using cost volume profit (CVP) determine the

1)required sales dollars to achieve an annual operating income like 2016.

2) required sales dollars to achieve an annual net income after taxes of $180,000

3) the required sales in dollars to achieve an annual profit of 320,000 after taxes and after paying 12% of opertaing income before taxes.

been stuck on this question for a week now and still can't get it.

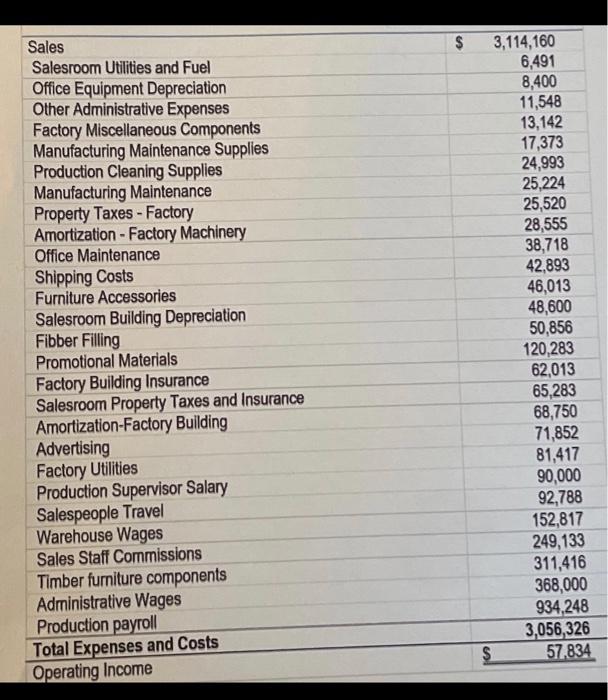

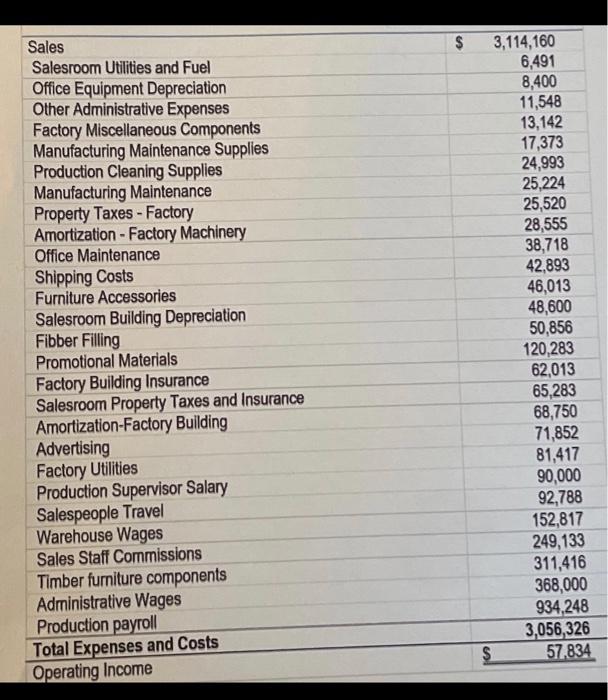

the second photo is related to the operating income from the end of december 2020

the total expenses and cost qre for the the 2020 year.

