Using 5 decimal points for each question if it's possible.

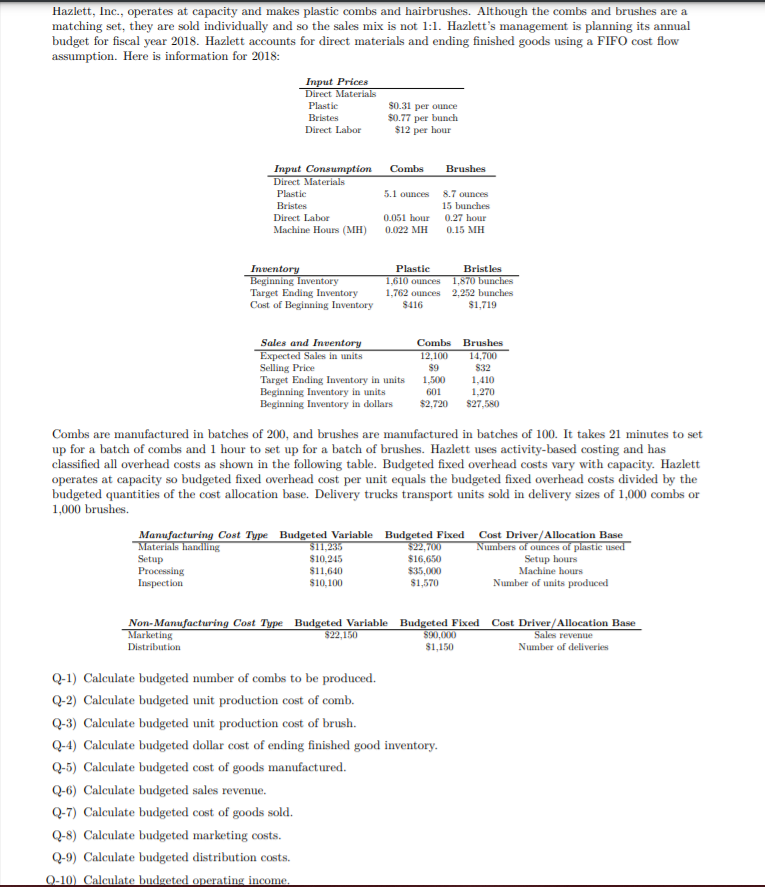

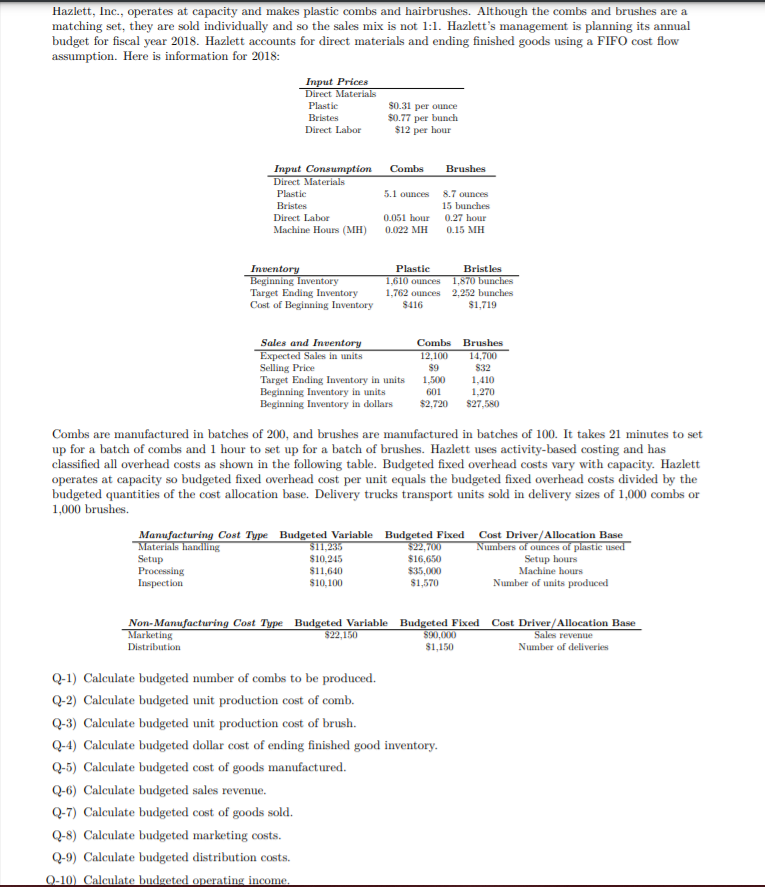

Hazlett, Inc., operates at capacity and makes plastic combs and hairbrushes. Although the combs and brushes are a matching set, they are sold individually and so the sales mix is not 1:1. Hazlett's management is planning its annual budget for fiscal year 2018. Hazlett accounts for direct materials and ending finished goods using a FIFO cost flow assumption. Here is information for 2018: Input Prices Direct Materials Plastic Bristes Direct Labor $0.31 per ounce $0.77 per bunch $12 per hour Combs Brushes Input Consumption Direct Materials Plastic Bristes Direct Labor Machine Hours (MH) 5.1 ounces 8.7 ounces 15 bunches 0.27 hour 0.15 MH 0.051 hour 0.022 MH Inventory Beginning Inventory Target Ending Inventory Cost of Beginning Inventory Plastic Bristles 1,610 ounces 1,870 bunches 1,762 ounces 2,252 bunches $416 $1,719 Sales and Inventory Expected Sales in units Selling Price Target Ending Inventory in units Beginning Inventory in units Beginning Inventory in dollars Combs Brushes 12.100 14,700 $9 S32 1,500 1,410 601 1,270 $2.720 $27.580 Combs are manufactured in batches of 200, and brushes are manufactured in batches of 100. It takes 21 minutes to set up for a batch of combs and 1 hour to set up for a batch of brushes. Hazlett uses activity-based costing and has classified all overhead costs as shown in the following table. Budgeted fixed overhead costs vary with capacity. Hazlett operates at capacity so budgeted fixed overhead cost per unit equals the budgeted fixed overhead costs divided by the budgeted quantities of the cost allocation base. Delivery trucks transport units sold in delivery sizes of 1,000 combs or 1,000 brushes. Manufacturing Cost Type Budgeted Variable Budgeted Fixed Cost Driver/Allocation Base Materials handling $11,235 $22,700 Numbers of ounces of plastic used Setup $10,245 $16,650 Setup hours Processing $11,640 $35,000 Machine hours Inspection $10,100 $1,570 Number of units produced Non-Manufacturing Cost Type Budgeted Variable Budgeted Fixed Cost Driver/ Allocation Base Marketing $22,150 S90,000 Sales revenue Distribution $1,150 Number of deliveries Q-1) Calculate budgeted number of combs to be produced. Q-2) Calculate budgeted unit production cost of comb. Q-3) Calculate budgeted unit production cost of brush. Q-4) Calculate budgeted dollar cost of ending finished good inventory. Q-5) Calculate budgeted cost of goods manufactured. Q-6) Calculate budgeted sales revenue. Q-7) Calculate budgeted cost of goods sold. Q-8) Calculate budgeted marketing costs. Q-9) Calculate budgeted distribution costs. 0-10) Calculate budgeted operating income