Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using an Aging Schedule to Account for Bad Debts Rough Stuff is a distributor of large rocks. It sells on credit to commercial landscaping

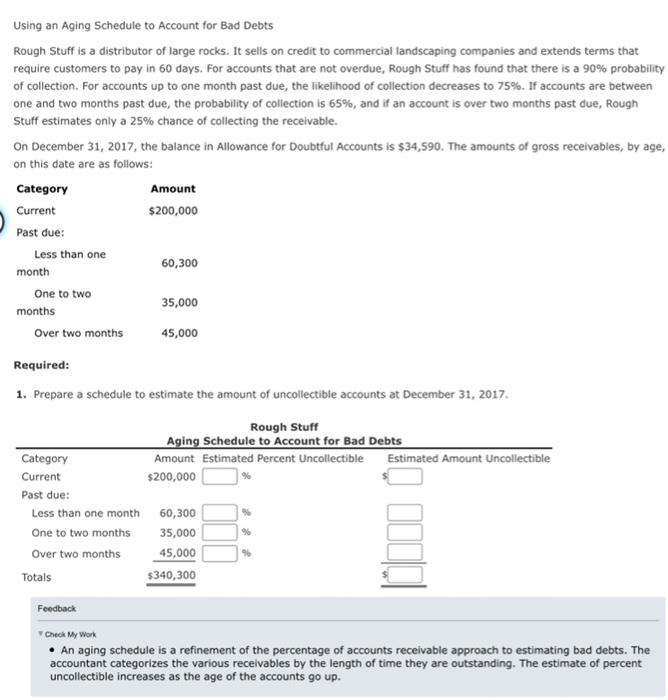

Using an Aging Schedule to Account for Bad Debts Rough Stuff is a distributor of large rocks. It sells on credit to commercial landscaping companies and extends terms that require customers to pay in 60 days. For accounts that are not overdue, Rough Stuff has found that there is a 90% probability of collection. For accounts up to one month past due, the likelihood of collection decreases to 75%. If accounts are between one and two months past due, the probability of collection is 65%, and if an account is over two months past due, Rough Stuff estimates only a 25% chance of collecting the receivable. On December 31, 2017, the balance in Allowance for Doubtful Accounts is $34,590. The amounts of gross receivables, by age, on this date are as follows: Category Current Amount $200,000 Past due: Less than one 60,300 month One to two 35,000 months Over two months 45,000 Required: 1. Prepare a schedule to estimate the amount of uncollectible accounts at December 31, 2017. Category Current Past due: Rough Stuff Aging Schedule to Account for Bad Debts Amount Estimated Percent Uncollectible Estimated Amount Uncollectible $200,000 Less than one month 60,300 One to two months 35,000 Over two months 45,000 Totals $340,300 Feedback Check My Work An aging schedule is a refinement of the percentage of accounts receivable approach to estimating bad debts. The accountant categorizes the various receivables by the length of time they are outstanding. The estimate of percent uncollectible increases as the age of the accounts go up.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started