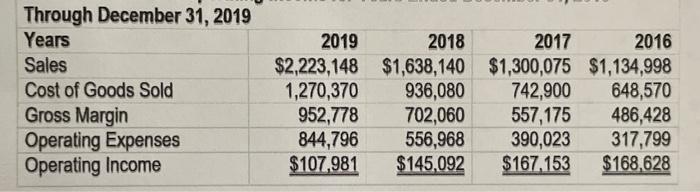

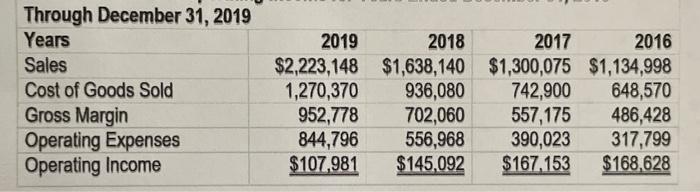

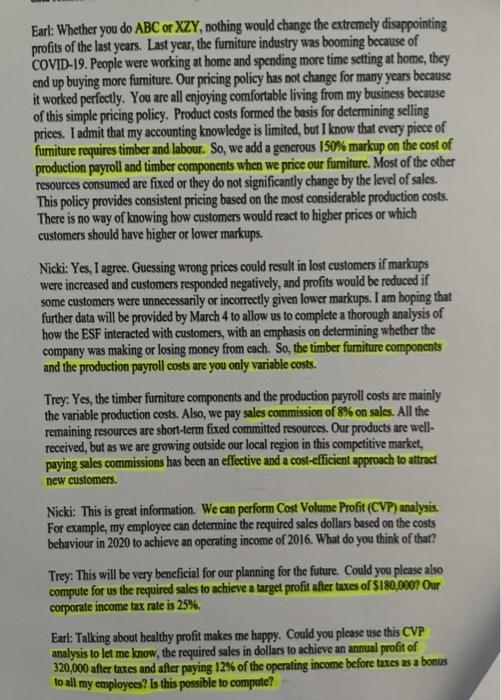

Through December 31, 2019 Years Sales Cost of Goods Sold Gross Margin Operating Expenses Operating Income 2019 2018 2017 2016 $2,223,148 $1,638,140 $1,300,075 $1,134,998 1,270,370 936,080 742,900 648,570 952,778 702,060 557,175 486,428 844,796 556,968 390,023 317,799 $107,981 $145,092 $167,153 $168,628 $ Sales Salesroom Utilities and Fuel Office Equipment Depreciation Other Administrative Expenses Factory Miscellaneous Components Manufacturing Maintenance Supplies Production Cleaning Supplies Manufacturing Maintenance Property Taxes - Factory Amortization - Factory Machinery Office Maintenance Shipping Costs Furniture Accessories Salesroom Building Depreciation Fibber Filling Promotional Materials Factory Building Insurance Salesroom Property Taxes and Insurance Amortization-Factory Building Advertising Factory Utilities Production Supervisor Salary Salespeople Travel Warehouse Wages Sales Staff Commissions Timber furniture components Administrative Wages Production payroll Total Expenses and Costs Operating Income 3,114,160 6,491 8,400 11,548 13,142 17,373 24,993 25,224 25,520 28,555 38,718 42,893 46,013 48,600 50,856 120,283 62,013 65,283 68,750 71,852 81,417 90,000 92,788 152,817 249,133 311,416 368,000 934,248 3,056,326 57.834 $ $ Earl: Whether you do ABC or XZY, nothing would change the extremely disappointing profits of the last years. Last year, the furniture industry was booming because of COVID-19. People were working at home and spending more time setting at home, they end up buying more furniture. Our pricing policy has not change for many years because it worked perfectly. You are all enjoying comfortable living from my business because of this simple pricing policy. Product costs formed the basis for determining selling prices. I admit that my accounting knowledge is limited, but I know that every piece of furniture requires timber and labour. So, we add a generous 150% markup on the cost of production payroll and timber components when we price our furniture. Most of the other resources consumed are fixed or they do not significantly change by the level of sales. This policy provides consistent pricing based on the most considerable production costs. There is no way of knowing how customers would react to higher prices or which customers should have higher or lower markups. Nicki: Yes, I agree. Guessing wrong prices could result in lost customers if markups were increased and customers responded negatively, and profits would be reduced if some customers were unnecessarily or incorrectly given lower markups. I am hoping that further data will be provided by March 4 to allow us to complete a thorough analysis of how the ESF interacted with customers, with an emphasis on determining whether the company was making or losing money from each. So, the timber furniture components and the production payroll costs are you only variable costs. Trey: Yes, the timber furniture components and the production payroll costs are mainly the variable production costs. Also, we pay sales commission of 8% on sales. All the remaining resources are short-term fixed committed resources. Our products are well- received, but as we are growing outside our local region in this competitive market, paying sales commissions has been an effective and a cost-efficient approach to attract new customers. Nicki: This is great information. We can perform Cost Volume Profit (CVP) analysis. For example, my employee can determine the required sales dollars based on the costs behaviour in 2020 to achieve an operating income of 2016. What do you think of that? Trey: This will be very beneficial for our planning for the future. Could you please also compute for us the required sales to achieve a target profit after taxes of $180,000? Our corporate income tax rate is 25%. Earl: Talking about healthy profit makes me happy. Could you please use this CVP analysis to let me know, the required sales in dollars to achieve an annual profit of 320,000 after taxes and after paying 12% of the operating income before