Question

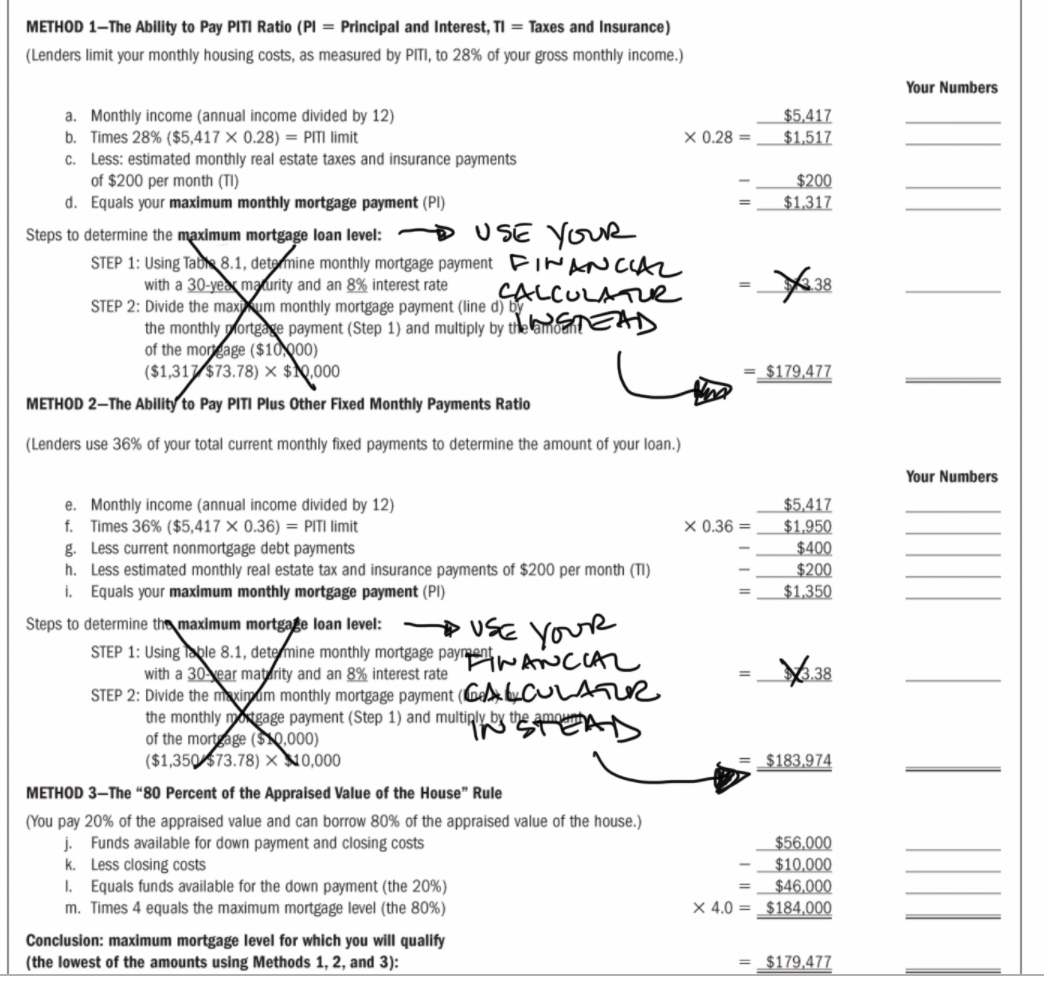

Using Figure 8.7 (screenshot added below) as a guide, calculate the maximum mortgage you would qualify for using the following assumptions for all three methods:

Using Figure 8.7 (screenshot added below) as a guide, calculate the maximum mortgage you would qualify for using the following assumptions for all three methods: Annual gross income of $120,000 Anticipated monthly real estate taxes and insurance = $750 Anticipated interest rate on the mortgage loan = 5.5% Mortgage maturity = 30 years Current non-mortgage debt payments = $500 Funds available for down payment and closing costs = $75,000 Estimated closing costs of $15,000 Minimum acceptable down payment 20% Please indicate your answers for each step in each of the following methods and indicate the maximum mortgage a lender would offer under: Method 1 "The Ability to Pay PITI Ratio" mortgage amount Method 2 "The Ability to Pay PITI Plus Other Fixed Monthly Payments Ratio" mortgage amount Method 3 "The 80 Percent of the Appraised Value of the House" mortgage amount Instead of the crossed-out sections in the sheet attached, use PV, FV, PMT, I/Y, and N to solve with a Financial Calculator

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started