Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using data from the case and your own evaluation of risk, estimate the sales that S&S will generate over the next five years. Make a

- Using data from the case and your own evaluation of risk, estimate the sales that S&S will generate over the next five years. Make a recommendation for what Gomez should do. Will S&S be able to repay the commercial mortgage loan? (See case Exhibit 6 for calculation guidance.)

- *Assumptions:

- Depreciation =4% of revenues

- Principal and interest (P&I) payment year 1 = $862K, year 2 = $833K, year 3 = $803K, year 4 = $773K, year 5 = $743K

- Interest year 1 = $580K, year 2 = $560K, year 3 = $530K, year 4 + $500K, year 5 = $470K

- Remember to include personal income in your analysis (be prepared to defend your choice of percentage for residual personal income).

- *Assumptions:

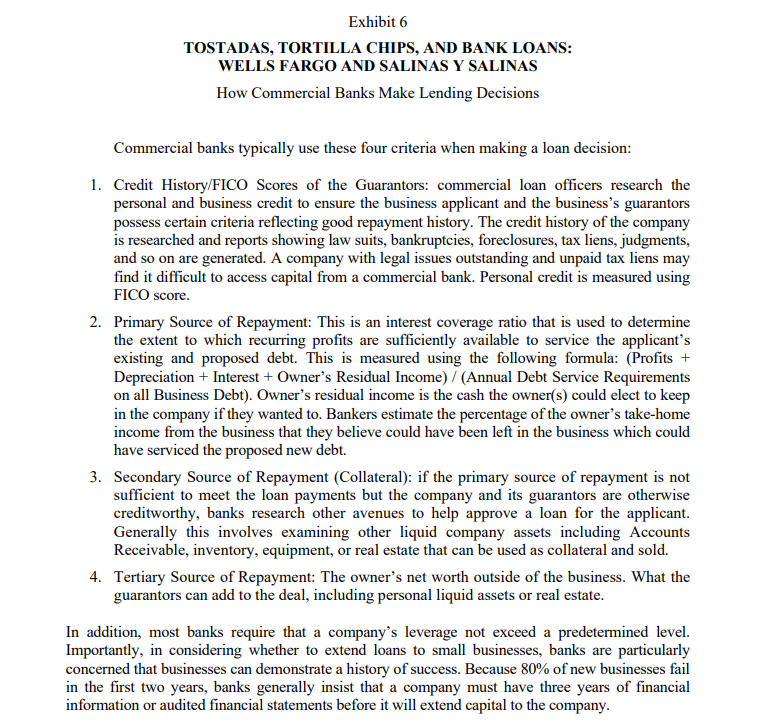

1. Credit History/FICO Scores of the Guarantors: commercial loan officers research the personal and business credit to ensure the business applicant and the business's guarantors possess certain criteria reflecting good repayment history. The credit history of the company is researched and reports showing law suits, bankruptcies, foreclosures, tax liens, judgments, and so on are generated. A company with legal issues outstanding and unpaid tax liens may find it difficult to access capital from a commercial bank. Personal credit is measured using FICO score. 2. Primary Source of Repayment: This is an interest coverage ratio that is used to determine the extent to which recurring profits are sufficiently available to service the applicant's existing and proposed debt. This is measured using the following formula: (Profits + Depreciation + Interest + Owner's Residual Income) / (Annual Debt Service Requirements on all Business Debt). Owner's residual income is the cash the owner(s) could elect to keep in the company if they wanted to. Bankers estimate the percentage of the owner's take-home income from the business that they believe could have been left in the business which could have serviced the proposed new debt. 3. Secondary Source of Repayment (Collateral): if the primary source of repayment is not sufficient to meet the loan payments but the company and its guarantors are otherwise creditworthy, banks research other avenues to help approve a loan for the applicant. Generally this involves examining other liquid company assets including Accounts Receivable, inventory, equipment, or real estate that can be used as collateral and sold. 4. Tertiary Source of Repayment: The owner's net worth outside of the business. What the guarantors can add to the deal, including personal liquid assets or real estate. In addition, most banks require that a company's leverage not exceed a predetermined level. Importantly, in considering whether to extend loans to small businesses, banks are particularly concerned that businesses can demonstrate a history of success. Because 80% of new businesses fail in the first two years, banks generally insist that a company must have three years of financial information or audited financial statements before it will extend capital to the company

1. Credit History/FICO Scores of the Guarantors: commercial loan officers research the personal and business credit to ensure the business applicant and the business's guarantors possess certain criteria reflecting good repayment history. The credit history of the company is researched and reports showing law suits, bankruptcies, foreclosures, tax liens, judgments, and so on are generated. A company with legal issues outstanding and unpaid tax liens may find it difficult to access capital from a commercial bank. Personal credit is measured using FICO score. 2. Primary Source of Repayment: This is an interest coverage ratio that is used to determine the extent to which recurring profits are sufficiently available to service the applicant's existing and proposed debt. This is measured using the following formula: (Profits + Depreciation + Interest + Owner's Residual Income) / (Annual Debt Service Requirements on all Business Debt). Owner's residual income is the cash the owner(s) could elect to keep in the company if they wanted to. Bankers estimate the percentage of the owner's take-home income from the business that they believe could have been left in the business which could have serviced the proposed new debt. 3. Secondary Source of Repayment (Collateral): if the primary source of repayment is not sufficient to meet the loan payments but the company and its guarantors are otherwise creditworthy, banks research other avenues to help approve a loan for the applicant. Generally this involves examining other liquid company assets including Accounts Receivable, inventory, equipment, or real estate that can be used as collateral and sold. 4. Tertiary Source of Repayment: The owner's net worth outside of the business. What the guarantors can add to the deal, including personal liquid assets or real estate. In addition, most banks require that a company's leverage not exceed a predetermined level. Importantly, in considering whether to extend loans to small businesses, banks are particularly concerned that businesses can demonstrate a history of success. Because 80% of new businesses fail in the first two years, banks generally insist that a company must have three years of financial information or audited financial statements before it will extend capital to the company Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started