Answered step by step

Verified Expert Solution

Question

1 Approved Answer

using data from https://ca.finance.yahoo.com/ You have helped your friend, Forrest, to construct an equally weighted portfolio of ten stocks: Microsoft Corporation, Meta Platform inc., Advanced

using data from https://ca.finance.yahoo.com/

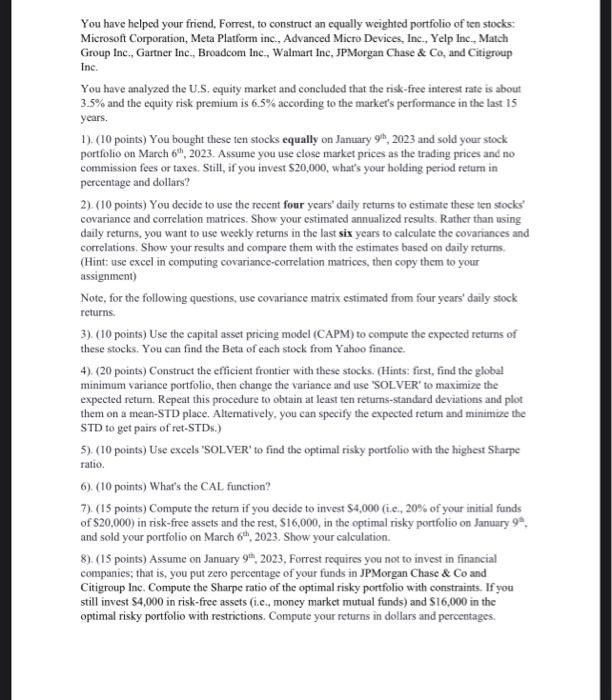

You have helped your friend, Forrest, to construct an equally weighted portfolio of ten stocks: Microsoft Corporation, Meta Platform inc., Advanced Micro Devices, Inc., Yelp Inc., Match Group Inc., Gartner Inc., Broadcom Inc., Walmart Inc, JPMorgan Chase \& Co, and Citigroup Inc. You have analyzed the U.S. equity market and concluded that the risk-free interest rate is about 3.5% and the equity risk premium is 6.5% according to the market's performance in the last 15 years. 1). (10 points) You bought these ten stocks equally on January 9th,2023 and sold your stock portfolio on March 6th,2023. Assume you use close market prices as the trading prices and no commission fees or taxes. Still, if you invest $20,000, what's your holding period retum in percentage and dollars? 2). (10 points) You decide to use the recent four years' daily returns to estimate these ten stocks' covariance and correlation matrices. Show your estimated annualized results. Rather than using daily returns, you want to use weekly returns in the last six years to calculate the covariances and correlations. Show your results and compare them with the estimates based on daily returns. (Hint: use excel in computing covariance-correlation matrices, then copy them to your assignment) Note, for the following questions, use covariance matrix estimated from four years' daily stock returns. 3). (10 points) Use the capital asset pricing model (CAPM) to compute the expected retums of these stocks. You can find the Beta of each stock from Yahoo finance. 4). (20 points) Construct the efficient frontier with these stocks. (Hints: first, find the global minimum variance portfolio, then change the variance and use 'SOLVER' to maximize the expected retum. Repeat this procedure to obtain at least ten retums-standard deviations and plot them on a mean-STD place. Altematively, you can specify the expected retum and minimice the STD to get pairs of ret-STDs.) 5). (10 points) Use exeels 'SOLVER' to find the optimal risky portfolio with the highest Sharpe ratio. 6). (10 points) What's the CAL function? 7). (15 points) Compute the retum if you decide to invest $4,000 (i.e., 20% of your initial funds of $20,000 ) in risk-free assets and the rest, $16,000, in the eptimal risky portfolio on January 9a.. and sold your portfolio on March 6th,2023. Show your calculation. 8). (15 points) Assume on January 9th,2023, Forrest requires you not to invest in financial companies; that is, you put zero percentage of your funds in JPMorgan Chase \& Co and Citigroup Inc. Compute the Sharpe ratio of the optimal risky portfolio with constraints. If you still invest $4,000 in risk-free assets (i.c., money market mutual funds) and $16,000 in the optimal risky portfolio with restrictions. Compute your returns in dollars and percentages Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started