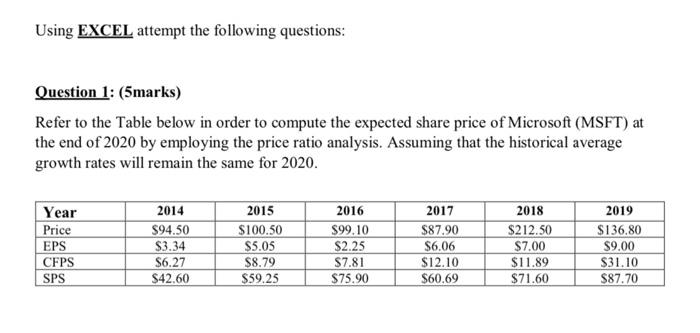

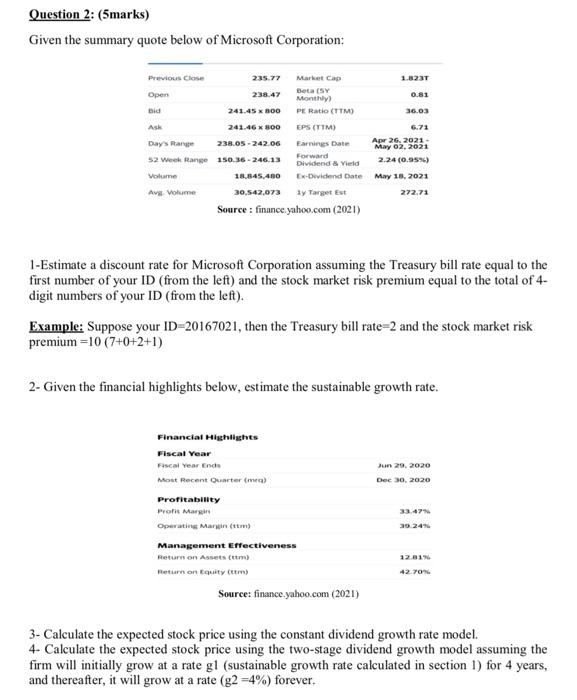

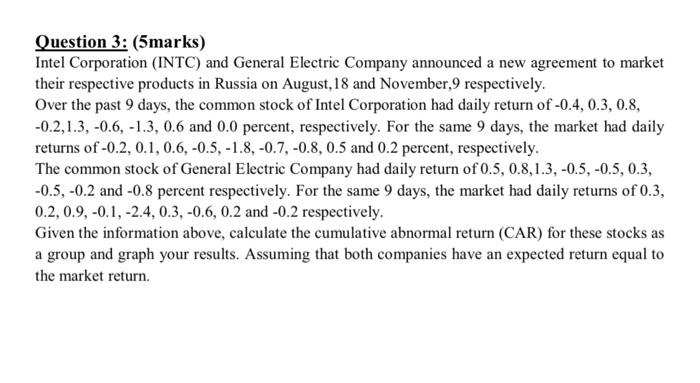

Using EXCEL attempt the following questions: Question 1: (5marks) Refer to the Table below in order to compute the expected share price of Microsoft (MSFT) at the end of 2020 by employing the price ratio analysis. Assuming that the historical average growth rates will remain the same for 2020. Year Price EPS CFPS SPS 2014 $94.50 $3.34 $6.27 $42.60 2015 $100.50 $5.05 $8.79 $59.25 2016 $99.10 $2.25 $7.81 $75.90 2017 $87.90 $6.06 $12.10 $60.69 2018 $212.50 $7.00 $11.89 $71.60 2019 $136.80 $9.00 $31.10 $87.70 Question 2: (5marks) Given the summary quote below of Microsoft Corporation: Previous Close 235.77 Market Cap 1.823T Open 238.47 Beta (SY 0.81 Monthly bid 241.45 x HOO PE Ratio (TTM) 36.03 Ash 241.46 X 800 EPS (TIM) 6.71 Days Range 238.05 - 242.06 Earnings Date Apr 26, 2021 May 02, 2021 52 Week Range 150.36.246.13 Forward 2.24 (0.95%) Dividend & Vield Volume 18,845.480 Ex-Dividend Date May 18, 2021 Ave Volume 30.542,073 2y Target Et 272.71 Source: finance.yahoo.com (2021) 1-Estimate a discount rate for Microsoft Corporation assuming the Treasury bill rate equal to the first number of your ID (from the left) and the stock market risk premium equal to the total of 4- digit numbers of your ID (from the left). Example: Suppose your ID=20167021, then the Treasury bill rate=2 and the stock market risk premium=10 (7+0+2+1) 2- Given the financial highlights below, estimate the sustainable growth rate. Financial Highlights Fiscal Year Fiscal Year Ends Most Recent Quarter (m) Profitability Profit Margit Operating Marin (m) Jun 29, 2020 Dec 30, 2020 33.47 39.24% Management Effectiveness Return on Assets (tm) Return on Equity tm) Source: finance.yahoo.com (2021) 42.70% 3- Calculate the expected stock price using the constant dividend growth rate model. 4- Calculate the expected stock price using the two-stage dividend growth model assuming the firm will initially grow at a rate gl (sustainable growth rate calculated in section 1) for 4 years, and thereafter, it will grow at a rate (g2 =4%) forever. Question 3: (5marks) Intel Corporation (INTC) and General Electric Company announced a new agreement to market their respective products in Russia on August, 18 and November, 9 respectively. Over the past 9 days, the common stock of Intel Corporation had daily return of -0.4, 0.3, 0.8, -0.2,1.3, -0.6, -1.3, 0.6 and 0.0 percent, respectively. For the same 9 days, the market had daily returns of -0.2, 0.1, 0.6, -0.5, -1.8, -0.7, -0.8, 0.5 and 0.2 percent, respectively. The common stock of General Electric Company had daily return of 0.5, 0.8, 1.3, -0.5, -0.5, 0.3, -0.5, -0.2 and -0.8 percent respectively. For the same 9 days, the market had daily returns of 0.3, 0.2, 0.9,-0.1, -2.4, 0.3, -0.6, 0.2 and -0.2 respectively. Given the information above, calculate the cumulative abnormal return (CAR) for these stocks as a group and graph your results. Assuming that both companies have an expected return equal to the market return