Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using Adidas's most recent form 10-k fill out the table and then summarize the result of your analysis with evidence. This is my third try

Using Adidas's most recent form 10-k fill out the table and then summarize the result of your analysis with evidence. This is my third try so please don't say needs more information, looking for someone who can help.

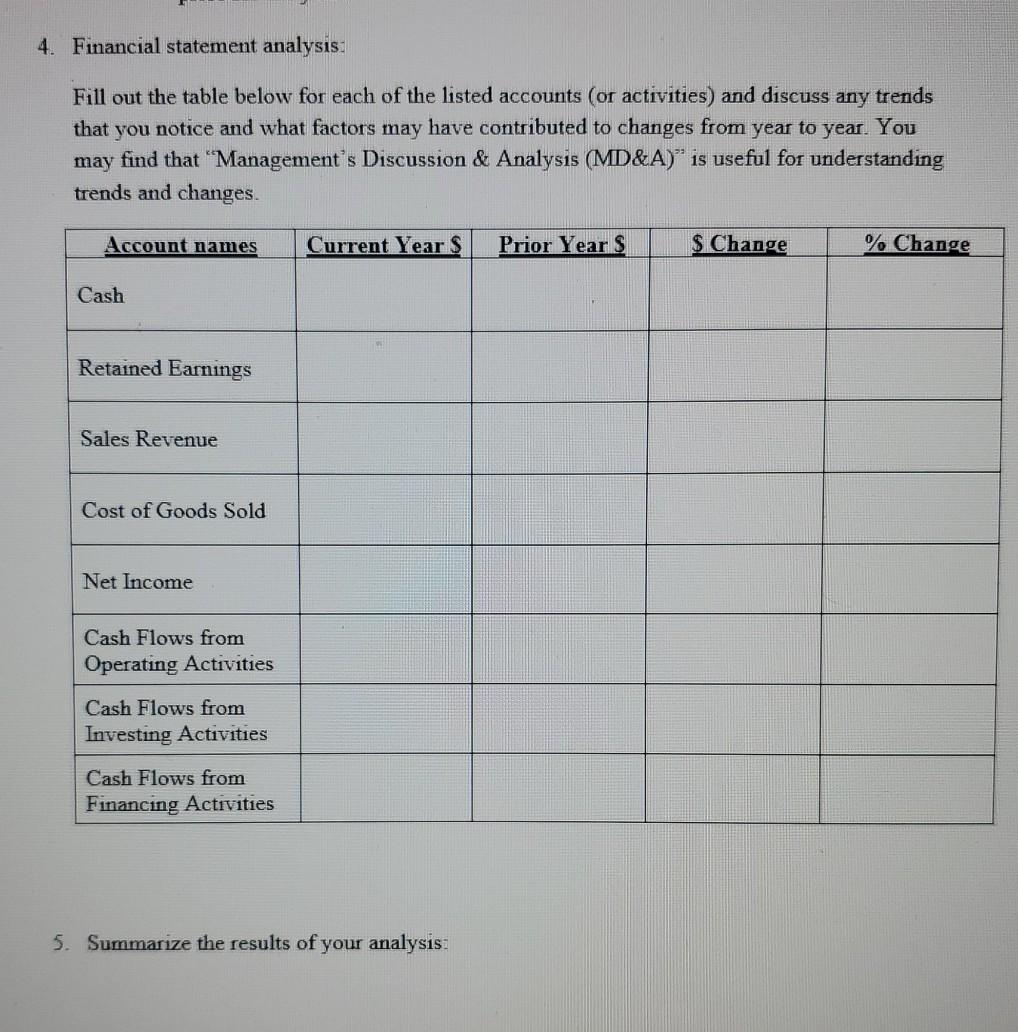

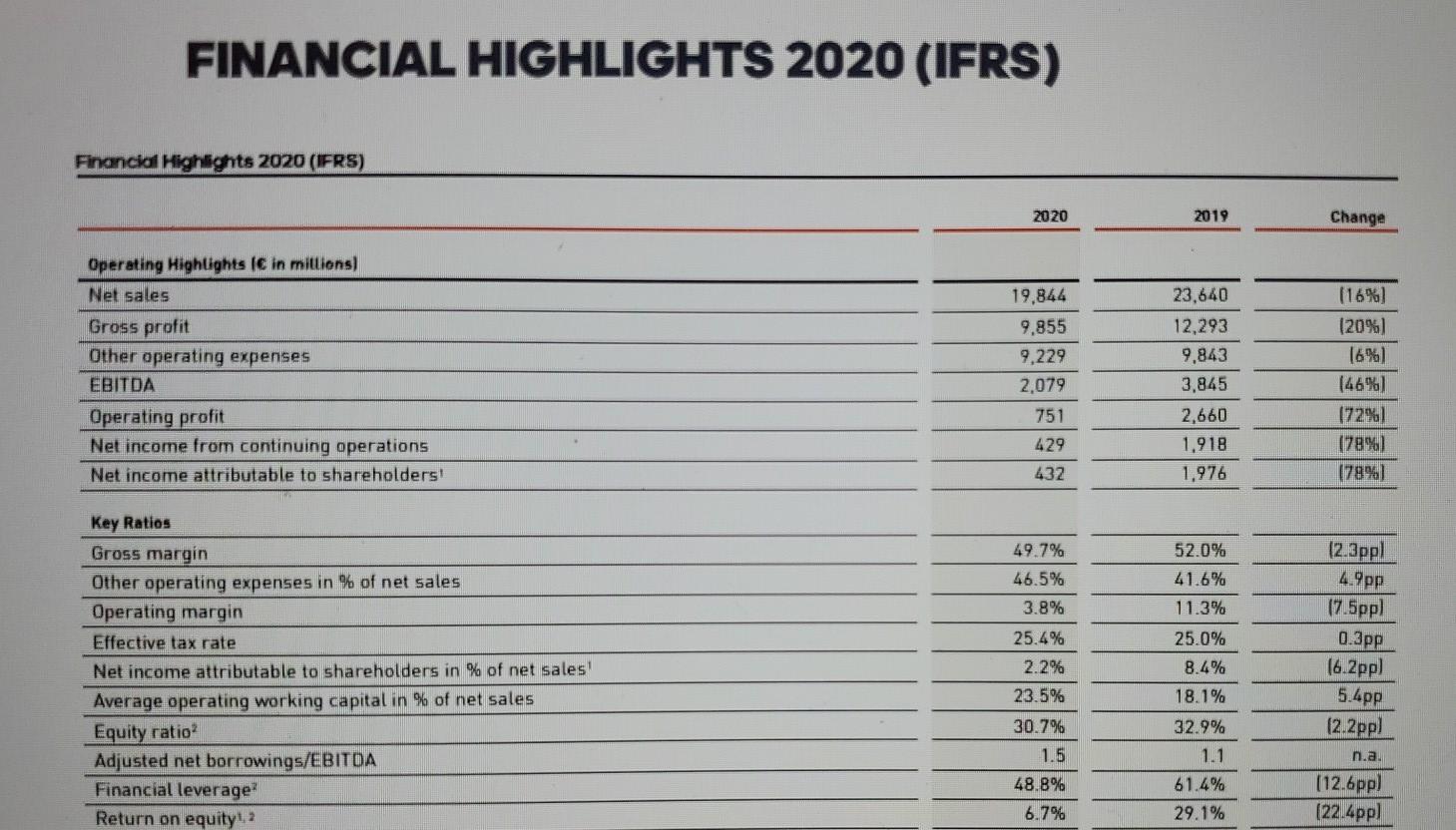

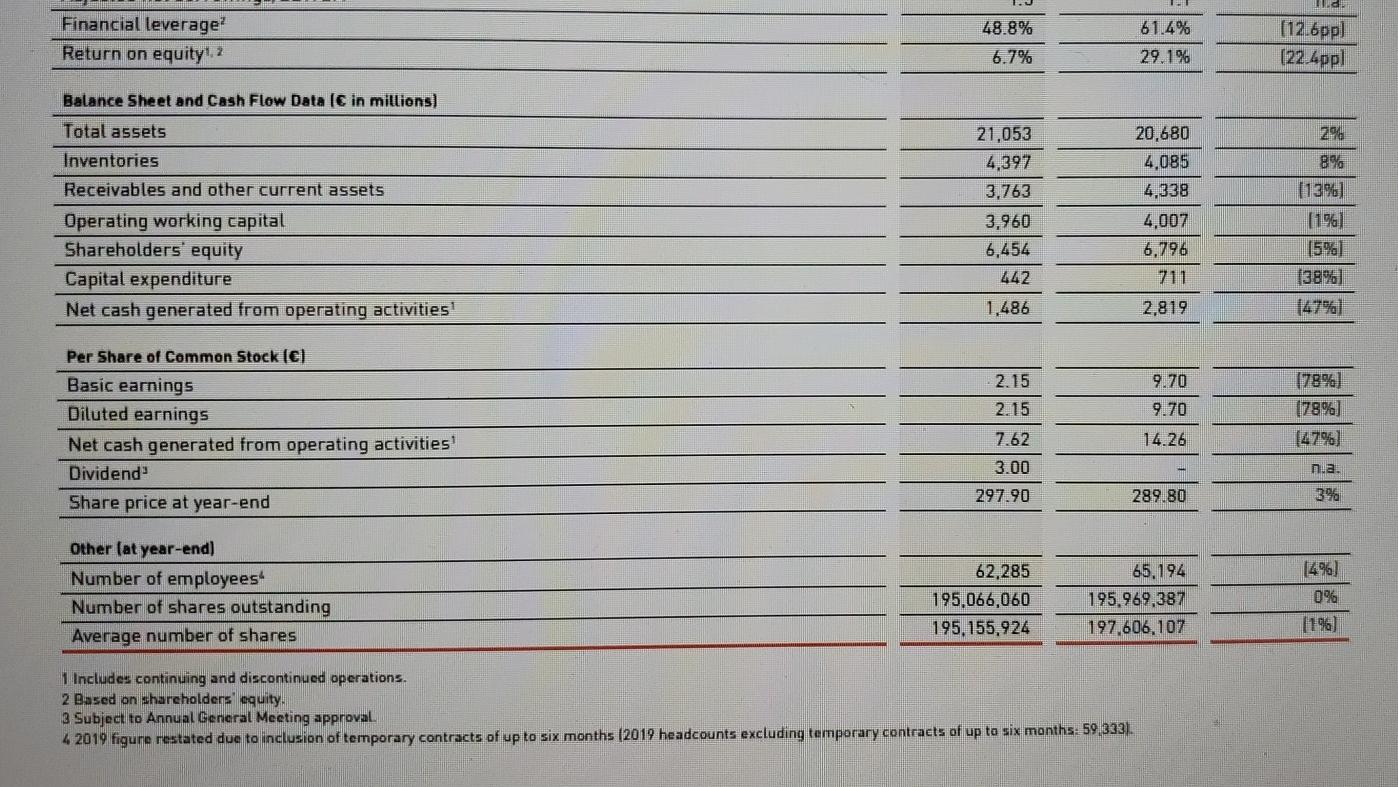

4. Financial statement analysis. Fill out the table below for each of the listed accounts (or activities, and discuss any trends that you notice and what factors may have contributed to changes from year to year. You may find that "Management's Discussion & Analysis (MD&A)" is useful for understanding trends and changes. Account names Current Year S Prior Year $ $ Change % Change Cash Retained Earnings Sales Revenue Cost of Goods Sold Net Income Cash Flows from Operating Activities Cash Flows from Investing