Answered step by step

Verified Expert Solution

Question

1 Approved Answer

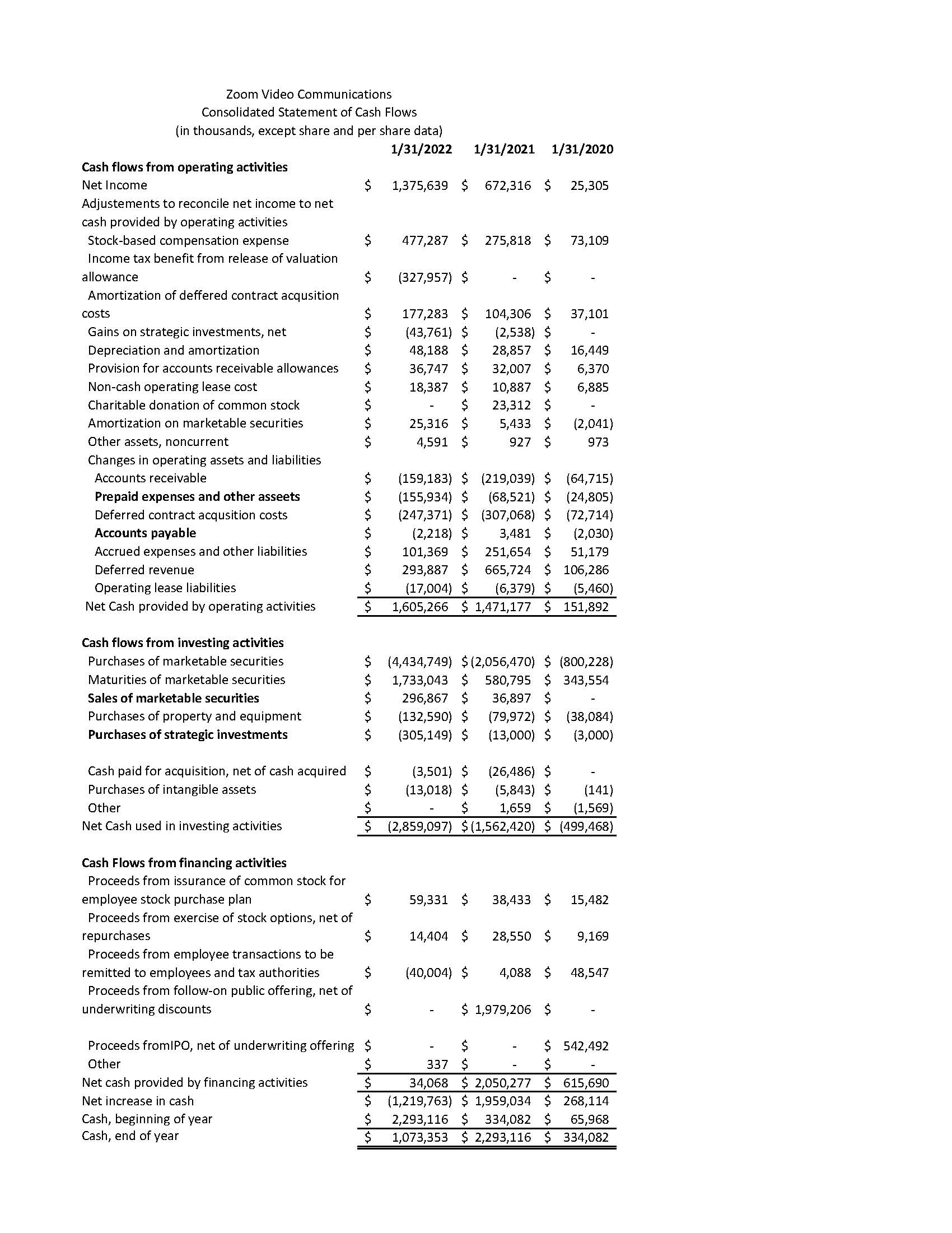

Using a cost of capital of 10% to calculate the discounted cash flows show me how to do a discounted cash flow analysis from the

Using a cost of capital of 10% to calculate the discounted cash flows show me how to do a discounted cash flow analysis from the attached balance sheet.

