Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using CVP analysis build a graph based on the latest income statement. Calculate the following figures for two years based on the income statement: (4

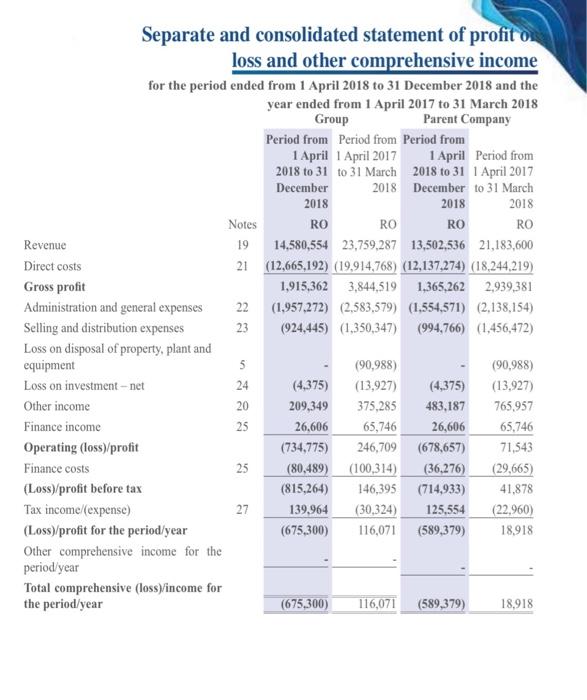

Using CVP analysis build a graph based on the latest income statement. Calculate the following figures for two years based on the income statement: (4 points) Contribution Margin Ratio Level of sales needed to achieve a desired target profit (for example, if the company wants to increase profits by 10%) Break-even point Margin of safety Explain the meaning of each indicator and describe their dynamics over two years Revenue Separate and consolidated statement of profit o loss and other comprehensive income for the period ended from 1 April 2018 to 31 December 2018 and the year ended from 1 April 2017 to 31 March 2018 Notes Group Period from Period from Period from Parent Company 1 April Period from 2018 to 311 April 2017 2018 RO 2018 RO 2018 RO 1. April 1 April 2017 2018 to 31 to 31 March December 2018 RO December to 31 March Direct costs Gross profit Administration and general expenses Selling and distribution expenses 19 14.580,554 23,759,287 13502.536 21,183,600 21 (12,665,192) (19,914,768) (12,137,274) (18.244,219) 1,915,362 3,344,519 1.365,262 2,939,381 22 (1.957.272) (2.583,579) (1.554,571) (2,138,154) (924,445) (1,350,347) (994,766) (1.456,472) 23 Loss on disposal of property, plant and equipment 5 (90,988) (90,988) Loss on investment-net 24 (4375) (13,927) (4.375) (13,927) Other income 20 209,349 375,285 483,187 765957 Finance income 25 26,606 65,746 26,606 65,746 Operating (loss) profit (734,775) 246,709 (678,657) 71,543 Finance costs 25 (30,499) (100314) (36276) (29,665) (Loss) profit before tax Tax income (expense) (Low) profit for the period/year (675300) (815,264) 146,395 (714,933) 41,878 139,964 (30,334) 125.554 (22.960) 116,071 (589,379) 18918 period year Other comprehensive income for the Total comprehensive (loss) income for the period/year (675,300) 116.071 (589,379) 18,918 Using CVP analysis build a graph based on the latest income statement. Calculate the following figures for two years based on the income statement: (4 points) . . Contribution Margin Ratio Level of sales needed to achieve a desired target profit (for example, if the company wants to increase profits by 10%) Break-even point Margin of safety Explain the meaning of each indicator and describe their dynamics over two years Separate and consolidated statement of profit or loss and other comprehensive income for the period ended from 1 April 2018 to 31 December 2018 and the year ended from 1 April 2017 to 31 March 2018 Group Period from Period from Period from 1 April 1 April 2017 2018 to 31 to 31 March December Parent Company 1 April Period from 2018 to 31 1 April 2017 2018 2018 Notes RO RO 2018 RO 2018 RO 19 14,580,554 23,759,287 December to 31 March Revenue Direct costs Gross profit Administration and general expenses Selling and distribution expenses Loss on disposal of property, plant and equipment Loss on investment-net 13,502,536 21,183,600 21 (12,665,192) (19,914,768) (12,137,274) (18,244,219) 225 23 1,915,362 3,844,519 1,365,262 2,939,381 (1,957,272) (2,583,579) (1,554,571) (2,138,154) (924,445) (1,350,347) (994,766) (1,456,472) Other income Finance income Operating (loss)/profit Finance costs (Loss)/profit before tax Tax income/(expense) (Loss)/profit for the period/year Other comprehensive income for the period/year Total comprehensive (loss)/income for the period/year 5 (90,988) (90,988) 24 (4,375) (13,927) (4,375) (13,927) 20 209,349 375,285 483,187 765,957 25 26,606 65,746 26,606 65,746 (734,775) 246,709 (678,657) 71,543 27 25 22 25 (80,489) (100,314) (36,276) (29,665) (815,264) 146,395 (714,933) 41,878 139,964 (30,324) 125,554 (675,300) 116,071 (589,379) (22,960) 18,918 (675,300) 116,071 (589,379) 18,918

