Question

Using Exhibit 9a & 9b (Consolidated PBB) & information in the case on valuation find the following: D. Stage/Phase 1 - PBB PV (@ R

Using Exhibit 9a & 9b (Consolidated PBB) & information in the case on valuation find the following:

D. Stage/Phase 1 - PBB PV (@ R = ______%, C. above from Jan-96) _________

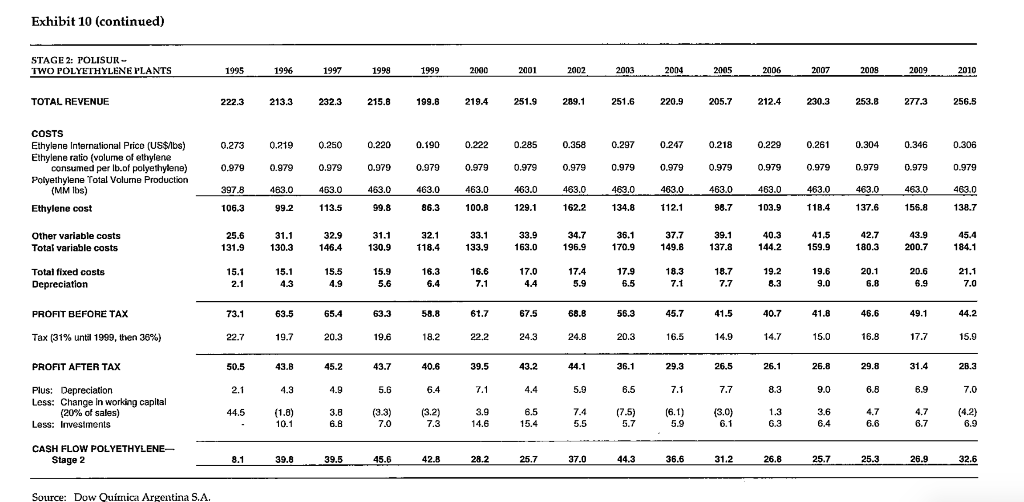

Using Exhibit 10 (Polisur 2 Poly Plants) & information in the case on valuation find the following:

E. Stage/Phase 2 - Polisur PV (@ R = ______%, C. above from Jan-96) _________

(Note: In D. & E. above, the calculation is PV rather than NPV, as cost, CF0, or the estimate of the projects value is being determined.)

Based on your results from parts D. and E., what would you bid for Phase 1 and Phase 2?

