Answered step by step

Verified Expert Solution

Question

1 Approved Answer

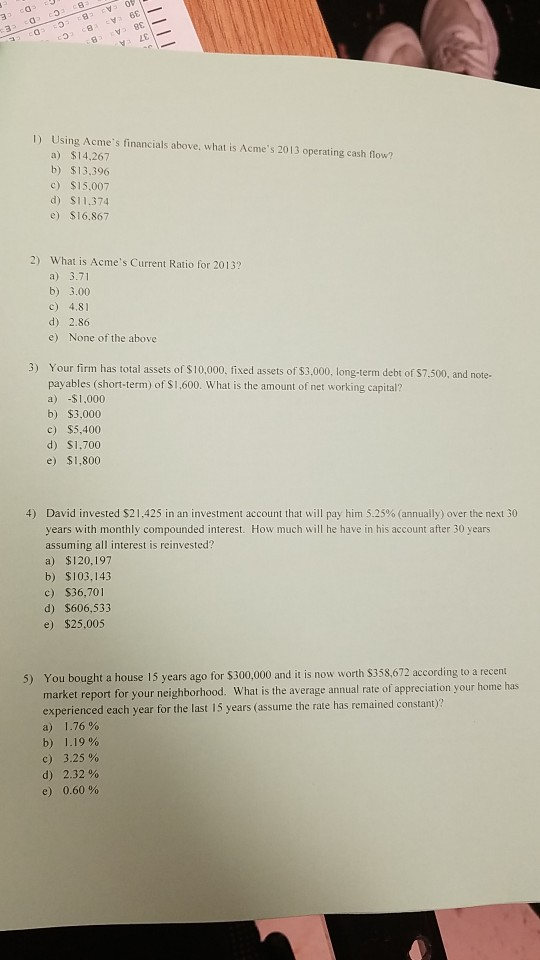

) Using Acme's financials above. what is Acme's 2013 operating cash flow? a) $14.267 b) $13.396 c) $15.007 d) $11,374 e) $16.867 2) What is

) Using Acme's financials above. what is Acme's 2013 operating cash flow? a) $14.267 b) $13.396 c) $15.007 d) $11,374 e) $16.867 2) What is Acme's Current Ratio for 2013? a) 3.71 b) 3.00 c) 4.81 d) 2.86 e) None of the above Your firm has total assets of S10,000, fixed assets of S3.000, long-term debt of $7.500, and note- payables (short-term) of $1.600. What is the amount of net working capital? a) -$1,000 b) $3,000 3) c) $5,400 d) S1.700 e $1,800 4) David invested $2 1.425 in an investment account that will pay him sas%(annually)overthe nelu years with monthly compounded interest. How much will he have in his account after 30 years assuming all interest is reinvested? a) $120.197 b) $103,143 c) $36,701 d) $606,533 e) $25,005 5) You bought a house 15 years ago for $300,000 and it is now worth $358,672 according to a recent market report for your neighborhood. What is the average annual rate of appreciation your home has experienced each year for the last 15 years (assume the rate has remained constant)? a) 1.76 % b) 1,19% c) 3.25% d) 2.32% e) 060%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started