Using Exhibit 1 data, what would the company's profit be on each delivery if it had a contract to make 3 deliveries of 100,000 barrels at $20 per barrel in March, June, and September?

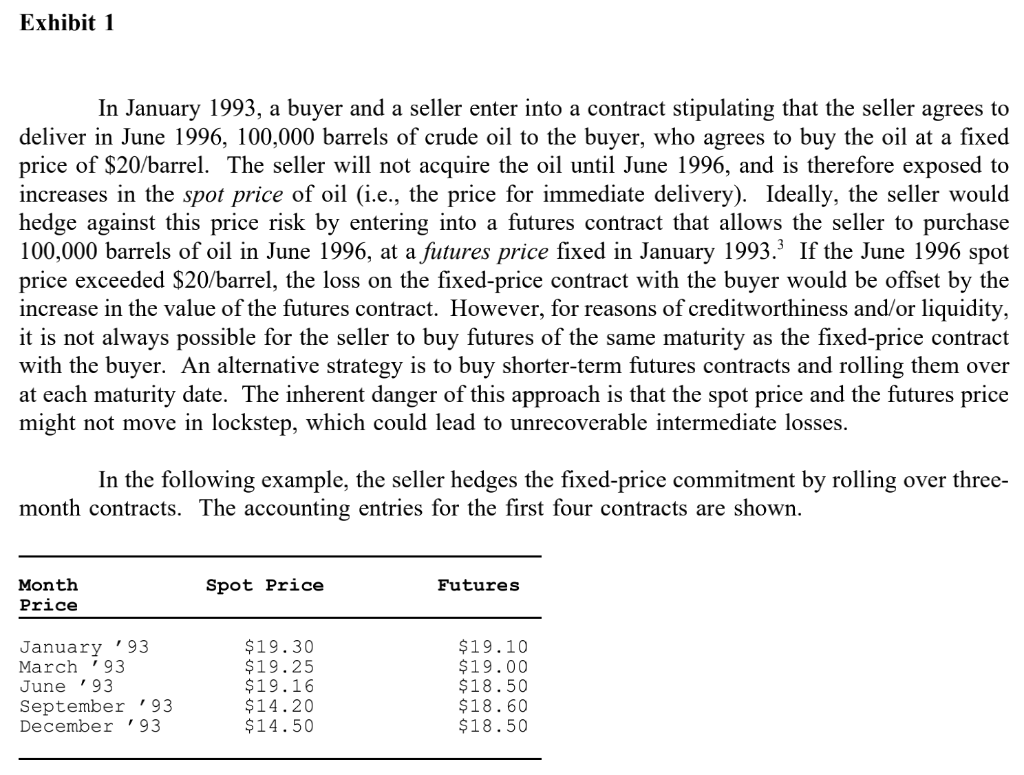

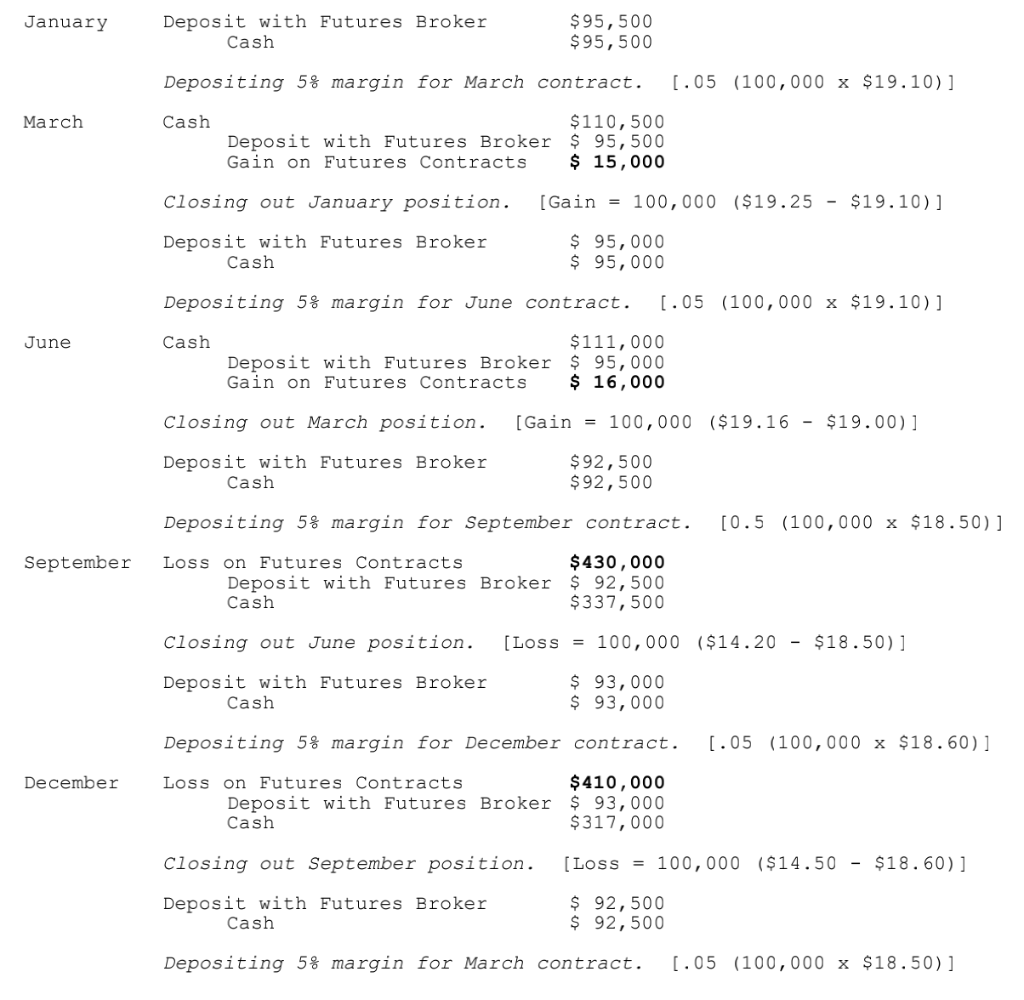

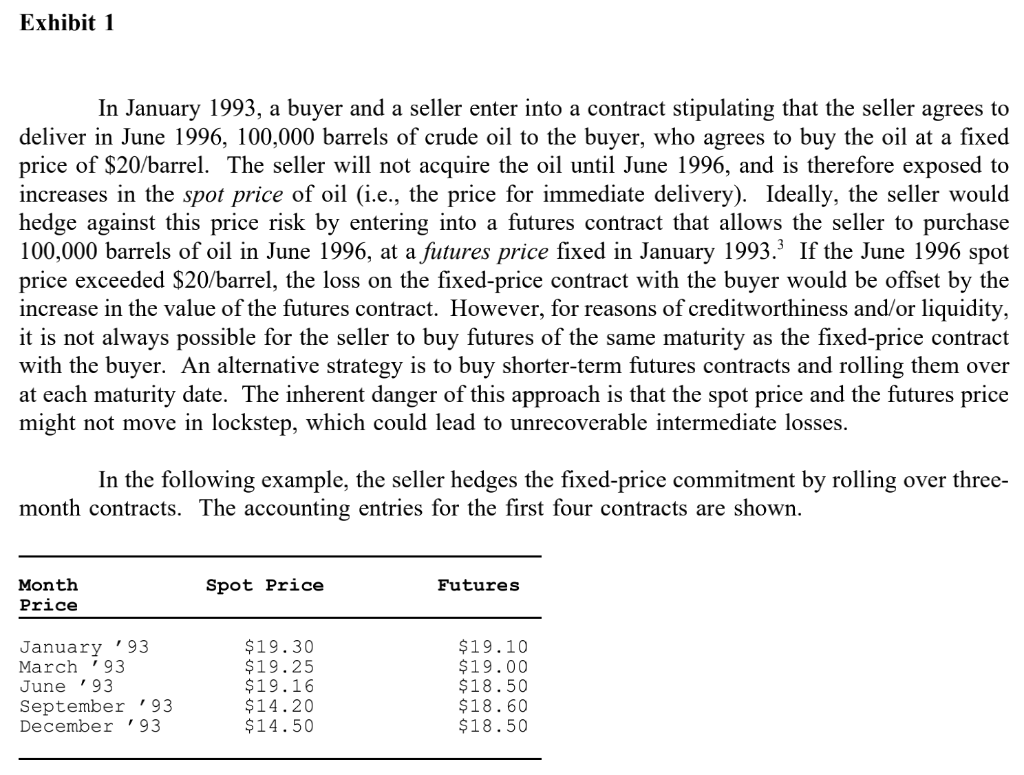

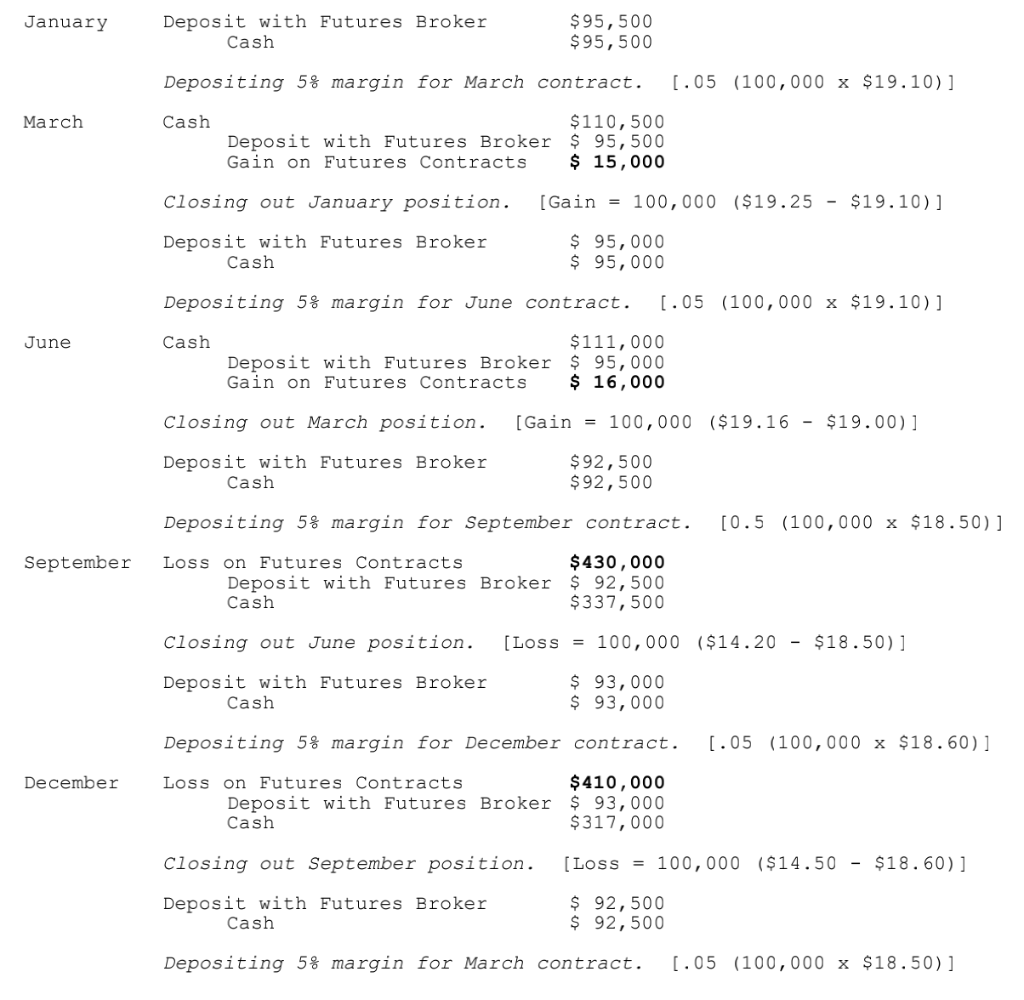

Exhibit 1 In January 1993, a buyer and a seller enter into a contract stipulating that the seller agrees to deliver in June 1996, 100,000 barrels of crude oil to the buyer, who agrees to buy the oil at a fixed price of $20/barrel. The seller will not acquire the oil until June 1996, and is therefore exposed to increases in the spot price of oil (i.e., the price for immediate delivery). Ideally, the seller would hedge against this price risk by entering into a futures contract that allows the seller to purchase 100,000 barrels of oil in June 1996, at a futures price fixed in January 1993. If the June 1996 spot price exceeded $20/barrel, the loss on the fixed-price contract with the