F. Stage/Phase 1 - PBB Bid ($) _________

G. Stage/Phase 2 - Polisur Bid ($) _________

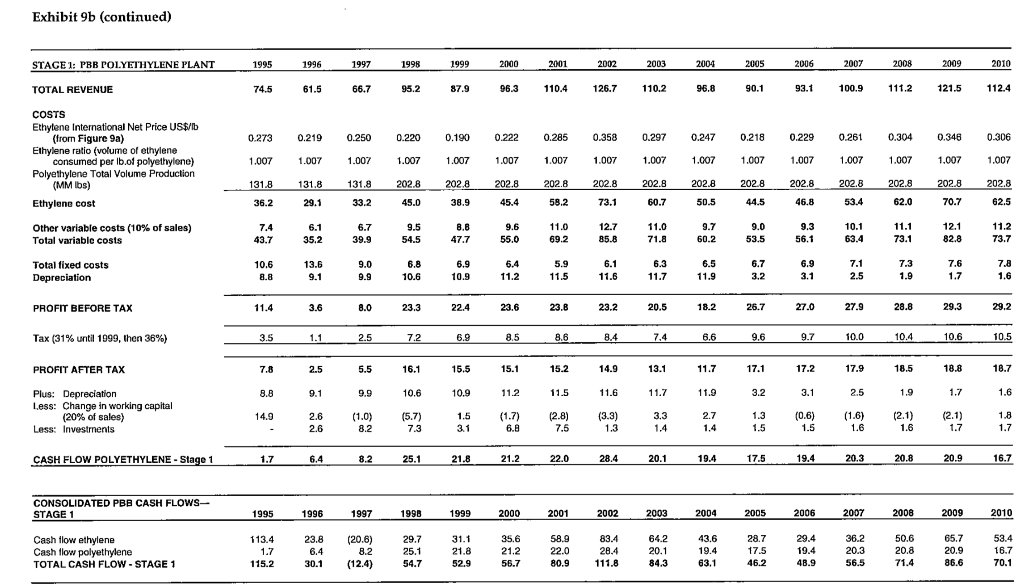

Terminal Values In their financial analysis, Vignart and Marcer also had to incorporate the terminal value of each stage of the project. Since demand and prices were subject to cyclical changes, they decided that the future cash flows for each stage of the project could best be estimated by using the average of the last five years of cash flows. They used 3.3% as the terminal growth rate for the project. Risk Measurement To assess whether the project would earn an acceptable return on the investment, Vignart and Marcer had to consider Dow's weighted average cost of capital and determine a risk premium for doing the project in Argentina. The risks of political instability or expropriation appeared small, since Argentina had had a stable democratic government for the past 12 years and there had been no case of expropriation in the previous 50 years. Currency risk, and the possible impact of government policies on the project, were more difficult to evaluate. Argentina had experienced no less than eight major currency crises between the early 1970s and 1991, and in 1995 the banking and credit crisisknown as the Tequila crisisaffected Argentina.10 The Convertibility Law, which tied the peso to the U.S. dollar, had remained in force despite the Tequila crisis, and by November 1995, the availability and cost of funds in Argentina had significantly improved over January 1995, albeit not to the pre-Tequila level. Most of the business and financial communities, having witnessed the robustness of convertibility, were confident to a large extent that it would last for several years. However, Vignart and Marcer had to consider the possibility of future crises and their likely impact on the project. They also examined government policies relevant to foreign investments. The Menem government had dismantled many of the laws and regulations on repatriation of capital. Capital repatriation in hard currency was now permitted through the free foreign exchange market without limits. No limits were imposed on payments of foreign loan principal and interest, and there were no restrictions on borrowing abroad by non- resident companies or private individuals. Vignart and Marcer debated whether to cover for exchange-rate risk in the event that the Argentine convertibility law came to an end, and discussed how to assess the risk that the laws on capital repatriation might change. Vignart and Marcer were aware that Dow had analyzed a similar project in the United States using discount rates in the range of 8% to 10%, and they debated the country risk premium required for the Bahia Blanca project. As part of their analysis, they examined interest rates and yield spreads in the U.S. and Argentina over the previous five years (see Exhibit 12) and reviewed the various currency, economic, and political risks they had identified. Preparing for the Bid Vignart and Marcer reviewed the different scenarios they had built and the uncertainties they had identified for each stage of the project. In Stage 1, they had to decide whether Copesul/Perez Companc were serious bidders and how Dow would finance the acquisition. In