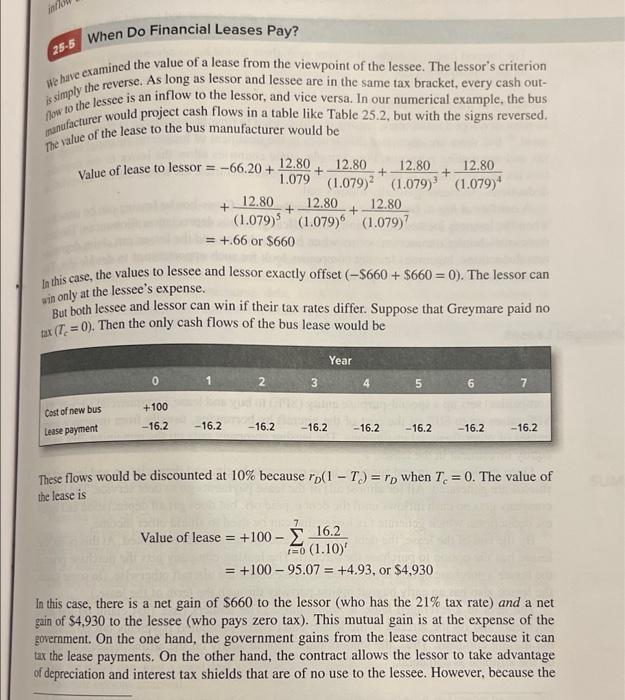

25-5 When Do Financial Leases Pay? We have examined the value of a lease from the viewpoint of the lessee. The lessor's criterion is simply the reverse. As long as lessor and lessee are in the same tax bracket, every cash out- manufacturer would project cash flows in a table like Table 25.2, but with the signs reversed. How to the lessee is an inflow to the lessor, and vice versa. In our numerical example, the bus The value of the lease to the bus manufacturer would be Value of lease to lessor = -66.20+ 12.80 + 12.80 + 12.80 12.80 1.079 + (1.079)2 (1.079) (1.079) + 12.80 + 12.80 + 12.80 (1.079) (1.079). (1.079) = +.66 or 8660 In this case, the values to lessee and lessor exactly offset (-$660 + $660 = 0). The lessor can But both lessee and lessor can win if their tax rates differ. Suppose that Greymare paid no fax (T=0). Then the only cash flows of the bus lease would be win only at the lessee's expense. Year 0 2 3 4 5 6 7 Cost of new bus +100 -16.2 -16.2 -16.2 -16.2 Lease payment -16.2 -16.2 -16.2 -16.2 These flows would be discounted at 10% because rp(1-T)=ro when T = 0. The value of the lease is 7 Value of lease = = +100 - 16.2 20 (1.10) = +100 - 95.07 = +4.93, or $4,930 a In this case, there is a net gain of $660 to the lessor (who has the 21% tax rate) and a net gain of $4.930 to the lessee (who pays zero tax). This mutual gain is at the expense of the government. On the one hand, the government gains from the lease contract because it can tax the lease payments. On the other hand, the contract allows the lessor to take advantage of depreciation and interest tax shields that are of no use to the lessee. However, because the depreciation is accelerated and the interest rate is positive, the government suffers a net loss in the present value of its tax receipts as a result of the lease. Now you should begin to understand the circumstances in which the government incurs a loss on the lease and the other two parties gain. Other things being equal, the combined gains to lessor and lessee are highest when The lessor's tax rate is substantially higher than the lessee's. The depreciation tax shield is received early in the lease period. The lease period is long and the lease payments are concentrated toward the end of the period. The interest rate rp is high-if it were zero, there would be no advantage in present value terms to postponing tax. 14. Valuing financial leases In Section 25-5, we showed that the lease offered to Greymare Bus Lines had a positive NPV of $660 if Greymare paid no tax and a +$4,930 NPV to a lessor paying 21% tax. What is the minimum lease payment the lessor could accept under these assumptions? What is the maximum amount that Greymare could pay? 25-5 When Do Financial Leases Pay? We have examined the value of a lease from the viewpoint of the lessee. The lessor's criterion is simply the reverse. As long as lessor and lessee are in the same tax bracket, every cash out- manufacturer would project cash flows in a table like Table 25.2, but with the signs reversed. How to the lessee is an inflow to the lessor, and vice versa. In our numerical example, the bus The value of the lease to the bus manufacturer would be Value of lease to lessor = -66.20+ 12.80 + 12.80 + 12.80 12.80 1.079 + (1.079)2 (1.079) (1.079) + 12.80 + 12.80 + 12.80 (1.079) (1.079). (1.079) = +.66 or 8660 In this case, the values to lessee and lessor exactly offset (-$660 + $660 = 0). The lessor can But both lessee and lessor can win if their tax rates differ. Suppose that Greymare paid no fax (T=0). Then the only cash flows of the bus lease would be win only at the lessee's expense. Year 0 2 3 4 5 6 7 Cost of new bus +100 -16.2 -16.2 -16.2 -16.2 Lease payment -16.2 -16.2 -16.2 -16.2 These flows would be discounted at 10% because rp(1-T)=ro when T = 0. The value of the lease is 7 Value of lease = = +100 - 16.2 20 (1.10) = +100 - 95.07 = +4.93, or $4,930 a In this case, there is a net gain of $660 to the lessor (who has the 21% tax rate) and a net gain of $4.930 to the lessee (who pays zero tax). This mutual gain is at the expense of the government. On the one hand, the government gains from the lease contract because it can tax the lease payments. On the other hand, the contract allows the lessor to take advantage of depreciation and interest tax shields that are of no use to the lessee. However, because the depreciation is accelerated and the interest rate is positive, the government suffers a net loss in the present value of its tax receipts as a result of the lease. Now you should begin to understand the circumstances in which the government incurs a loss on the lease and the other two parties gain. Other things being equal, the combined gains to lessor and lessee are highest when The lessor's tax rate is substantially higher than the lessee's. The depreciation tax shield is received early in the lease period. The lease period is long and the lease payments are concentrated toward the end of the period. The interest rate rp is high-if it were zero, there would be no advantage in present value terms to postponing tax. 14. Valuing financial leases In Section 25-5, we showed that the lease offered to Greymare Bus Lines had a positive NPV of $660 if Greymare paid no tax and a +$4,930 NPV to a lessor paying 21% tax. What is the minimum lease payment the lessor could accept under these assumptions? What is the maximum amount that Greymare could pay

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started