taxes as a bonus to all my employees? Is this possible to compute? Through December 31, 2019 Years Sales Cost of Goods Sold Gross Margin Operating Expenses Operating Income 2019 2018 2017 2016 $2,223,148 $1,638,140 $1,300,075 $1,134,998 1,270,370 936,080 742,900 648,570 952,778 702,060 557,175 486,428 844,796 556,968 390,023 317,799 $107,981 $145,092 $167,153 $168,628 $ Sales Salesroom Utilities and Fuel Office Equipment Depreciation Other Administrative Expenses Factory Miscellaneous Components Manufacturing Maintenance Supplies Production Cleaning Supplies Manufacturing Maintenance Property Taxes - Factory Amortization - Factory Machinery Office Maintenance Shipping Costs Furniture Accessories Salesroom Building Depreciation Fibber Filling Promotional Materials Factory Building Insurance Salesroom Property Taxes and Insurance Amortization-Factory Building Advertising Factory Utilities Production Supervisor Salary Salespeople Travel Warehouse Wages Sales Staff Commissions Timber furniture components Administrative Wages Production payroll Total Expenses and Costs Operating Income 3,114,160 6,491 8,400 11,548 13,142 17,373 24,993 25,224 25,520 28,555 38,718 42,893 46,013 48,600 50,856 120,283 62,013 65,283 68,750 71,852 81,417 90,000 92,788 152,817 249,133 311,416 368,000 934,248 3,056,326 57.834 $ $ Earl: Whether you do ABC or XZY, nothing would change the extremely disappointing profits of the last years. Last year, the furniture industry was booming because of COVID-19. People were working at home and spending more time setting at home, they end up buying more furniture. Our pricing policy has not change for many years because it worked perfectly. You are all enjoying comfortable living from my business because of this simple pricing policy. Product costs formed the basis for determining selling prices. I admit that my accounting knowledge is limited, but I know that every piece of furniture requires timber and labour. So, we add a generous 150% markup on the cost of production payroll and timber components when we price our furniture. Most of the other resources consumed are fixed or they do not significantly change by the level of sales. This policy provides consistent pricing based on the most considerable production costs. There is no way of knowing how customers would react to higher prices or which customers should have higher or lower markups. Nicki: Yes, I agree. Guessing wrong prices could result in lost customers if markups were increased and customers responded negatively, and profits would be reduced if some customers were unnecessarily or incorrectly given lower markups. I am hoping that further data will be provided by March 4 to allow us to complete a thorough analysis of how the ESF interacted with customers, with an emphasis on determining whether the company was making or losing money from each. So, the timber furniture components and the production payroll costs are you only variable costs. Trey: Yes, the timber furniture components and the production payroll costs are mainly the variable production costs. Also, we pay sales commission of 8% on sales. All the remaining resources are short-term fixed committed resources. Our products are well- received, but as we are growing outside our local region in this competitive market, paying sales commissions has been an effective and a cost-efficient approach to attract new customers. Nicki: This is great information. We can perform Cost Volume Profit (CVP) analysis. For example, my employee can determine the required sales dollars based on the costs behaviour in 2020 to achieve an operating income of 2016. What do you think of that? Trey: This will be very beneficial for our planning for the future. Could you please also compute for us the required sales to achieve a target profit after taxes of $180,000? Our corporate income tax rate is 25%. Earl: Talking about healthy profit makes me happy. Could you please use this CVP analysis to let me know, the required sales in dollars to achieve an annual profit of 320,000 after taxes and after paying 12% of the operating income before taxes as a bonus to all my employees? Is this possible to compute