buyer would be offset by the increase in the value of the futures contract. However, for reasons of creditworthiness and/or liquidity, it is not always possible for the seller to buy futures of the same maturity as the fixed-price contract with the buyer. An alternative strategy is to buy shorter-term futures contracts and rolling them over at each maturity date. The inherent danger of this approach is that the spot price and the futures price might not move in lockstep, which could lead to unrecoverable intermediate losses. In the following example, the seller hedges the fixed-price commitment by rolling over three- month contracts. The accounting entries for the first four contracts are shown. Month Price Spot Price Futures January '93 March '93 June '93 September '93 December '93 $19.30 $19.25 $19.16 $14.20 $14.50 $19.10 $19.00 $18.50 $18.60 $18.50 January Deposit with Futures Broker Cash $ 95,500 $ 95,500 Depositing 5% margin for March contract. [.05 (100,000 x $19.10)] March Cash $110,500 Deposit with Futures Broker $ 95,500 Gain on Futures Contracts $ 15,000 closing out January position. (Gain = 100,000 ($19.25 - $19.10)] Deposit with Futures Broker Cash $ 95,000 $ 95,000 Depositing 5% margin for June contract. 1.05 (100,000 x $19.10)] June Cash $111,000 Deposit with Futures Broker $ 95,000 Gain on Futures Contracts $ 16,000 closing out March position. [Gain = 100,000 ($19.16 - $19.00)] Broker Deposit with Futures Cash $92,500 $92,500 Depositing 5% margin for September contract. [0.5 (100,000 x $18.50) ] September Loss on Futures Contracts $430,000 Deposit with Futures Broker $ 92,500 Cash $337,500 [LOSS = 100,000 ($14.20 - $18.50)] Closing out June position. Deposit with Futures Broker Cash $ 93,000 $ 93,000 Depositing 5% margin for December contract. [.05 (100,000 x $18.60)] December LOSS on Futures Contracts Deposit with Futures Broker Cash $410,000 $ 93,000 $317,000 Closing out September position. [LOSS = 100,000 ($14.50 - $18.60)] Deposit with Futures Broker Cash $ 92,500 $ 92,500 Depositing 5% margin for March contract. [.05 (100,000 x $18.50)]