Question

Using EXCEL attempt the following questions: Question 2: (2.5 marks) Given the summary quote below of Microsoft Corporation: 1- Estimate a discount rate for Microsoft

Using EXCEL attempt the following questions:

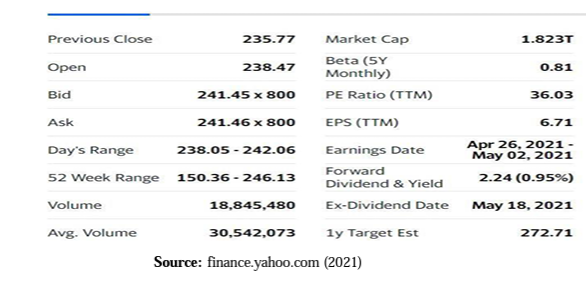

Question 2: (2.5 marks) Given the summary quote below of Microsoft Corporation:

1- Estimate a discount rate for Microsoft Corporation assuming the Treasury bill rate equal to the first number of your ID (from the left) and the stock market risk premium equal to the total of 4- digit numbers of your ID (from the right).

Example: Suppose your ID=20167021, then the Treasury bill rate=2 and the stock market risk premium =10 (7+0+2+1) 2- Given the financial highlights below, estimate the sustainable growth rate.

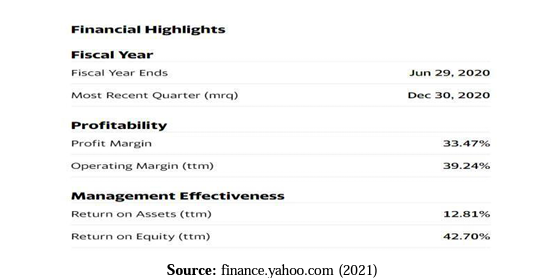

2- Given the financial highlights below, estimate the sustainable growth rate.

3- Calculate the expected stock price using the constant dividend growth rate model.

4- Calculate the expected stock price using the two-stage dividend growth model assuming the firm will initially grow at a rate g1 (sustainable growth rate calculated in section 1) for 4 years, and thereafter, it will grow at a rate (g2 =4%) forever.

Question 2: (2.5 marks) Refer to the Table below in order to compute the expected share price of Microsoft (MSFT) at the end of 2020 by employing the price ratio analysis. Assuming that the historical average growth rates will remain the same for 2020.

Year Price EPS CFPS SPS

2014 $94.50 $13.34 $6.27 $42.60

2015 $101.50 $5.05 $8.79 $54.25

2016 $98.10 $2.25 $7.81 $74.90

2017 $87.90 $6.06 $11.10 $68.69

2018 $212.50 $7.00 $11.79 $71.60

2019 $138.80 $9.00 $31.10 $89.70

Financial Highlights Fiscal Year Fiscal Year Ends Most Recent Quarter (mra) Jun29,2020 Dec30,2020 Profitability Profit Margin Operating Margin (ttm) Management Effectiveness Return on Assets (ttm) 12.81% Return on Equity (ttm) 42.70% Source: finance.yahoo.com (2021) Financial Highlights Fiscal Year Fiscal Year Ends Most Recent Quarter (mra) Jun29,2020 Dec30,2020 Profitability Profit Margin Operating Margin (ttm) Management Effectiveness Return on Assets (ttm) 12.81% Return on Equity (ttm) 42.70% Source: finance.yahoo.com (2021)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started