Answered step by step

Verified Expert Solution

Question

1 Approved Answer

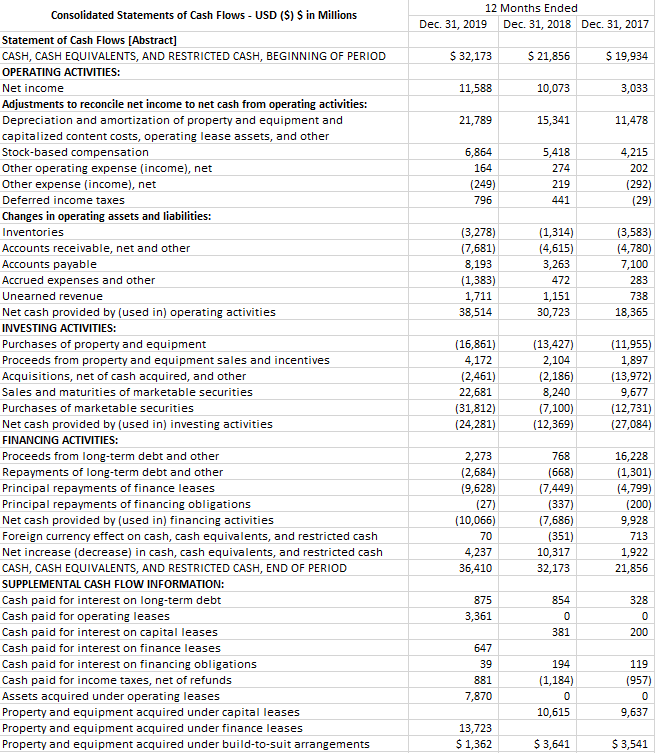

Using Amazon as the company, prepare a two year forecast of their statement of cash flow. Consolidated Statements of Cash Flows - USD ($) $

Using Amazon as the company, prepare a two year forecast of their statement of cash flow.

Consolidated Statements of Cash Flows - USD ($) $ in Millions 12 Months Ended Dec 31, 2019 Dec 31, 2018 Dec 31, 2017 $ 32,173 $ 21,856 $ 19,934 11,588 10,073 3,033 21,789 15,341 11,478 6,864 164 (249) 796 5,418 274 219 441 4,215 202 (292) (29) (3,278) (7,681) 8,193 (1,383) 1,711 38,514 (1,314) (4,615) 3,263 472 1,151 30,723 (3,583) (4,780) 7,100 283 738 18,365 Statement of Cash Flows [Abstract] CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash from operating activities: Depreciation and amortization of property and equipment and capitalized content costs, operating lease assets, and other Stock-based compensation Other operating expense (income), net Other expense (income), net Deferred income taxes Changes in operating assets and liabilities: Inventories Accounts receivable, net and other Accounts payable Accrued expenses and other Unearned revenue Net cash provided by (used in) operating activities INVESTING ACTIVITIES: Purchases of property and equipment Proceeds from property and equipment sales and incentives Acquisitions, net of cash acquired, and other Sales and maturities of marketable securities Purchases of marketable securities Net cash provided by (used in) investing activities FINANCING ACTIVITIES: Proceeds from long-term debt and other Repayments of long-term debt and other Principal repayments of finance leases Principal repayments of financing obligations Net cash provided by (used in) financing activities Foreign currency effect on cash, cash equivalents, and restricted cash Net increase (decrease) in cash, cash equivalents, and restricted cash CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD SUPPLEMENTAL CASH FLOW INFORMATION: Cash paid for interest on long-term debt Cash paid for operating leases Cash paid for interest on capital leases Cash paid for interest on finance leases Cash paid for interest on financing obligations Cash paid for income taxes, net of refunds Assets acquired under operating leases Property and equipment acquired under capital leases Property and equipment acquired under finance leases Property and equipment acquired under build-to-suit arrangements (16,861) 4,172 (2,461) 22,681 (31,812) (24,281) (13,427) 2,104 (2,186) 8,240 (7,100) (12,369) (11,955) 1,897 (13,972) 9,677 (12,731) (27,084) 2,273 (2,684) (9,628) (27) (10,066) 70 4,237 36,410 768 (668) (7,449) (337) (7,686) (351) 10,317 32,173 16,228 (1,301) (4,799) (200) 9,928 713 1,922 21,856 328 875 3,361 854 0 381 200 647 39 881 7,870 119 (957) 194 (1,184) 0 10,615 9,637 13,723 $ 1,362 $ 3,641 $ 3,541 Consolidated Statements of Cash Flows - USD ($) $ in Millions 12 Months Ended Dec 31, 2019 Dec 31, 2018 Dec 31, 2017 $ 32,173 $ 21,856 $ 19,934 11,588 10,073 3,033 21,789 15,341 11,478 6,864 164 (249) 796 5,418 274 219 441 4,215 202 (292) (29) (3,278) (7,681) 8,193 (1,383) 1,711 38,514 (1,314) (4,615) 3,263 472 1,151 30,723 (3,583) (4,780) 7,100 283 738 18,365 Statement of Cash Flows [Abstract] CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, BEGINNING OF PERIOD OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash from operating activities: Depreciation and amortization of property and equipment and capitalized content costs, operating lease assets, and other Stock-based compensation Other operating expense (income), net Other expense (income), net Deferred income taxes Changes in operating assets and liabilities: Inventories Accounts receivable, net and other Accounts payable Accrued expenses and other Unearned revenue Net cash provided by (used in) operating activities INVESTING ACTIVITIES: Purchases of property and equipment Proceeds from property and equipment sales and incentives Acquisitions, net of cash acquired, and other Sales and maturities of marketable securities Purchases of marketable securities Net cash provided by (used in) investing activities FINANCING ACTIVITIES: Proceeds from long-term debt and other Repayments of long-term debt and other Principal repayments of finance leases Principal repayments of financing obligations Net cash provided by (used in) financing activities Foreign currency effect on cash, cash equivalents, and restricted cash Net increase (decrease) in cash, cash equivalents, and restricted cash CASH, CASH EQUIVALENTS, AND RESTRICTED CASH, END OF PERIOD SUPPLEMENTAL CASH FLOW INFORMATION: Cash paid for interest on long-term debt Cash paid for operating leases Cash paid for interest on capital leases Cash paid for interest on finance leases Cash paid for interest on financing obligations Cash paid for income taxes, net of refunds Assets acquired under operating leases Property and equipment acquired under capital leases Property and equipment acquired under finance leases Property and equipment acquired under build-to-suit arrangements (16,861) 4,172 (2,461) 22,681 (31,812) (24,281) (13,427) 2,104 (2,186) 8,240 (7,100) (12,369) (11,955) 1,897 (13,972) 9,677 (12,731) (27,084) 2,273 (2,684) (9,628) (27) (10,066) 70 4,237 36,410 768 (668) (7,449) (337) (7,686) (351) 10,317 32,173 16,228 (1,301) (4,799) (200) 9,928 713 1,922 21,856 328 875 3,361 854 0 381 200 647 39 881 7,870 119 (957) 194 (1,184) 0 10,615 9,637 13,723 $ 1,362 $ 3,641 $ 3,541

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started