Zoom Video Communications Consolidated Statement of Cash Flows (in thousands, except share and per share data) 1/31/20221/31/20211/31/2020 Cash flows from operating activities Net Income \$ \$ 1,375,639 \$ 672,316$25,305 Adjustements to reconcile net income to net cash provided by operating activities Stock-based compensation expense $477,287$275,818$73,109 Income tax benefit from release of valuation allowance Amortization of deffered contract acqusition costsGainsonstrategicinvestments,netDepreciationandamortizationProvisionforaccountsreceivableallowancesNon-cashoperatingleasecostCharitabledonationofcommonstockAmortizationonmarketablesecuritiesOtherassets,noncurrent$$$$$$$$177,283(43,761)48,18836,74718,38725,3164,591$$$$$$$$104,306(2,538)28,85732,00710,88723,3125,433927$$$$$$$$37,10116,4496,3706,885(2,041)973 Changes in operating assets and liabilities Accounts receivable $(159,183)$(219,039)$(64,715) Prepaid expenses and other asseets $(155,934)$(68,521)$(24,805) Deferred contract acqusition costs $(247,371)$(307,068)$(72,714) Deferred revenue $293,887$665,724$106,286 Operating lease liabilities Net Cash provided by operating activities \begin{tabular}{lrrrrr} $ & (17,004) & $ & (6,379) & $ & (5,460) \\ \hline$ & 1,605,266 & $1,471,177 & $ & 151,892 \\ \hline \end{tabular} Cash flows from investing activities Purchases of marketable securities $(4,434,749)$(2,056,470)$(800,228) Maturities of marketable securities \$ 1,733,043$580,795$343,554 Sales of marketable securities $296,867$36,897$ - Purchases of strategic investments $(305,149)$(13,000)$(3,000) Cash Flows from financing activities Proceeds from issurance of common stock for employee stock purchase plan $59,331$38,433$15,482 Proceeds from exercise of stock options, net of repurchases $14,404$28,550$9,169 Proceeds from employee transactions to be remitted to employees and tax authorities $(40,004)$4,088$48,547 Proceeds from follow-on public offering, net of underwriting discounts $$1,979,206$ Proceeds fromIPO, net of underwriting offering $$$542,492 Other Net cash provided by financing activities Net increase in cash Cash, beginning of year Cash, end of year \begin{tabular}{rrrrrr} $ & - & $ & - & $ & 542,492 \\ $ & 337 & $ & - & $ & - \\ \hline$ & 34,068 & $2,050,277 & $ & 615,690 \\ \hline$ & (1,219,763) & $1,959,034 & $ & 268,114 \\ $ & 2,293,116 & $ & 334,082 & $ & 65,968 \\ \hline$ & 1,073,353 & $2,293,116 & $ & 334,082 \\ \hline \hline \end{tabular} Zoom Video Communications Consolidated Statement of Cash Flows (in thousands, except share and per share data) 1/31/20221/31/20211/31/2020 Cash flows from operating activities Net Income \$ \$ 1,375,639 \$ 672,316$25,305 Adjustements to reconcile net income to net cash provided by operating activities Stock-based compensation expense $477,287$275,818$73,109 Income tax benefit from release of valuation allowance Amortization of deffered contract acqusition costsGainsonstrategicinvestments,netDepreciationandamortizationProvisionforaccountsreceivableallowancesNon-cashoperatingleasecostCharitabledonationofcommonstockAmortizationonmarketablesecuritiesOtherassets,noncurrent$$$$$$$$177,283(43,761)48,18836,74718,38725,3164,591$$$$$$$$104,306(2,538)28,85732,00710,88723,3125,433927$$$$$$$$37,10116,4496,3706,885(2,041)973 Changes in operating assets and liabilities Accounts receivable $(159,183)$(219,039)$(64,715) Prepaid expenses and other asseets $(155,934)$(68,521)$(24,805) Deferred contract acqusition costs $(247,371)$(307,068)$(72,714) Deferred revenue $293,887$665,724$106,286 Operating lease liabilities Net Cash provided by operating activities \begin{tabular}{lrrrrr} $ & (17,004) & $ & (6,379) & $ & (5,460) \\ \hline$ & 1,605,266 & $1,471,177 & $ & 151,892 \\ \hline \end{tabular} Cash flows from investing activities Purchases of marketable securities $(4,434,749)$(2,056,470)$(800,228) Maturities of marketable securities \$ 1,733,043$580,795$343,554 Sales of marketable securities $296,867$36,897$ - Purchases of strategic investments $(305,149)$(13,000)$(3,000) Cash Flows from financing activities Proceeds from issurance of common stock for employee stock purchase plan $59,331$38,433$15,482 Proceeds from exercise of stock options, net of repurchases $14,404$28,550$9,169 Proceeds from employee transactions to be remitted to employees and tax authorities $(40,004)$4,088$48,547 Proceeds from follow-on public offering, net of underwriting discounts $$1,979,206$ Proceeds fromIPO, net of underwriting offering $$$542,492 Other Net cash provided by financing activities Net increase in cash Cash, beginning of year Cash, end of year \begin{tabular}{rrrrrr} $ & - & $ & - & $ & 542,492 \\ $ & 337 & $ & - & $ & - \\ \hline$ & 34,068 & $2,050,277 & $ & 615,690 \\ \hline$ & (1,219,763) & $1,959,034 & $ & 268,114 \\ $ & 2,293,116 & $ & 334,082 & $ & 65,968 \\ \hline$ & 1,073,353 & $2,293,116 & $ & 334,082 \\ \hline \hline \end{tabular}

