Question

Using EXCEL, calculate the overall cost of each hedging strategy (e.g., do nothing, full forward, 50% forward, full put option, and money market hedge)

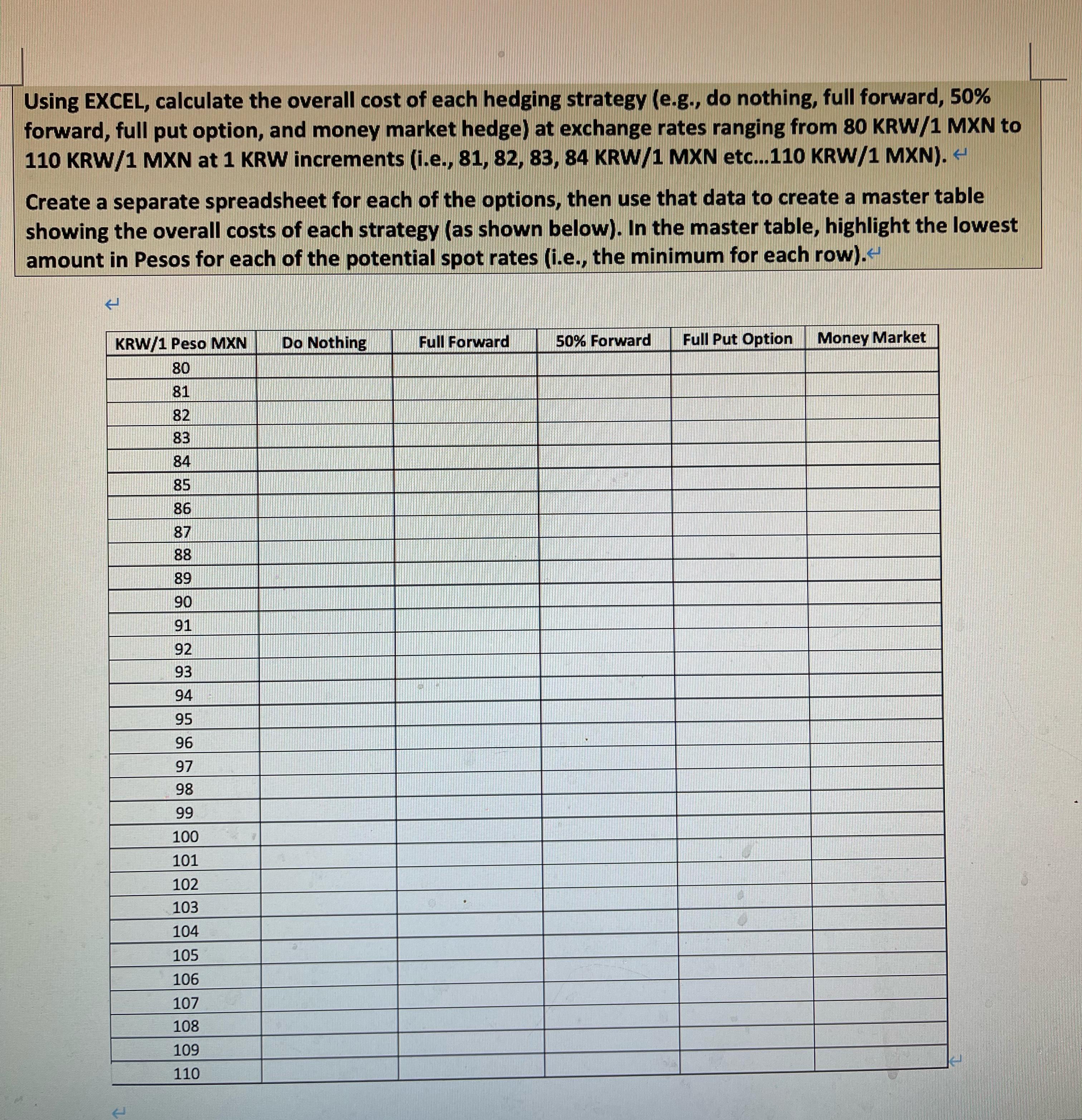

Using EXCEL, calculate the overall cost of each hedging strategy (e.g., do nothing, full forward, 50% forward, full put option, and money market hedge) at exchange rates ranging from 80 KRW/1 MXN to 110 KRW/1 MXN at 1 KRW increments (i.e., 81, 82, 83, 84 KRW/1 MXN etc...110 KRW/1 MXN). < Create a separate spreadsheet for each of the options, then use that data to create a master table showing the overall costs of each strategy (as shown below). In the master table, highlight the lowest amount in Pesos for each of the potential spot rates (i.e., the minimum for each row). < KRW/1 Peso MXN Do Nothing 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 Full Forward 10 50% Forward Full Put Option Money Market

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Economics Theory and Policy

Authors: Paul R. Krugman, Maurice Obstfeld, Marc Melitz

11th Edition

134519574, 9780134521046 , 978-0134519579

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App