Stage 2, Dow would have to acquire Polisur, which would require successful negotiations with its owner. For Stage 3, Vignart believed that securing a partnership with YPF would significantly drive down the level of investment risk. Reaching a pricing agreement acceptable to both parties, however, would not be an easy task. In addition to these uncertainties, Vignart had to consider the political and economic factors that were relevant in determining the country risk for the project. Vignart believed that Dow had the opportunity to become the number-one player in the Latin American polyethylene industry. His immediate concern was to decide on the price to bid for PBB in the upcoming privatization. He also needed to complete the valuation of the entire project to justify the investment in Argentina to the parent company. Exhibit 9b (continued) STAGE 1: PBB POLYETHYLENE PLANT 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 TOTAL REVENUE 74.5 61.5 66.7 95.2 87.9 96.3 110.4 126.7 110.2 96.8 90.1 93.1 100.9 111.2 121.5 112.4 0.273 0.219 0.250 0.220 0.190 0.222 0.285 0.358 0.297 0.247 0.218 0.229 0.261 0.304 0.346 0.306 COSTS Ethylene International Net Price US$/b (from Figure 9a) Ethylene ratio (volume of ethylene consumed per Ib.of polyethylene) Polyethylene Total Volume Production (MM lbs) Ethylene cost 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 131.8 131.8 131.8 202.8 202.8 202.8 202.8 202.8 202.8 202.8 202.8 202.8 202.8 202.8 202.8 202.8 46.8 36.2 29.1 33.2 45.0 38.9 45.4 58.2 73.1 60.7 50.5 44.5 53.4 62.0 70.7 62.5 Other variable costs (10% of sales) Total variable costs 7.4 43.7 6.1 35.2 6.7 39.9 9.5 54.5 8.8 47.7 9.6 55.0 11.0 69.2 12.7 85.8 11.0 71.8 9.7 60.2 9.0 53.5 9.3 56.1 10.1 63.4 11.1 73.1 12.1 82.8 11.2 73.7 Total fixed costs Depreciation 10.6 8.8 13.6 9.1 9.0 9.9 6.8 10.6 6.9 10.9 6.4 11.2 5.9 11.5 6.1 11.6 6.3 11.7 6.5 11.9 6.7 3.2 6.9 3.1 7.1 2.5 7.3 1.9 7.6 1.7 7.8 1.6 PROFIT BEFORE TAX 11.4 3.6 8.0 23.3 22.4 23.6 23.B 23.2 20.5 18.2 26.7 27.0 27.9 28.8 29.3 29.2 Tax (31% until 1999, then 36%) 3.5 1.1 2.5 7.2 6.9 8.5 8.6 8.4 7.4 6.6 9.6 9.7 10.0 10.4 10.6 10.5 PROFIT AFTER TAX 7.8 2.5 5.5 16.1 15.5 15.1 15.2 14.9 13.1 11.7 17.1 17.2 17.9 18.5 18.8 18.7 8.8 9.1 10.6 10.9 11.2 11.5 11.6 11.7 11.9 3.2 3.1 2.5 1.9 1.7 1.6 Plus: Depreciation Less: Change in working capital (20% of sales) Less: Investments 14.9 2.6 2.6 (1.0) 8.2 (5.7) 7.3 1.5 3.1 (1.7) 6.8 (2.8) 7.6 (3.3) 1.3 3.3 1.4 2.7 1.4 1.3 1.5 (0.6) 1.5 (1.6) 1.6 (2.1) 1.6 (2.1) 1.7 1.8 1.7 CASH FLOW POLYETHYLENE - Stage 1 1.7 6.4 8.2 25.1 21.8 21.2 22.0 28.4 20.1 19.4 17.5 19.4 20.3 20.8 20.9 16.7 CONSOLIDATED PBB CASH FLOWS STAGE 1 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Cash flow ethylene Cash flow polyethylene TOTAL CASH FLOW - STAGE 1 113.4 1.7 115.2 23.8 6.4 30.1 (20.6) 8.2 (12.4) 29.7 25.1 54.7 31.1 21.8 52.9 35.6 21.2 58.9 22.0 80.9 83.4 28.4 111.8 64.2 20.1 84.3 43.6 19.4 63.1 28.7 17.5 46.2 29.4 19.4 48.9 36.2 20.3 56.5 50.6 20.8 71.4 65.7 20.9 86.6 53.4 16.7 70.1 56.7 Exhibit 10 (continued) STAGE 2: POLISUR- TWO POLYETHYLENE PLANTS 1995 1996 1997 1999 1999 2000 2001 2002 2003 2004 2005 2006 2007 2009 2009 2010 TOTAL REVENUE 222.3 213.3 232.3 215.8 199.6 219.4 251.9 289.1 251.6 220.9 205.7 212.4 230.3 