Zoom Video Communications Consolidated Statement of Cash Flows (in thousands, except share and per share data) 1/31/20221/31/20211/31/2020 Cash flows from operating activities Net Income \$ \$ 1,375,639 \$ 672,316$25,305 Adjustements to reconcile net income to net cash provided by operating activities Stock-based compensation expense $477,287$275,818$73,109 Income tax benefit from release of valuation allowance Amortization of deffered contract acqusition costsGainsonstrategicinvestments,netDepreciationandamortizationProvisionforaccountsreceivableallowancesNon-cashoperatingleasecostCharitabledonationofcommonstockAmortizationonmarketablesecuritiesOtherassets,noncurrent$$$$$$$$177,283(43,761)48,18836,74718,38725,3164,591$$$$$$$$104,306(2,538)28,85732,00710,88723,3125,433927$$$$$$$$37,10116,4496,3706,885(2,041)973 Changes in operating assets and liabilities Accounts receivable $(159,183)$(219,039)$(64,715) Prepaid expenses and other asseets $(155,934)$(68,521)$(24,805) Deferred contract acqusition costs $(247,371)$(307,068)$(72,714) Deferred revenue $293,887$665,724$106,286 Operating lease liabilities Net Cash provided by operating activities \begin{tabular}{lrrrrr} $ & (17,004) & $ & (6,379) & $ & (5,460) \\ \hline$ & 1,605,266 & $1,471,177 & $ & 151,892 \\ \hline \end{tabular} Cash flows from investing activities Purchases of marketable securities $(4,434,749)$(2,056,470)$(800,228) Maturities of marketable securities \$ 1,733,043$580,795$343,554 Sales of marketable securities $296,867$36,897$ - Purchases of strategic investments $(305,149)$(13,000)$(3,000) Cash Flows from financing activities Proceeds from issurance of common stock for employee stock purchase plan $59,331$38,433$15,482 Proceeds from exercise of stock options, net of repurchases $14,404$28,550$9,169 Proceeds from employee transactions to be remitted to employees and tax authorities $(40,004)$4,088$48,547 Proceeds from follow-on public offering, net of underwriting discounts $$1,979,206$ Proceeds fromIPO, net of underwriting offering $$$542,492 Other Net cash provided by financing activities Net increase in cash Cash, beginning of year Cash, end of year \begin{tabular}{rrrrrr} $ & - & $ & - & $ & 542,492 \\ $ & 337 & $ & - & $ & - \\ \hline$ & 34,068 & $2,050,277 & $ & 615,690 \\ \hline$ & (1,219,763) & $1,959,034 & $ & 268,114 \\ $ & 2,293,116 & $ & 334,082 & $ & 65,968 \\ \hline$ & 1,073,353 & $2,293,116 & $ & 334,082 \\ \hline \hline \end{tabular} Zoom Video Communications Consolidated Statement of Cash Flows (in thousands, except share and per share data) 1/31/20221/31/20211/31/2020 Cash flows from operating activities Net Income \$ \$ 1,375,639 \$ 672,316$25,305 Adjustements to reconcile net income to net cash provided by operating activities Stock-based compensation expense $477,287$275,818$73,109 Income tax benefit from release of valuation allowance Amortization of deffered contract acqusition costsGainsonstrategicinvestments,netDepreciationandamortizationProvisionforaccountsreceivableallowancesNon-cashoperatingleasecostCharitabledonationofcommonstockAmortizationonmarketablesecuritiesOtherassets,noncurrent$$$$$$$$177,283(43,761)48,18836,74718,38725,3164,591$$$$$$$$104,306(2,538)28,85732,00710,88723,3125,433927$$$$$$$$37,10116,4496,3706,885(2,041)973 Changes in operating assets and liabilities Accounts receivable $(159,183)$(219,039)$(64,715) Prepaid expenses and other asseets $(155,934)$(68,521)$(24,805) Deferred contract acqusition costs $(247,371)$(307,068)$(72,714) Deferred revenue $293,887$665,724$106,286 Operating lease liabilities Net Cash provided by operating activities \begin{tabular}{lrrrrr} $ & (17,004) & $ & (6,379) & $ & (5,460) \\ \hline$ & 1,605,266 & $1,471,177 & $ & 151,892 \\ \hline \end{tabular} Cash flows from investing activities Purchases of marketable securities $(4,434,749)$(2,056,470)$(800,228) Maturities of marketable securities \$ 1,733,043$580,795$343,554 Sales of marketable securities $296,867$36,897$ - Purchases of strategic investments $(305,149)$(13,000)$(3,000) Cash Flows from financing activities Proceeds from issurance of common stock for employee stock purchase plan $59,331$38,433$15,482 Proceeds from exercise of stock options, net of repurchases $14,404$28,550$9,169 Proceeds from employee transactions to be remitted to employees and tax authorities $(40,004)$4,088$48,547 Proceeds from follow-on public offering, net of underwriting discounts $$1,979,206$ Proceeds fromIPO, net of underwriting offering $$$542,492 Other Net cash provided by financing activities Net increase in cash Cash, beginning of year Cash, end of year \begin{tabular}{rrrrrr} $ & - & $ & - & $ & 542,492 \\ $ & 337 & $ & - & $ & - \\ \hline$ & 34,068 & $2,050,277 & $ & 615,690 \\ \hline$ & (1,219,763) & $1,959,034 & $ & 268,114 \\ $ & 2,293,116 & $ & 334,082 & $ & 65,968 \\ \hline$ & 1,073,353 & $2,293,116 & $ & 334,082 \\ \hline \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started