Activities Cash Flows from Financing Activities 5. Summarize the results of your analysis FINANCIAL HIGHLIGHTS 2020 (IFRS) Financial Highlights 2020 (IFRS) 2020 2019 Change Operating Highlights ( in millions) Net sales Gross profit Other operating expenses EBITDA Operating profit Net income from continuing operations Net income attributable to shareholders! 19,844 9,855 9.229 2,079 751 429 23,640 12,293 9.843 3,845 2,660 1,918 1.976 (16%) (20%) 16%) (46%) 172%) (78%) 179%) 432 (2.3ppl 4.9 pp Key Ratios Gross margin Other operating expenses in % of net sales Operating margin Effective tax rate Net income attributable to shareholders in % of net sales Average operating working capital in % of net sales Equity ratio Adjusted net borrowings/EBITDA Financial leverage Return on equity 49.7% 46.5% 3.8% 25.4% 2.2% 23.5% 30.7% 1.5 48.8% 6.7% 52.0% 41.6% 11.3% 25.0% 8.4% 18.1% 17.5pp) 0.3pp (6.2 pp) 5.4pp (2.2pp) 32.9% n.a. 61.4% 29.1% (12.6pp) (22.4pp] ud Financial leverage? Return on equity", 48.8% 6.7% 61.4% 29.1% [12.6pp) (22.4ppl Balance Sheet and Cash Flow Data (c in millions) Total assets Inventories Receivables and other current assets Operating working capital Shareholders' equity Capital expenditure Net cash generated from operating activities! 21,053 4,397 3,763 3,960 6,454 442 20,680 4,085 4,338 4,007 6,796 711 2% 8% (13%) [196] 15%] 138%) 147%) 1,486 2,819 2.15 9.70 2.15 9.70 Per Share of Common Stock (c) Basic earnings Diluted earnings Net cash generated from operating activities! Dividend Share price at year-end (78%) (78%) 147%) 14.26 7.62 3.00 na. 297.90 289.80 3% Other (at year-end) Number of employees Number of shares outstanding Average number of shares 62,285 195,066,060 195.155,924 65,194 195.969,387 197,606, 107 (4%) 0% (196) 1 Includes continuing and discontinued operations. 2 Based on shareholders equity. 3 Subject to Annual General Meeting approval. 4 2019 figure restated due to inclusion of temporary contracts of up to six months (2019 headcounts excluding temporary contracts of up to six months: 59.333)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started