253.8 277.3 256.5 0.273 0.219 0.250 0.220 0.190 0.222 0.285 0.358 0.297 0.247 0.218 0.229 0.261 0.304 0.346 0.306 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 COSTS Ethylene International Prico (US$/bs) Ethylene ratio (volume of ethylene consumed per lb.of polyethylene) Polyethylene Total Volume Production (MM lbs) Ethylene cost 0.979 397.8 463.0 463.0 463.0 463.0 463.0 463.0 463.0 463.0 463.0 463.0 463.0 463.0 86.3 463.0 100.8 463.0 129.1 463.0 137.6 106.3 99.2 113.5 99.8 162.2 134.8 112.1 96.7 103.9 118.4 156.8 138.7 Other variable costs Total variable costs 25.6 131.9 31.1 130.3 32.9 146.4 31.1 130.9 32.1 118.4 33.1 133.9 33.9 163.0 34.7 196.9 36.1 170.9 37.7 149.8 39.1 137.8 40.3 144.2 41.5 159.9 42.7 180.3 43.9 200.7 45.4 184.1 Total fixed costs Depreciation 15.1 2.1 15.1 4.3 15.5 4.9 15.9 5.6 16.3 6.4 16.6 7.1 17.0 4.4 17.4 5.9 17.9 6.5 18.3 7.1 18.7 7.7 19.2 6.3 19.6 9.0 20.1 6.8 20.6 6.9 21,1 7.0 PROFIT BEFORE TAX 73.1 63.5 65.4 63.3 58.8 61.7 67.5 68.8 56.3 45.7 41.5 40.7 41.8 46.6 49.1 44.2 Tax (31% until 1999, then 36%) 22.7 19.7 20.3 19.6 18.2 22.2 24.3 24.8 20.3 16.5 14.9 14.7 15.0 16.8 17.7 15.9 PROFIT AFTER TAX 50.5 43.8 45.2 43.7 40.6 39.5 43.2 44.1 36.1 29.3 26.5 26.1 26.8 29.8 31.4 28.3 2.1 4.3 4.9 5.6 6.4 7.1 4.4 5.9 6.5 7.1 7.7 8.3 9.0 6.8 6.9 7.0 Plus: Depreciation Less: Change in working capital (20% of sales) Less: Investments 44.5 (1.8) 10.1 3.8 6.8 (3.3) 7.0 (3.2) 7.3 3.9 14.6 6.5 15.4 (7.5) 5.7 (6.1) 5.9 (3.0) 6.1 1.3 6.3 3.6 6.4 4.7 6.6 (4.2) 6.9 5.5 6.7 CASH FLOW POLYETHYLENE Stage 2 8.1 39.8 39.5 45.6 42.8 28.2 25.7 37.0 44.3 36.6 31.2 26.8 25.7 25.3 26.9 32.6 Source: Dow Quitrica Argentina S.A. Terminal Values In their financial analysis, Vignart and Marcer also had to incorporate the terminal value of each stage of the project. Since demand and prices were subject to cyclical changes, they decided that the future cash flows for each stage of the project could best be estimated by using the average of the last five years of cash flows. They used 3.3% as the terminal growth rate for the project. Risk Measurement To assess whether the project would earn an acceptable return on the investment, Vignart and Marcer had to consider Dow's weighted average cost of capital and determine a risk premium for doing the project in Argentina. The risks of political instability or expropriation appeared small, since Argentina had had a stable democratic government for the past 12 years and there had been no case of expropriation in the previous 50 years. Currency risk, and the possible impact of government policies on the project, were more difficult to evaluate. Argentina had experienced no less than eight major currency crises between the early 1970s and 1991, and in 1995 the banking and credit crisisknown as the Tequila crisisaffected Argentina.10 The Convertibility Law, which tied the peso to the U.S. dollar, had remained in force despite the Tequila crisis, and by November 1995, the availability and cost of funds in Argentina had significantly improved over January 1995, albeit not to the pre-Tequila level. Most of the business and financial communities, having witnessed the robustness of convertibility, were confident to a large extent that it would last for several