Using CVP analysis build a graph based on the latest income statement. Calculate the following figures for two years based on the income statement: (4 points) Contribution Margin Ratio Level of sales needed to achieve a desired target profit (for example, if the company wants to increase profits by 10%) Break-even point Margin of safety Explain the meaning of each indicator and describe their dynamics over two years Revenue Separate and consolidated statement of profit o loss and other comprehensive income for the period ended from 1 April 2018 to 31 December 2018 and the year ended from 1 April 2017 to 31 March 2018 Notes Group Period from Period from Period from Parent Company 1 April Period from 2018 to 311 April 2017 2018 RO 2018 RO 2018 RO 1. April 1 April 2017 2018 to 31 to 31 March December 2018 RO December to 31 March Direct costs Gross profit Administration and general expenses Selling and distribution expenses 19 14.580,554 23,759,287 13502.536 21,183,600 21 (12,665,192) (19,914,768) (12,137,274) (18.244,219) 1,915,362 3,344,519 1.365,262 2,939,381 22 (1.957.272) (2.583,579) (1.554,571) (2,138,154) (924,445) (1,350,347) (994,766) (1.456,472) 23 Loss on disposal of property, plant and equipment 5 (90,988) (90,988) Loss on investment-net 24 (4375) (13,927) (4.375) (13,927) Other income 20 209,349 375,285 483,187 765957 Finance income 25 26,606 65,746 26,606 65,746 Operating (loss) profit (734,775) 246,709 (678,657) 71,543 Finance costs 25 (30,499) (100314) (36276) (29,665) (Loss) profit before tax Tax income (expense) (Low) profit for the period/year (675300) (815,264) 146,395 (714,933) 41,878 139,964 (30,334) 125.554 (22.960) 116,071 (589,379) 18918 period year Other comprehensive income for the Total comprehensive (loss) income for the period/year (675,300) 116.071 (589,379) 18,918 Using CVP analysis build a graph based on the latest income statement. Calculate the following figures for two years based on the income statement: (4 points) . . Contribution Margin Ratio Level of sales needed to achieve a desired target profit (for example, if the company wants to increase profits by 10%) Break-even point Margin of safety Explain the meaning of each indicator and describe their dynamics over two years Separate and consolidated statement of profit or loss and other comprehensive income for the period ended from 1 April 2018 to 31 December 2018 and the year ended from 1 April 2017 to 31 March 2018 Group Period from Period from Period from 1 April 1 April 2017 2018 to 31 to 31 March December Parent Company 1 April Period from 2018 to 31 1 April 2017 2018 2018 Notes RO RO 2018 RO 2018 RO 19 14,580,554 23,759,287 December to 31 March Revenue Direct costs Gross profit Administration and general expenses Selling and distribution expenses Loss on disposal of property, plant and equipment Loss on investment-net 13,502,536 21,183,600 21 (12,665,192) (19,914,768) (12,137,274) (18,244,219) 225 23 1,915,362 3,844,519 1,365,262 2,939,381 (1,957,272) (2,583,579) (1,554,571) (2,138,154) (924,445) (1,350,347) (994,766) (1,456,472) Other income Finance income Operating (loss)/profit Finance costs (Loss)/profit before tax Tax income/(expense) (Loss)/profit for the period/year Other comprehensive income for the period/year Total comprehensive (loss)/income for the period/year 5 (90,988) (90,988) 24 (4,375) (13,927) (4,375) (13,927) 20 209,349 375,285 483,187 765,957 25 26,606 65,746 26,606 65,746 (734,775) 246,709 (678,657) 71,543 27 25 22 25 (80,489) (100,314) (36,276) (29,665) (815,264) 146,395 (714,933) 41,878 139,964 (30,324) 125,554 (675,300) 116,071 (589,379) (22,960) 18,918 (675,300) 116,071 (589,379) 18,918 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started