Answered step by step

Verified Expert Solution

Question

1 Approved Answer

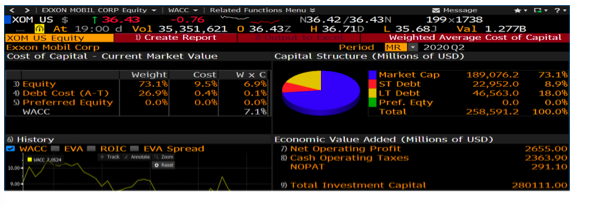

Using Bloombergs presentation below (only this information), please calculate the following : Capital Charge Economic Value Added ROIC EVA Spread 24) What is Economic Value

Using Bloombergs presentation below (only this information), please calculate the following :

Capital Charge

Economic Value Added

ROIC

EVA Spread

24) What is Economic Value Added?

> DOXON MOBIL CORP Equity WACC - Related Functions Menu XOM US $ 1 36,43 -0.76 N36.42/36.43N 199x1738 At 19:00 d Vol 35, 351,621 0 36.43Z H 36.710 L 35.683 Val 1.277B XOM US Guity D Create Report Weighted Average Cost of Capital Exxon Mobil Corp Period MR-2020 Q2 Cost of Capital - Current Market Value Capital Structure (Millions of USD) Weight Cost WXC Market Cap 189,076.2 73.16 30 Equity 73.18 9.5% 6.90 ST Debt 22,952.0 8.9% Debt Cost (A-T) 26.9 0.44 0,10 LT Debt 46,563.0 18.0% S Preferred Equity 0.00 0,04 0.00 Pref. Eqty 0.0 0.06 WACC 7.18 Total 258,591.2 100.0% History WACC EVA ROIC EVA Spread Economic Value Added (Millions of USD) 7 Net Operating Profit Cash Operating Taxes NOPAT 2655.00 2363.90 291.10 9 Total Investment Capital 280111.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started