years. However, Vignart and Marcer had to consider the possibility of future crises and their likely impact on the project. They also examined government policies relevant to foreign investments. The Menem government had dismantled many of the laws and regulations on repatriation of capital. Capital repatriation in hard currency was now permitted through the free foreign exchange market without limits. No limits were imposed on payments of foreign loan principal and interest, and there were no restrictions on borrowing abroad by non- resident companies or private individuals. Vignart and Marcer debated whether to cover for exchange-rate risk in the event that the Argentine convertibility law came to an end, and discussed how to assess the risk that the laws on capital repatriation might change. Vignart and Marcer were aware that Dow had analyzed a similar project in the United States using discount rates in the range of 8% to 10%, and they debated the country risk premium required for the Bahia Blanca project. As part of their analysis, they examined interest rates and yield spreads in the U.S. and Argentina over the previous five years (see Exhibit 12) and reviewed the various currency, economic, and political risks they had identified. Preparing for the Bid Vignart and Marcer reviewed the different scenarios they had built and the uncertainties they had identified for each stage of the project. In Stage 1, they had to decide whether Copesul/Perez Companc were serious bidders and how Dow would finance the acquisition. In Stage 2, Dow would have to acquire Polisur, which would require successful negotiations with its owner. For Stage 3, Vignart believed that securing a partnership with YPF would significantly drive down the level of investment risk. Reaching a pricing agreement acceptable to both parties, however, would not be an easy task. In addition to these uncertainties, Vignart had to consider the political and economic factors that were relevant in determining the country risk for the project. Vignart believed that Dow had the opportunity to become the number-one player in the Latin American polyethylene industry. His immediate concern was to decide on the price to bid for PBB in the upcoming privatization. He also needed to complete the valuation of the entire project to justify the investment in Argentina to the parent company. Exhibit 9b (continued) STAGE 1: PBB POLYETHYLENE PLANT 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 TOTAL REVENUE 74.5 61.5 66.7 95.2 87.9 96.3 110.4 126.7 110.2 96.8 90.1 93.1 100.9 111.2 121.5 112.4 0.273 0.219 0.250 0.220 0.190 0.222 0.285 0.358 0.297 0.247 0.218 0.229 0.261 0.304 0.346 0.306 COSTS Ethylene International Net Price US$/b (from Figure 9a) Ethylene ratio (volume of ethylene consumed per Ib.of polyethylene) Polyethylene Total Volume Production (MM lbs) Ethylene cost 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 1.007 131.8 131.8 131.8 202.8 202.8 202.8 202.8 202.8 202.8 202.8 202.8 202.8 202.8 202.8 202.8 202.8 46.8 36.2 29.1 33.2 45.0 38.9 45.4 58.2 73.1 60.7 50.5 44.5 53.4 62.0 70.7 62.5 Other variable costs (10% of sales) Total variable costs 7.4 43.7 6.1 35.2 6.7 39.9 9.5 54.5 8.8 47.7 9.6 55.0 11.0 69.2 12.7 85.8 11.0 71.8 9.7 60.2 9.0 53.5 9.3 56.1 