Answered step by step

Verified Expert Solution

Question

1 Approved Answer

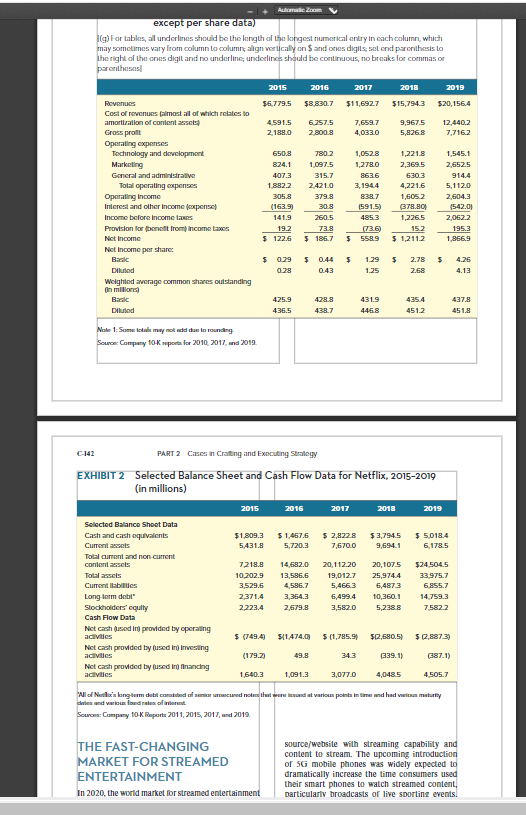

UseUsing the equation on Table 4.1 of Chapter 4 to calculate the Net Profit Margin of Netflix in 2018 and in 2019. the e Using

UseUsing the equation on Table 4.1 of Chapter 4 to calculate the Net Profit Margin of Netflix in 2018 and in 2019. the e

Using the equation on Table 4.1 of Chapter 4 to calculate the Net Profit Margin of Netflix in 2018 and in 2019.

