Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using Excel please help solve Present worth(PW) and Annual worth(AW) for this investment. The Greentree Lumber Company is attempting to evaluate the profitability of adding

Using Excel please help solve Present worth(PW) and Annual worth(AW) for this investment.

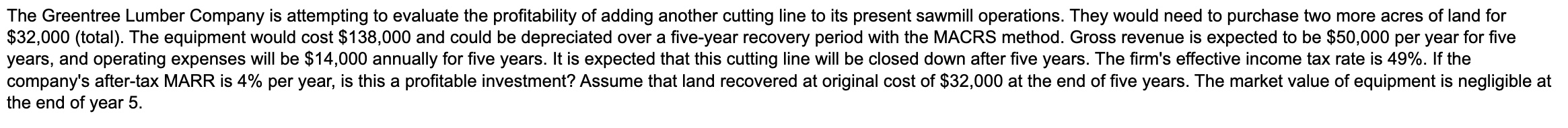

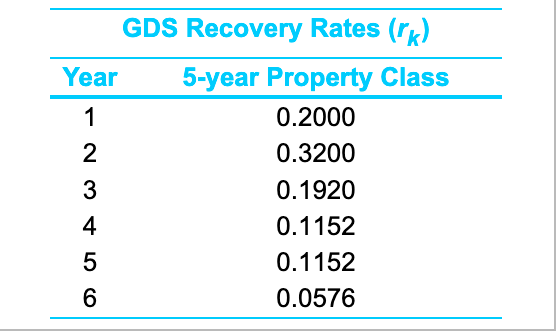

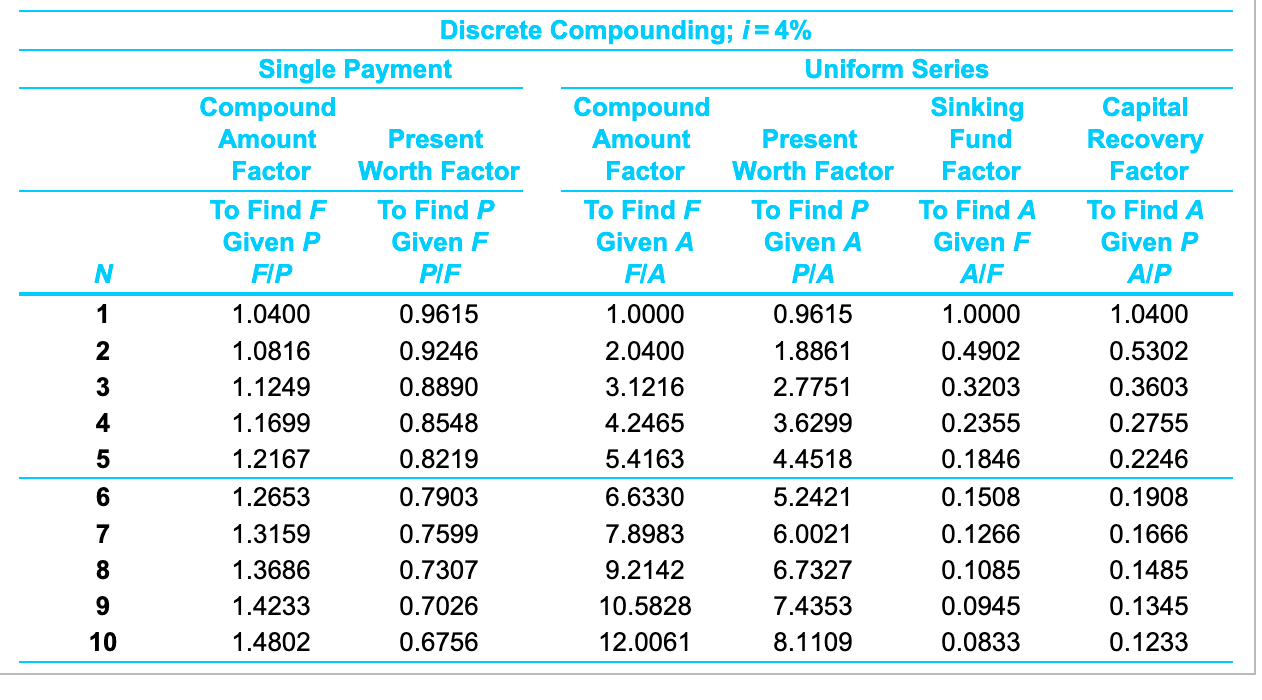

The Greentree Lumber Company is attempting to evaluate the profitability of adding another cutting line to its present sawmill operations. They would need to purchase two more acres of land for $32,000 (total). The equipment would cost $138,000 and could be depreciated over a five-year recovery period with the MACRS method. Gross revenue is expected to be $50,000 per year for five years, and operating expenses will be $14,000 annually for five years. It is expected that this cutting line will be closed down after five years. The firm's effective income tax rate is 49%. If the company's after-tax MARR is 4% per year, is this a profitable investment? Assume that land recovered at original cost of $32,000 at the end of five years. The market value of equipment is negligible at the end of year 5. GDS Recovery Rates (rk) Year 5-year Property Class 1 0.2000 2 0.3200 3 0.1920 4 0.1152 5 0.1152 6 0.0576 N 1 Discrete Compounding; i = 4% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.0400 0.9615 1.0000 0.9615 1.0000 1.0816 0.9246 2.0400 1.8861 0.4902 1.1249 0.8890 3.1216 2.7751 0.3203 1.1699 0.8548 4.2465 3.6299 0.2355 1.2167 0.8219 5.4163 4.4518 0.1846 1.2653 0.7903 6.6330 5.2421 0.1508 1.3159 0.7599 7.8983 6.0021 0.1266 1.3686 0.7307 9.2142 6.7327 0.1085 1.4233 0.7026 10.5828 7.4353 0.0945 1.4802 0.6756 12.0061 8.1109 0.0833 2 Capital Recovery Factor To Find A Given P AIP 1.0400 0.5302 0.3603 0.2755 0.2246 0.1908 0.1666 0.1485 0.1345 0.1233 3 4 5 6 7 8 9 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started