10.1 63.4 11.1 73.1 12.1 82.8 11.2 73.7 Total fixed costs Depreciation 10.6 8.8 13.6 9.1 9.0 9.9 6.8 10.6 6.9 10.9 6.4 11.2 5.9 11.5 6.1 11.6 6.3 11.7 6.5 11.9 6.7 3.2 6.9 3.1 7.1 2.5 7.3 1.9 7.6 1.7 7.8 1.6 PROFIT BEFORE TAX 11.4 3.6 8.0 23.3 22.4 23.6 23.B 23.2 20.5 18.2 26.7 27.0 27.9 28.8 29.3 29.2 Tax (31% until 1999, then 36%) 3.5 1.1 2.5 7.2 6.9 8.5 8.6 8.4 7.4 6.6 9.6 9.7 10.0 10.4 10.6 10.5 PROFIT AFTER TAX 7.8 2.5 5.5 16.1 15.5 15.1 15.2 14.9 13.1 11.7 17.1 17.2 17.9 18.5 18.8 18.7 8.8 9.1 10.6 10.9 11.2 11.5 11.6 11.7 11.9 3.2 3.1 2.5 1.9 1.7 1.6 Plus: Depreciation Less: Change in working capital (20% of sales) Less: Investments 14.9 2.6 2.6 (1.0) 8.2 (5.7) 7.3 1.5 3.1 (1.7) 6.8 (2.8) 7.6 (3.3) 1.3 3.3 1.4 2.7 1.4 1.3 1.5 (0.6) 1.5 (1.6) 1.6 (2.1) 1.6 (2.1) 1.7 1.8 1.7 CASH FLOW POLYETHYLENE - Stage 1 1.7 6.4 8.2 25.1 21.8 21.2 22.0 28.4 20.1 19.4 17.5 19.4 20.3 20.8 20.9 16.7 CONSOLIDATED PBB CASH FLOWS STAGE 1 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Cash flow ethylene Cash flow polyethylene TOTAL CASH FLOW - STAGE 1 113.4 1.7 115.2 23.8 6.4 30.1 (20.6) 8.2 (12.4) 29.7 25.1 54.7 31.1 21.8 52.9 35.6 21.2 58.9 22.0 80.9 83.4 28.4 111.8 64.2 20.1 84.3 43.6 19.4 63.1 28.7 17.5 46.2 29.4 19.4 48.9 36.2 20.3 56.5 50.6 20.8 71.4 65.7 20.9 86.6 53.4 16.7 70.1 56.7 Exhibit 10 (continued) STAGE 2: POLISUR- TWO POLYETHYLENE PLANTS 1995 1996 1997 1999 1999 2000 2001 2002 2003 2004 2005 2006 2007 2009 2009 2010 TOTAL REVENUE 222.3 213.3 232.3 215.8 199.6 219.4 251.9 289.1 251.6 220.9 205.7 212.4 230.3 253.8 277.3 256.5 0.273 0.219 0.250 0.220 0.190 0.222 0.285 0.358 0.297 0.247 0.218 0.229 0.261 0.304 0.346 0.306 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 0.979 COSTS Ethylene International Prico (US$/bs) Ethylene ratio (volume of ethylene consumed per lb.of polyethylene) Polyethylene Total Volume Production (MM lbs) Ethylene cost 0.979 397.8 463.0 463.0 463.0 463.0 463.0 463.0 463.0 463.0 463.0 463.0 463.0 463.0 86.3 463.0 100.8 463.0 129.1 463.0 137.6 106.3 99.2 113.5 99.8 162.2 134.8 112.1 96.7 103.9 118.4 156.8 138.7 Other variable costs Total variable costs 25.6 131.9 31.1 130.3 32.9 146.4 31.1 130.9 32.1 118.4 33.1 133.9 33.9 163.0 34.7 196.9 36.1 170.9 37.7 149.8 39.1 137.8 40.3 144.2 41.5 159.9 42.7 180.3 43.9 200.7 45.4 184.1 Total fixed costs Depreciation 15.1 2.1 15.1 4.3 15.5 4.9 15.9 5.6 16.3 6.4 16.6 7.1 17.0 4.4 17.4 5.9 17.9 6.5 18.3 7.1 18.7 7.7 19.2 6.3 19.6 9.0 20.1 6.8 20.6 6.9 21,1 7.0 PROFIT BEFORE TAX 73.1 63.5 65.4 63.3 58.8 61.7 67.5 68.8 56.3 45.7 41.5 40.7 41.8 46.6 49.1 44.2 Tax (31% until 1999, then 36%) 22.7 19.7 20.3 19.6 18.2 22.2 24.3 24.8 20.3 16.5 14.9 14.7 15.0 16.8 17.7 15.9 PROFIT AFTER TAX 50.5 43.8 45.2 43.7 40.6 39.5 43.2 44.1 36.1 29.3 26.5 26.1 26.8 29.8 31.4 28.3 2.1 4.3 4.9 5.6 6.4 7.1 4.4 5.9 6.5 7.1 7.7 8.3 9.0 6.8 6.9 7.0 Plus: Depreciation Less: Change in working capital (20% of sales) Less: Investments 44.5 (1.8) 10.1 3.8 6.8 (3.3) 7.0 (3.2) 7.3 3.9 14.6 6.5 15.4 (7.5) 5.7 (6.1) 5.9 (3.0) 6.1 1.3 6.3 3.6 6.4 4.7 6.6 (4.2) 6.9 5.5 6.7 CASH FLOW POLYETHYLENE Stage 2 8.1 39.8 39.5 45.6 42.8 28.2 25.7 37.0 44.3 36.6 31.2 26.8 25.7 25.3 26.9 32.6 Source: Dow Quitrica Argentina S.AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started