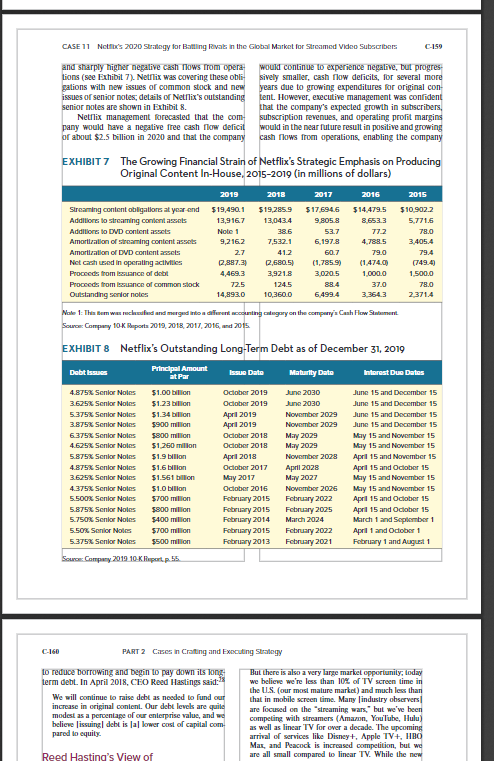

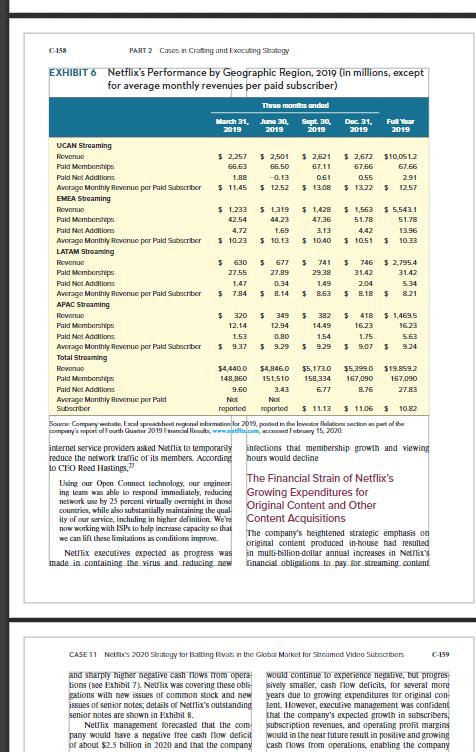

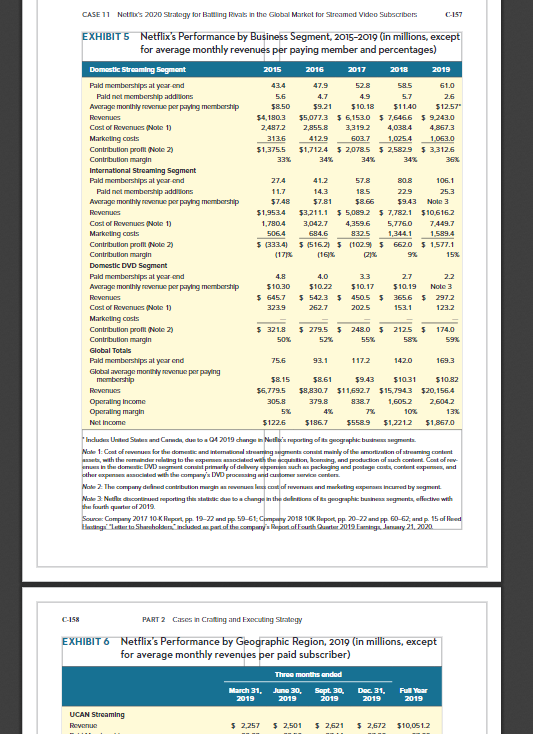

CASE 11 Netftx's 2020 Stralhgy for Batlling Rovale in the Gboal Market for Streamed Video Subacrbers C-159 and sharply higher negalive cash mows from operations (see Exhibit 7). Netflix was covering these obli gations with new issues of common stock and new issues of senior notes; details of Netflix's outstanding senior notes are shown in Exhibit 8 . Netflix management forecasted that the company would have a negative free cash flow deficit of about $2.5 billion in 2020 and that the company would continue to experience negative, but progres. sively smaller, cash flow deficits, for several more years due to growing expenditures for original content. Howerer, executive management was confident that the company's expected growth in subscribers, subscription revenues, and operating profit margins would in the near future result in positive and growing cash flows from operations, enabling the company EXHIBIT 7 The Growing Financial Strain of Netflix's Strategic Emphasis on Producing Original Content In-House, 2015-2019 (in millions of dollars) Seuve: Cempany 10K Reporis 2019, 201B, 2018, 2015, and 2015 EXHIBIT 8 Netflix's Outstanding Long-Term Debt as of December 31, 2019 C-160 PART 2 CiEcs in Crafting and Exocuting Stolngy to reduce borrowing and begin to pay down its long term debt. In April 2018, CEO Reed Hastings said: We will continue to raise debt as needed to fund our increase in original content. Our debe levels are quile modest as a peroentage of our enierprise valuc, and wo believe |issuing| debt is |a| lower cost of capital compared is equity. But there is also a very large market opportunity; today we believe we're less than 10% of 'IV screen time in the U.S. (our most mature market) and much less than that in mobile screen time. Many |industry observers] are focused on the "streaming wars," but we've been competing with streamers (Amarnn, Youlube, Hulu) as well as linear TV for over a decads. The upcoming arrival of services like Disney+, Apple TV+, 11BO Max, and Peacock is increased competition, but we are all small compared io linear TV. While the new EXHIBIT 6 Netflix's Performance by Geographic Region, 2019 (in millions, except for average monthly revenues per paid subscriber) CASE 11 Netfix's 2020 Strilegy for Batling Reval in the Global Market for Streamed Video Subacribers C-159 and sharply highar negative cash nows from operations (see Fxhibit 7). Netflix was covering these obli gations with new issues of common stock and new issues of senior notes; details of Netflix's outstanding senior notes are shawn in Exhibit 8 . Netflix management forecasted that the company would have a negative free cash flow deficit of about $2.5 billion in 2020 and that the company would continue to experience negalive, but progres. sively smaller, cash flaw deficits, for several more years due to growing expenditures for original content. However, executive management was confident that the company's expected growth in subscribers, subscription revenues, and operating profit margins would in the near future result in positive and growing cash flows from operations, enabling the company CASE 11 Netflx's 2020 Stralegy for Battling Revale in the Global Market for Streamed Vadeo Subacribers C.157 EXHIBIT 5 Netflix's Performance by Business Segment, 2015-2019 (in millions, except for averaae monthlv revenues per Davina member and percentages) the fourth qunter af 2019 C- -158 PART 2 CaEcs in Crafting and Exocuting Stralsgy EXHIBIT 6 Netflix's Performance by Geographic Region, 2019 (in millions, except for average monthly revenues per paid subscriber) (g) For tables, al underlines should be the length of the langest numerial entry in each calumn, which may sometimns vary from column to columr; align wertically on $ and ones digits; set cod parenthusis to the right of the ones digit and no underline; underlines should be continuous, no breaks for coenmas or perentheses: C-142 PART 2 CaEes in Crafting and Exocuting Stealogy EXHIBIT 2 Selected Balance Sheet and Cash Flow Data for Netflix, 2015-2019 (in millions)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started